Miramar raises to relaunch drilling over walk up Kalgoorlie gold discoveries

Investors seem keen to get drilling on gold and critical minerals targets. Pic: Getty Images

- Miramar raises $1.8m to refire drilling over walk up gold drill targets 15kms north of Kalgoorlie

- M2R to re-focus on gold projects in record gold price environment

- Funds to also see use in the company’s collection of Gascoyne projects

Special Report: Miramar Resources has the firm backing of investors to rustle up $1.8m and refire drilling over walk up drill targets at its Gidji JV gold project near Kalgoorlie.

Proceeds raised from new investors and the current register will also see use in advancing Miramar Resources’ (ASX:M2R) polymetallic projects in the WA Gascoyne.

But it’s the largely untouched drill targets surrounded by major gold deposits and processing plants near the gold capital of Kalgoorlie that’s an obvious headliner.

As baffling as seems now, there was little interest in drilling for good old gold through the heights of the battery metal boom, but it’s now in Miramar’s favour to take another look after keeping it tucked away in the portfolio.

Miramar executive chairman Alan Kelly noted that the company made multiple discoveries a few years ago, but sentiment surrounding gold in locations like Gidji is now more enthusiastic as gold prices hit record levels.

“At the time, investors had little interest in gold exploration, so we suspended work at Gidji and instead focussed on advancing our Gascoyne region projects until investor sentiment towards gold explorers improved,” Kelly said.

“As a result, we have multiple walk-up drill targets, including several shallow high-grade gold results, that require infill and/or extensional aircore drilling followed by systematic bedrock testing and this placement will enable us to kick-start those drilling programmes in a record gold price environment.

“We look forward to getting back out on the ground at Gidji and progressing this highly prospective emerging gold camp in a prime location.”

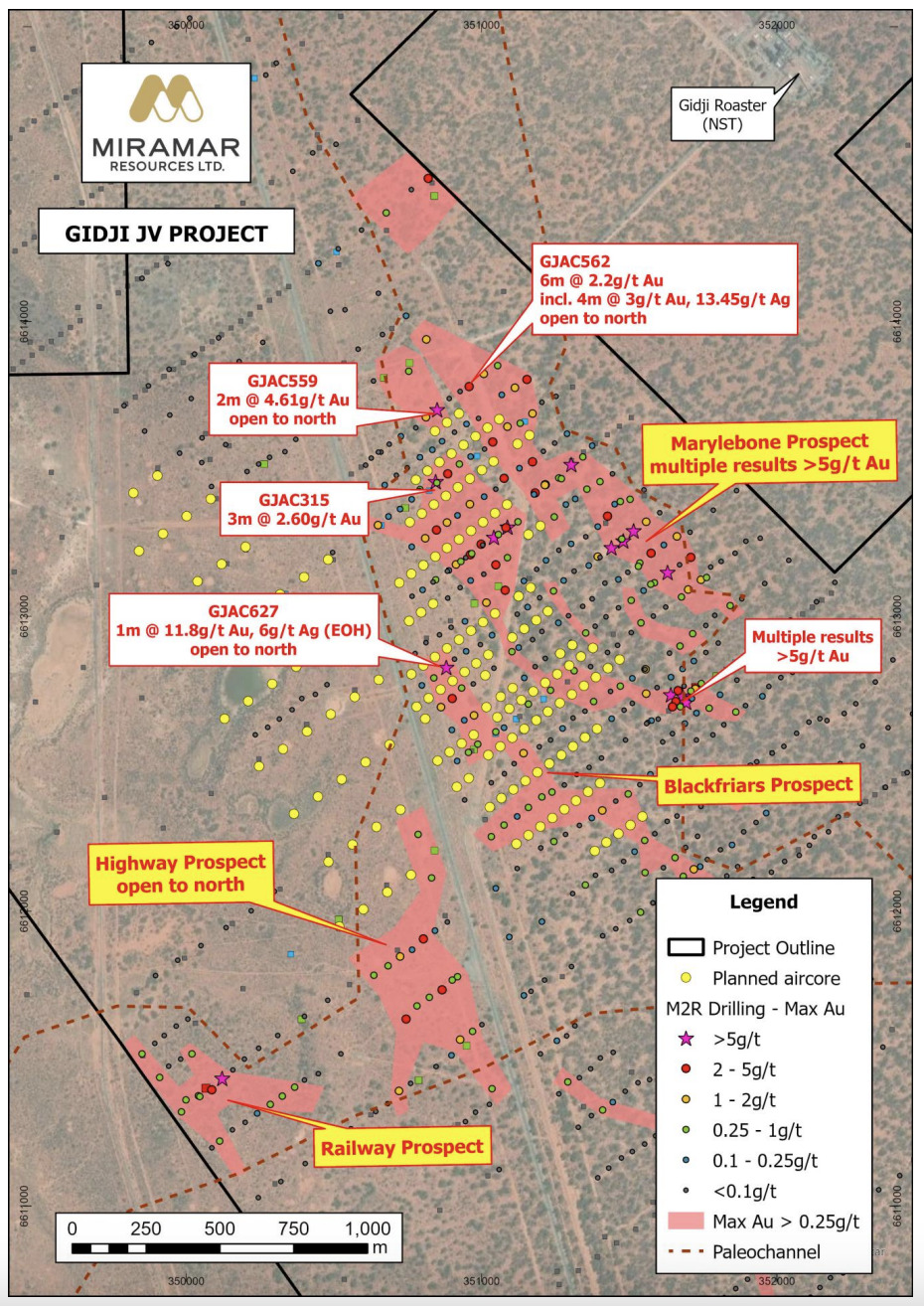

The plan over M2R’s 80%-owned Gidji is now for infill and extensional aircore drilling over the Marylebone, Blackfriars and Highway targets, a heritage survey over several others, and some combination of RC/diamond drilling pending approval over the Blackfriars, 8-Mile, and Jog targets.

The placement will be done at an issue price of $0.003, a 30% discount to M2R’s 15-day average of $0.0043.

Gascoyne ground

Though its Kalgoorlie quarry will see the bulk of the funds, Miramar will not be ignoring its projects in the Gascoyne region, where it has some quality nickel, copper, gold and additional base metals projects.

Within a newly confirmed Bangemall nickel-cobalt province, the company is applying for this round of EIS funding to assist in surveys covering newly granted tenements and a priority Trouble Bore subproject marked for the diamond drill bit.

At its Whaleshark copper-gold and magnetite iron project, M2R is planning a property-wide heritage survey and an extension of interface aircore drilling over buried targets.

And the company also plans infill and extensional soil and rock chip sampling at the Joy Helen prospect within its SEDEX-style Pb-Cu-Zn-Ag Chain Pool project.

This article was developed in collaboration with Miramar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.