Meteoric’s ‘outstanding’ resource update to improve Caldeira economics

Meteoric’s at the peak with a doubling in the Caldeira measure and indicated resource to underpin an imminent scoping study. Pic: Getty Images

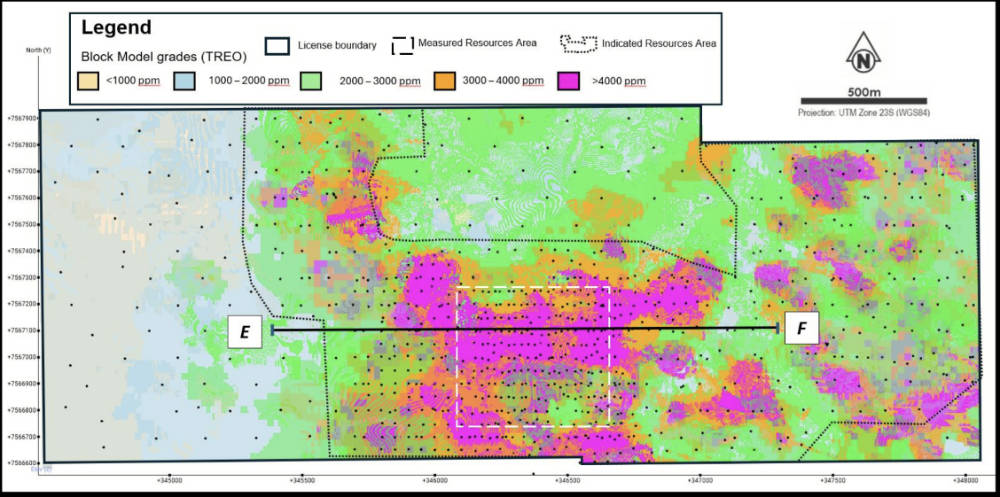

- Meteoric Resources defines big measured and indicated resource of 85Mt at 3,034ppm TREO at Capão do Mel

- Upgrade doubles the higher confidence resources at the broader Caldeira project

- Capão do Mel resource includes high-grade core that supports the company’s initial production strategy targeting high-grade feed

- High grade core is adjacent to planned processing facility

Special Report: Meteoric Resources has vastly increased the certainty of its Caldeira project in Brazil after defining a significant measured and indicated resource of 85Mt at 3,034ppm TREO for the Capão do Mel deposit.

The ionic adsorption clay (IAC) resource, which has enough certainty to enable mine planning, includes a high-grade core of 36Mt grading 4,345 parts per million (ppm) total rare earth oxides (TREO) and doubles the measured and indicated resources across the broader Caldeira project in Minas Gerais state.

Minas Gerais is a leading mining province in Brazil and is home to some of the world’s highest-grade IAC-hosted REE projects, many of them held by the Meteoric’s ASX peers.

IAC deposits – known for their higher percentages of valuable magnet REOs (MREO) that are used in electric vehicle motors and wind turbines – are typically easier to explore, mine and process compared to their hard rock competitors.

The latest resource upgrade comes less than a month after Meteoric Resources (ASX:MEI) delivered a separate resource upgrade for the Soberbo mining licence by 150% to 229Mt at 2,601ppm TREO including 86Mt at 2,730ppm TREO in the indicated category.

Caldeira comprises 51 licences and hosts clay-hosted REE mineralisation that starts from surface and contains a significant percentage of MREOs.

It sits within the Cretaceous-aged Poços de Caldas intrusive complex, an important geological terrain which hosts deposits of REE, bauxite, white clay for ceramics, uranium, zirconium and leucite over an area of ~800km2.

Primary mineralisation includes uranium, zirconium and REE that are confined to the intrusives emplaced during the magmatic event.

Metallurgical testing has also proven its IAC chops with testing by ANSTO confirming that Caldeira mineralisation is amendable to low capex and opex AMSUL leaching at pH 4.0.

Upgraded resource underpins scoping study economics

The 147% increase in the Capão do Mel resource was based on results from 504 infill diamond and aircore holes totalling 12,775m.

It takes the global Caldeira resource up from the 545Mt at 2,561ppm TREO estimate delivered in May to 619Mt at 2,538ppm TREO with MREOs making up 23.6% of the REE basket.

Higher confidence measured and indicated resources now make up nearly a quarter of the total resource, standing at 171Mt grading 2,880ppm TREO.

MEI notes that not only does the upgrade resource underpin the upcoming scoping study, the high-grade core at Capão do Mel also supports its initial production strategy targeting feed grades greater than 4,000ppm TREO for the first 5-10 years.

The company plans to develop a processing facility adjacent to these high-grade areas to maximise project economics and deliver rapid capital payback.

“Another outstanding result which reflects the company’s rapid progress to be the next rare earth mine developed in Brazil,” executive chairman Dr Andrew Tunks said.

“Importantly, the high-grade core of the updated resource is located within close proximity to our proposed plant site at Capão do Mel and clearly supports our strategy to prioritise the development of this unique, very high-grade zone of approximately 36Mt for the best part of a decade.

“With more significant resource updates and the scoping study to come, coupled with our extensive ground holdings all within the volcanic crater of Poços de Caldas, it is clear the Caldeira project stands above all of its peers in the market.”

Chief executive officer Nick Holthouse added the resource upgrade took the company another step toward first production for 2027.

“With more than 170Mt of measured and indicated resources available from the Capão do Mel and Soberbo licences alone, there are more than enough suitably classified high-grade tonnes to update the financial projections in our Scoping Study and release to market imminently,” he added.

“High grades, high recoveries and easy access to tonnes from surface all contributing to a low operating cost environment.”

This article was developed in collaboration with Meteoric Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.