Meteoric’s Caldeira is a true rare earths unicorn

Mining

Mining

Brazil’s potential to host rich, ionic adsorption, clay-hosted rare earth deposits has attracted more than its fair share of attention and for good reason.

Companies in this space have conducted exploration that returned some truly eye-popping results and defined significant resources.

However, there is one company’s project in particular that stands out due to how often it is referenced by its peers as well as on its own merits.

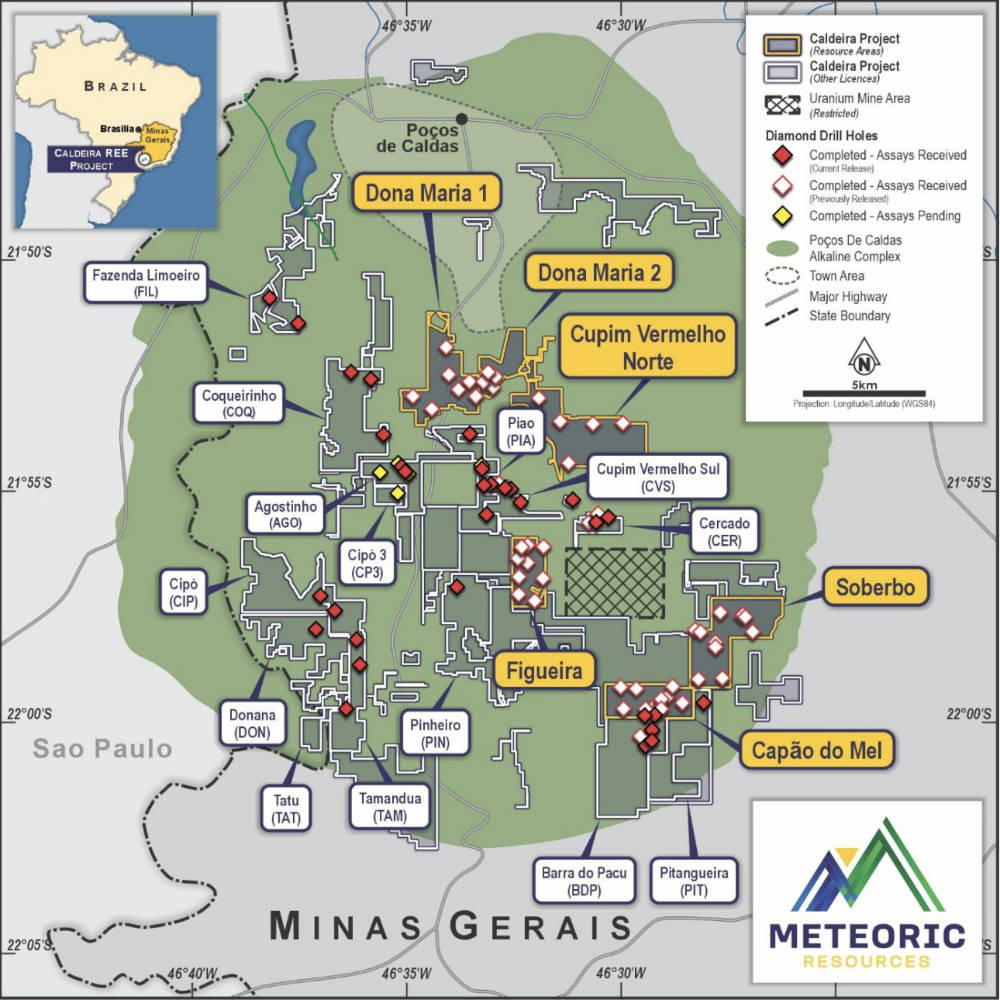

This standout is Meteoric Resources’ (ASX:MEI) giant Caldeira project in Minas Gerais state, which, following two resource upgrades in rapid succession this year, now has a global resource of 619Mt at 2538 parts per million (ppm) total rare earth oxides (TREO).

Not only do high value magnet rare earths – used to manufacture rare earth magnets found in electric vehicle motors and wind turbines – make up 23% of the in ground REE mix, higher confidence measured and indicated resources, which have enough certainty for mine planning make up a quarter of resource at 171Mt at 2880ppm TREO.

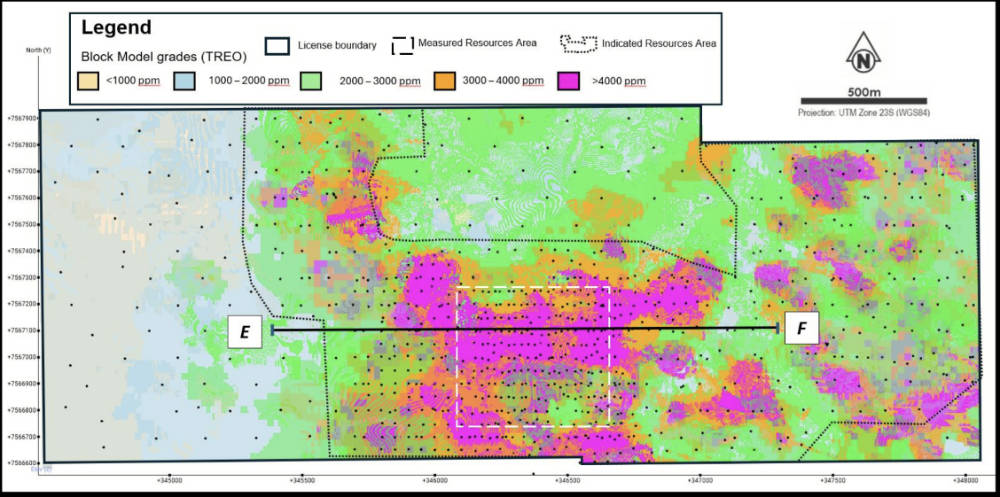

There’s also a high-grade core of 36Mt grading 4345ppm TREO at Capão do Mel that will sit next to planned processing facility and support the company’s initial production strategy targeting feed grades greater than 4,000ppm TREO for the first 5-10 years.

Speaking to Stockhead, chief executive officer Nick Holthouse said that in the ionic clay space, what made Caldeira stand out was the quality of the resources.

“It is a bit of a unicorn, the geology makes it different from everything else,” he noted.

“We have these fantastically high grades within Caldeira coupled with the very strong metallurgical response we are getting from the technically simple ammonium sulphate flowsheet equate to a very low opex, putting us at the very bottom end of the operating cost curve.

“This means that even with the current low pricing cycles coming out of China at present, we are likely to be operating well underneath those, making the project resilient against low pricing pressures.

Chief financial officer Stuart Gale added that this was coupled with operating in a mining friendly jurisdiction.

“The government’s – federal, state and local – are very supportive of our project and we have got a letter of support from the government which talks to that support,” he said.

Holthouse added that Caldeira is quite a unique project.

“There are not many projects that I have been involved in where the infrastructure is in place from the start, it is a brownfields mining area, there is no requirement to build an airstrip or a camp, roads, etc.

“Very little CAPEX is devoted to infrastructure, the power is there, the water is there, the people are there, the services industries are there.”

Besides its industry-leading grades, Caldeira’s other claim to fame is its high MREE content.

“We have a very good tenor of lights, about 31% of the composition of our REEs recovered to the basket consists of the magnet REEs neodymium, praseodymium, dysprosium and terbium; all major components which go into a magnet,” Holthouse said.

“DyTb is about 1%, which doesn’t sound like a lot, but it is a lot more than most producers will have – it makes our basket quite attractive.

“1% DyTb equates to about 14% of the value of the basket. And those four elements out of the 17 in the basket, account for 94-95% of the value of the basket.

“Those four metals are paramount to the manufacture of permanent magnets, which go into EVs, wind turbines and a range of consumer electronics like speakers, the vibrating motor in your phone, robotics etc.”

Highlighting just how far MEI has progressed the project, the company has already secured a letter of support for up to US$250m from EXIM – the US import-export bank.

“What that really says is that the US government are very supportive of this project and we see that there are a number of different avenues potentially available to us to continue to look for sources of US and other government funding,” Gale noted.

“We will also have discussions with the Brazilian development bank and we are having discussions with Export Finance Australia who are very keen to figure out how they can support this project.

“I think that as soon as we get our scoping study out and we start to move towards our feasibility study, that will be the catalyst for those banks to start to stand up and take notice of where we are going.”

MEI expects to deliver more resource updates for Caldeira over the remainder of this year and to release the key scoping study in June.

“That’s going to answer a lot of questions that the market has been asking and give the market a lot of comfort and hopefully see some action in the share price,” Holthouse said.

“Beyond that we are continuing with our engineering, we already started our PFS work, that program is underway, we hope to deliver our PFS by the end of this year.”

He added that the company is continuing with its permitting work and has lodged its environmental impact statement, which is currently in the review process.

“Towards the end of the year or early next year we are expecting to be able to announce the granting of the EIS,” he added.

“That carries on to further permits that allow us to get on the ground and actually start constructing by end of next year.”

MEI will also continue working with different government funding organisations and seek out further offtake opportunities to add to the existing non-binding offtake memorandum of understanding with Neo Performance Materials.

“We have locked away a portion of our carbonate, but we need to work with those guys further downstream,” Holthouse said.

MEI is also pulling together a pilot demonstration plant in Brazil with Holthouse expecting construction to start toward the end of this year.

“There is some test work from ANSTO that is going to allow us to lock down the flowsheet and allow the design phase for that plant to be completed, then we will go ahead and start constructing and commissioning and operating that by Q1 next year,” he added.

“We are building it to satisfy the requirements to progress our non-binding term sheets for offtake into binding term sheets.

“There’s a bunch of test work that the separators need to do, they need to pilot and fine tune their plants to our particular carbonate composition.”

The company also has no intention to stop at the production of mixed rare earths carbonate, which it described as a “sensible first step”.

We are very focused on going further down-stream. Once we get the carbonate study bedded in, then we are looking to progress down into separation and beyond,” Holthouse said.

“That demonstration facility will allow us to do the separation work inhouse, build up our own IP in that space, and the data that is required to take a concept like that into engineering and then costed and ultimately built.”

At Stockhead, we tell it like it is. While Meteoric Resources is a Stockhead advertiser, it did not sponsor this article.