Meteoric adds sixth cobalt project to impressive Canadian portfolio

Pic: Tyler Stableford / Stone via Getty Images

Canadian cobalt play Meteoric (ASX:MEI) has added a further highly prospective cobalt project to its already impressive portfolio.

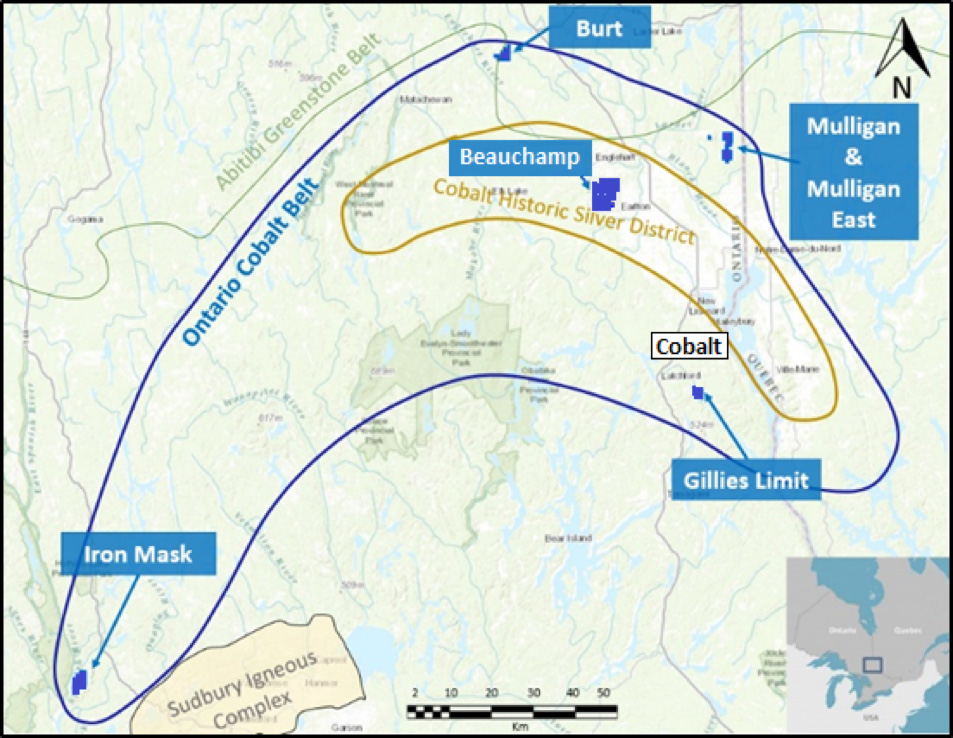

The company has secured the Beauchamp Cobalt project, 40km north of mining centre Cobalt Camp in Ontario – covering 33.5 sq km of highly prospective cobalt mineralisation within the region’s cobalt belt.

“Securing the Beauchamp project is a fantastic result for Meteoric, being a low-cost pegging of open ground, the project is a real standout where shareholder value can be quickly realised through geophysics,” cobalt manager Tony Cormack told the market on Tuesday.

“Beauchamp has the regional fault structure known as the Cross-Lake Fault, interpreted as the major control of cobalt/silver mineralisation at the Cobalt Camp, tracking through large areas of mapped Nipissing Diabase, the host rocks for cobalt/silver mineralisation.”

Meteoric says the site has all the right rock types combined with great geological structure – what it says will be a fast track to exploration.

This project takes the company’s assets to six, all within the cobalt belt but Beauchamp the only within the historic silver district – what brought the town of cobalt to riches in the 1900s.

Back then, silver prospectors in the region built it to be the fourth highest producer of silver in the world – alongside discoveries of cobalt, gold, nickel and copper.

Pure play

Fast forward 100 years from initial discoveries at the Cobalt region and now that the namesake’s commodity price has surpassed more than $110,000 a tonne – its ripe for the picking.

Meteoric is quick to make the distinction at where its focus lies – not on copper, nickel or any other cross metal play – purely on cobalt and what it says will be a boon for the entire region.

“This is a great country to explore in, if we can make a discovery in this area it is right on the doorstep for industry and could be the start of a region to rival the incumbents,” managing director Dr Andrew Tunks said.

“This year we will see not just our projects come to fruition, but more broadly it will be the litmus test for the district to prove it has what it takes.”

Earlier in the week the company commenced exploration at its Mulligan site – the first of its prospects and located to the north-east of the latest acquisition.

It marks the beginning of summer, when the snow melts and the field work can begin.

“The sun is finally shining in Canada and Meteoric will be hitting the ground running over the next few weeks,” Dr Tunks told Stockhead.

“We are ensuring all permissions are in place and working on target generation with the Orix team. It is exciting that we can finally commence field work on our cobalt portfolio, after all it is only during the field work and drilling cycle we can make a discovery.”

Ontario Cobalt Belt

Historically, the Canadian region has produced in excess of 28,000 tonnes of cobalt, and 720 million ounces of silver.

Meteoric has five strategic projects across the belt – including the Mulligan property which has produced 8-tonnes of cobalt ore grading at 10 per cent – what it says is unrivalled.

“The grade unearthed within the Ontario cobalt belt is extremely high relative to other cobalt mining regions – at 12-14 per cent cobalt compared to averages of 2 per cent in the historic cobalt regions of the DRC,” Mr Tunks said.

“While it is a different mineralisation, at the end of the day grade is king.”

But best of all, operation in Canada provides little to no sovereign risk – unlike its African competition.

The Democratic Republic of Congo (DRC) accounted for more than half of the world’s production of cobalt in 2016 – but ongoing political unrest has many producers questioning sovereign risk in the region.

“Producers are nervous about operations in the DRC and more broadly the African copper belt that has historically supplied the vast majority of the world’s cobalt,” Dr Tunks said.

“The government has been very fractious at the moment and realising the power they have at the current prices, add to that the issues around slave or child labour and poor health and safety – it is cause for concern all the way down the supply chain.”

In 2016, the Responsible Cobalt Initiative (RCI) was born – a consortium of companies like Apple, Samsung and Sony together vowing to address social and environmental risks in the cobalt supply chain starting with child labour.

A meeting of the initiative and major cobalt market players is scheduled for later this month in co-operation with the OECD in Paris, what Dr Tunks says will be a coup for non-conflict cobalt.

Where to next?

Canada’s rocky mountains and broad lakes make for a picturesque backdrop for Meteoric’s cobalt prospects, but all that water has to go somewhere.

With one third of all the world’s lakes and ground prone to bogging, Dr Tunks says organisation is key.

“You can work all year around but you have to be prepared – we prefer to do drilling in the winter but that means all the field work has to be done in the Summer.

“Tony Cormack is on field now doing the mapping, ground geophysics and identifying the targets to drill and as soon as it freezes over again you can do whatever you want.”

In a release to market Mr Cormack echoed the MDs sentiment, saying the ‘time had now come’ to explore for Canadian cobalt.

“We have the entire field season fully funded and with such great ground to work I have been eager to get across Canada for some time… Every cobalt project has been well considered by Meteoric, with all 5 projects being highly prospective for primary cobalt mineralisation.”

This special report is brought to you by Meteoric Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.