Metalicity’s high-grade hits match historical production at Altona

Being alike is not always a bad thing particularly when drill assays match the grades from historical production. Pic: Getty Images

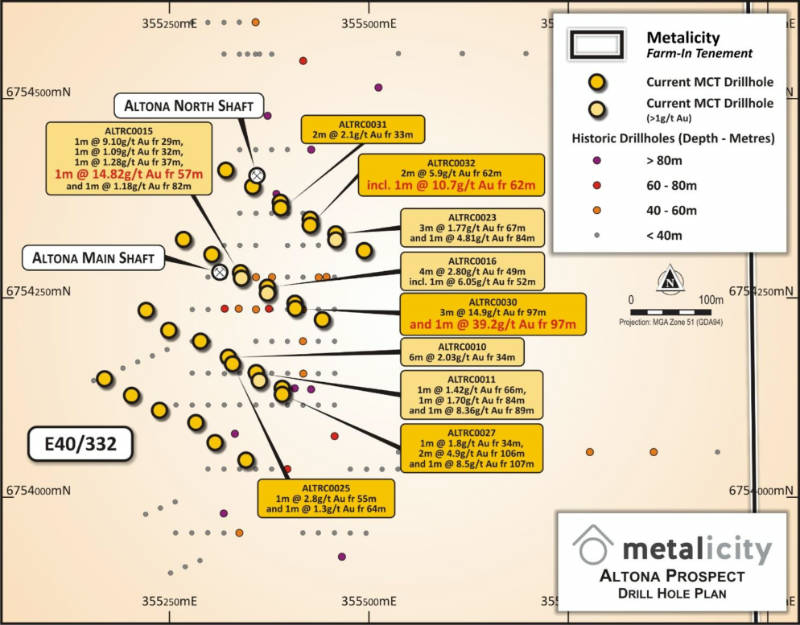

Metalicity’s drilling at the Altona prospect has confirmed that high-grade mineralisation continues along strike and at depth to the historical Altona Mining Centre.

Assays such as 1m at 39.2 grams per tonne (g/t) gold from 97m at the top of a broader 3m intercept grading 14.9g/t gold are in line with the production of 88,700oz of gold between 1900 and 1965 at an average grade of 30g/t gold.

This highlights the prospectivity of Altona with Metalicity (ASX:MCT) already expediting plans to return to the prospect later this year to continue extensional work across the full 2km strike.

“It is really pleasing to return assays from drilling that confirms the presence of mineralisation and the tenure of grade comparable to historical production,” managing director Jason Livingstone said.

He added the results stem from drilling conducted earlier this year that wraps up its initial program from 2020.

Drilling is also underway at the Cosmopolitan gold mine and the Leipold prospect.

Altona, Cosmopolitan and Leipold are all part of the Kookynie project located about 60km southeast of Leonora, Western Australia.

Altona drilling

Drilling at Altona, which could be a lookalike of Cosmopolitan, was designed to test potential mineralisation zones interpreted from detailed aerial geophysics and along strike from historical workings and currently known mineralised areas

To date, the company has drilled 33 holes totalling 3,251m at the prospect.

Metalicity previously noted that the variability observed in assays from the drilling is not uncommon in such high-grade areas due to the nuggety nature of the gold.

This article was developed in collaboration with Metalicity, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.