Metal prices are just consolidating. The big breakout is still to come

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

The Bloomberg Commodity Spot Index has almost doubled in value over the past year. Some believe the sector may now be overvalued, while others — like well-known analyst Jesse Felder — say the boom could be just beginning.

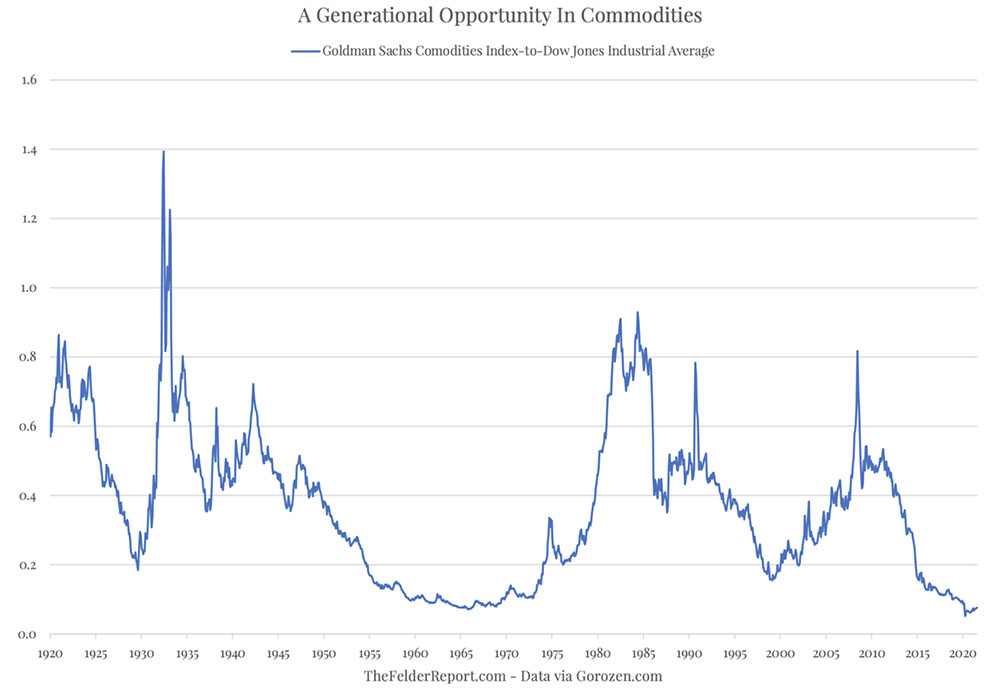

Despite their terrific run over the past 12 months, commodities prices remain extremely depressed relative to those of financial assets:

Additionally, supply/demand dynamics — especially for battery metals — appear to be improving every day.

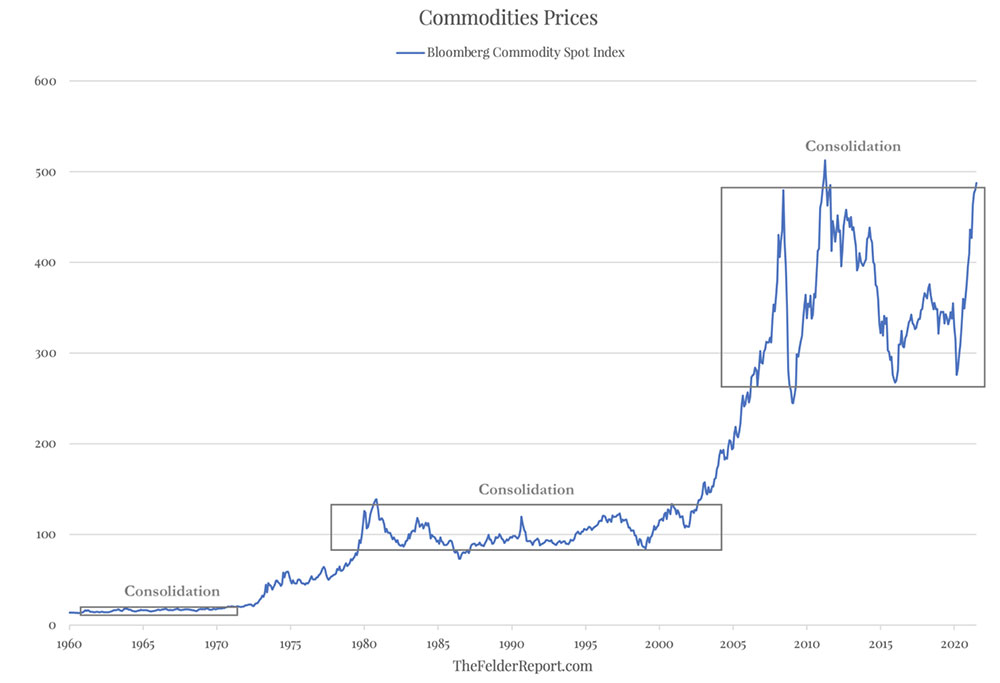

Commodities have been in a consolidation phase for well over a decade now. The breakout comes next, Felder says.

“The consolidation phase seen during the 1960s lasted just about as long as the current one; the subsequent breakout higher proved to be a good inflation signal,” he says.

“The next consolidation phase, during the 80s and 90s, lasted more than twice as long as it was marked by a prolonged period of disinflation.”

RIP transitory inflation?

While annual US inflation rose at decade-plus highs through the June quarter, US Fed Chair Jerome Powell remains steadfast in his view that upward pressure on consumer prices will tail off into 2022. Felder disagrees.

A clear breakout higher in the commodities index would probably represent the death knell of the Fed’s ‘transitory’ (short term) narrative regarding inflation — a story investors have bought “hook, line and sinker”, Felder says.

“As such, it could also usher in a wave of investor demand for the sort of inflation protection only commodities can offer,” he says.

“So, it may pay to stay bullish and to keep a close eye on the upper end of that most recent consolidation range.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.