Meeka Gold took the keys to its 1.1Moz Murchison Gold Project in 2021 and it’s not taking its foot off the gas any time soon

Pic: Getty

Meeka Gold jumped the kerb into 2021, snapping up its cornerstone Murchison Gold asset for a cool $8 million, before ripping through some 20km of drilling and growing the mineral resource by half.

12 months later and investors are already pouring over a scoping study which outlines Murchison’s potential operation life – a nine year, 443,000oz festival of gold, delivering some $180 million in free cash flow.

To complete a huge 12 months, Meeka (ASX:MEK) plans to deliver its pre-feasibility study in 2022.

Among WA’s discoveries of the millennium

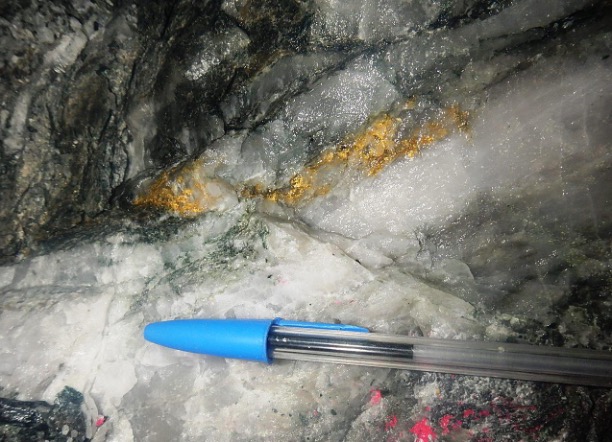

The Murchison Gold Project contains the Andy Well mine near Meekatharra, one of WA’s best gold discoveries in more than 15 years.

Andy Well produced 350,000oz at ripper grades of more than 8g/t for Doray Minerals between 2013 and 2017 before its merger with Silver Lake Resources.

In the hands of the right owner it is now ripe for reinvention.

So much to give

So far Meeka has successfully shown just how much more Andy Well and the nearby Turnberry open pit has to give, completing 20,000m of drilling and growing its resources by 44% to over 1.1Moz.

“We’ve been really fortunate this year to acquire a great project in a great jurisdiction and immediately setting about doing the work to get it back into production. We’ve built a strong team with foundation skills in exploration, geology and mine building” Meeka Gold managing director Tim Davidson told Stockhead.

“Certainly in mine development we have a lot of experience around so we have the right team for taking the project forward and putting it back into production over the next 18 to 24 months.”

Bright future at Murchison

The stars have aligned for the experienced, cost-effective explorers right now – particularly the savvy gold diggers – global market conditions are ripe enough for 2021 to witness record levels of exploration investment.

That’s been driven by the high prices smart money is putting on gold.

With gold comfortable treading water at around $2500/oz, Davidson says the 343km2 MGP is a much more tantalising prospect now than when Doray put the mine on care and maintenance in 2017 when the gold price was $1000/oz lower than it is today.

“Amongst other things, one of the key changes the gold price,” he said. “It completely changes the economics of the project when you look at it though the lens of a $2500/oz gold price”.

“We see the mining scenarios in the Murchison as being very similar to what was looked at by Doray, we’re not trying anything groundbreaking and new in that regard, and we want to go in there and get out as much of the high grade mineralisation as cheaply as possible.”

Do the math

Doray was producing at all in sustaining costs (AISC) of $1517/oz the year before it placed Andy Well on care and maintenance in September, 2017.

Meeka calculates the AISC in its scoping study at around $1,655/oz.

At today’s gold prices, that’s an almost $900/oz margin.

At a production rate of ~50,000ozpa, the project’s roughly $52 million price tag to restart production would be completely delivered in less than two years.

“The big benefit is we’ve got the wind in our sails with respect to gold price,” Davidson said.

“We’re in a gold price environment where we’re sitting around $2,500 an ounce and that’s about $900 an ounce higher than where it was when Doray was mining.

“In the mining study that we put out in December based on a $2,400 an ounce gold price the project delivers about $180 million free cash flow, after paying back all of the establishment costs and mining production costs.

“So when we think we paid $8 million dollars to buy the project, and we can mine it and deliver $180 million in free cash flow at today’s gold prices, we view that as a great success for the company and certainly something we can build a business around.”

Inflation to drive gold higher

US dollar gold prices are down around 3.5% for the year, but that trend has hidden two nuggets.

One, in the historical context gold remains extremely high, especially in Australian dollar terms.

Secondly, rampaging stimulus-driven economic growth has fuelled – and masked – the inflation storm clouds gathering in the background.

Davidson is in the same camp as analysts who see these as particularly fertile conditions for gold stocks to prosper.

“We’re walking into an environment where governments around the world are rolling out large fiscal stimulus programs, so lots of infrastructure building in the US and Europe,” he said.

“On the back of that you’ve also got monetary policy which is suppressing interest rates, and that’s a global phenomenon at the moment.

“So we see it as a fantastic setup and a fantastic environment for the strength in the gold price and we certainly see a route for the gold price to be materially higher over the next one to two years.”

Davidson said governments around the world are more likely to allow inflation to erode the value of their debts than use tax to pay them down.

“If you look at the drivers behind strong gold prices, inflation is a key driver, the erosion in the value of fiat currency is a key driver behind the improvement in gold price and certainly sentiment around gold price.”

Circle Valley the surprise packet

Circle Valley has emerged as Meeka Gold’s surprise packet, a secondary project that has started to punch above its weight.

Located just north of the coastal tourist town of Esperance, it is not the sort of place you necessarily expect to find a big gold deposit.

But already shallow drilling of a 1.2km long, 400m wide gold in soil anomaly has turned up similarities to the giant 7.1Moz Tropicana gold mine, more than 300km to the north-east in the Albany-Fraser belt.

“We had some really fantastic but unexpected exploration success down at Circle Valley, which is a project near Esperance, where we were doing some really early stage greenfields exploration work, really trying to understand what rocks we had down there,” Davidson said.

“And lo and behold, we actually drilled fairly thick mineralisation and that mineralisation while it wasn’t extremely high grade, it was 23m at 0.65 grams, and then the hole next to it, which was 20 odd metres away was 24m at 0.3ish.

“Within those broad zones of mineralisation, there was some high grade, so one of the holes had 12m at a gram, the other hole had 4m at a gram and a half. That’s all really shallow gold starting from 12m below surface.

“That area’s recognised as having the mineralisation is stripped so the gold grades are generally lower in that surface regolith profile, because the gold’s being stripped out of it.

“So we haven’t even drilled into the fresh rock yet and that was a fantastic surprise to get from the lab when we got those results in November.”

Davidson said Meeka Gold is planning to head back to Circle Valley in January to see if it can identify high-grade gold in the fresh rock with deeper drilling.

PFS, exploration drilling big catalysts in 2022

Up 43% year-to-date and with so much success in 2021, it stands to reason there will be plenty of catalysts for Meeka to potentially rerate in the year ahead.

“The key for us will be getting a pre-feasibility study out and to release a reserve as well,” Davidson said.

“So we’ll give investors a much higher level of confidence in the rigour and the information that they’ve been given.”

Start your engines

Davidson says a massive schedule of exploration drilling is also on the way that will generate significant news flow in 2022.

“We’ve currently got two drill rigs operating in the Murchison, so we’ve got a diamond drill rig doing some deeper holes following up on the high-grade shoots beneath the pit at Turnberry, and we’ve got an RC rig that’s doing some shallow drilling at Turnberry and St Anne’s,” Davidson said.

“So those two drill rigs will be working away in the Murchison until Christmas and then in January we’ll have the diamond drill rig staying in the Murchison and an aircore-RC rig that can do both types of drilling will be going to Circle Valley.

“it’s going to be a bumper year and the only frustrating thing is the amount of time it takes to turn these samples around in the lab.

“So we’re really looking forward to starting to receive those and get those out, and they’ll continue to flow reasonably consistently with the drilling carrying on all through the first half of next year and beyond.”

This article was developed in collaboration with Meeka Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.