Medallion’s latest Ariel-gold discovery is a sign of more to come for Ravensthorpe

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

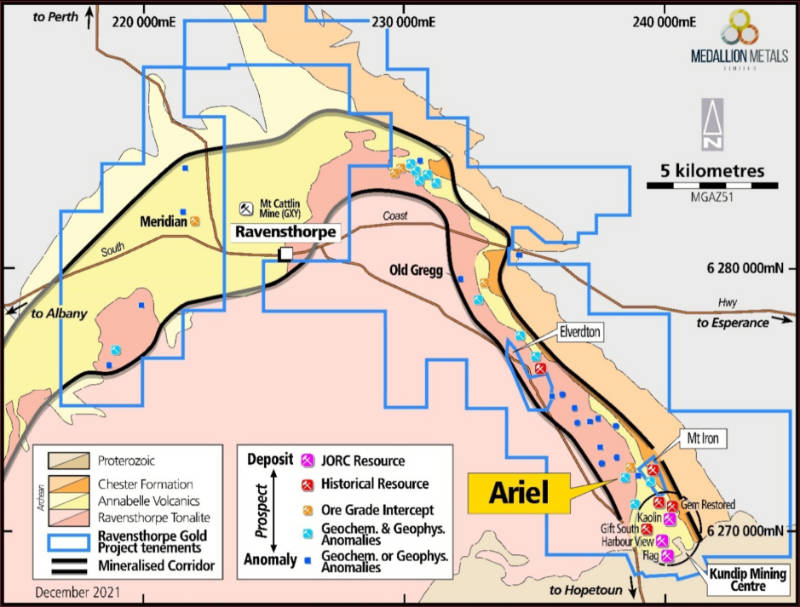

Medallion just took a big step closer to its goal of building a 1.5Moz resource at its Ravensthorpe project after a significant gold find at the Ariel prospect in WA.

The six hole drill program returned a number of dream intersections only 2kms to the north of the growing 674,000 ounce near surface Resource, including:

- a thick 26m zone grading 1.6g/t gold from surface at RC21AR006

- high-grade intervals of 1m at 5.15 grams per tonne (g/t) gold from a depth of 6m and 1m at 7.52g/t from 11m at RC21AR004

This has defined an 800m zone that remains open in all directions within the total geochemical and VTEM anomalism which extends over 1.4km in strike, indicating there’s potential for more gold mineralisation.

Untouched

Significantly for Medallion Metals (ASX:MM8), the Ariel prospect is just 200m west from the Ard Patrick prospect which remains untouched since the late 1980s – despite having historical high-grade results of up to 5m at 65.36g/t gold from 30m and 2km north of its 674,000oz Kundip Mining Centre.

It also follows on from recent high-grade results such as 5m at 11.4g/t gold and 1,572 parts per million copper at the Meridian regional prospect about 21km along strike from Kundip.

Add it up and you’ve got a strong indication there’s plenty of camp scale potential at Ravensthorpe.

You’ll most likely stand-alone

“This is another extremely positive outcome for Medallion. Ariel is the second regional prospect to be tested after Meridian and has yielded another discovery and is a distinct target area that has the potential to add significant ounces to the project resource,” managing director Paul Bennett said.

“Being located only 2 kilometres along strike from the Kundip Mining Centre significantly increases the potential for the area to support a stand-alone development.

“Just like the Meridian results, Ariel underlines the potential of Medallion’s dominant landholding in the Annabelle volcanics, which hosts numerous similar prospects that have yet to be adequately tested.”

Bennett added that with about 32,000m of drilling carried out since the company’s last resource update and the current ramp-up in exploration activities, he was confident of reporting a substantial upgrade to its resources in the first quarter of 2022.

Regional drilling, substantial upgrades and future activity

The six-hole reverse circulation program at Ariel is part of the company’s 32,000m campaign over the Ravensthorpe project targeting gold anomalism defined by surface geochemical and geophysical surveys and aircore drilling completed in 2018.

The pedigree is consistent with all 52 aircore holes returning a +1g/t gold intercept along the entire 800m strike of the drilling.

These included a top hit of 1m at 6.24g/t gold from 12m with Medallion noting that the highest concentration and thickness of gold intercepts corresponded well with the strongest section of the VTEM conductor.

I’m Old Gre-eeegg

The more recent RC drilling has identified that gold mineralisation intersected to date is predominantly shallow.

Medallion’s 32,000m campaign is nearing completion with about 28,000m of RC and diamond drilling completed to date.

MM8 currently has a single RC rig deployed at the project to conclude the remaining 4,000m of RC drilling and will drill a single diamond hole at the Old Gregg prospect prior to year-end.

A review of the Ariel results is currently underway with downhole electromagnetic surveys and additional Phase 1 RC drilling scheduled for the first quarter of 2022.

Design of Phase 2 drilling has already commenced, which will include additional aircore drilling to test the VTEM conductor along strike to the northwest of current drilling.

This article was developed in collaboration with Medallion Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.