Medallion sets the stage for bumper pre-feasibility study as Ravensthorpe grows to 1.62Moz gold equivalent

Pic: Sergey Nivens/iStock via Getty Images

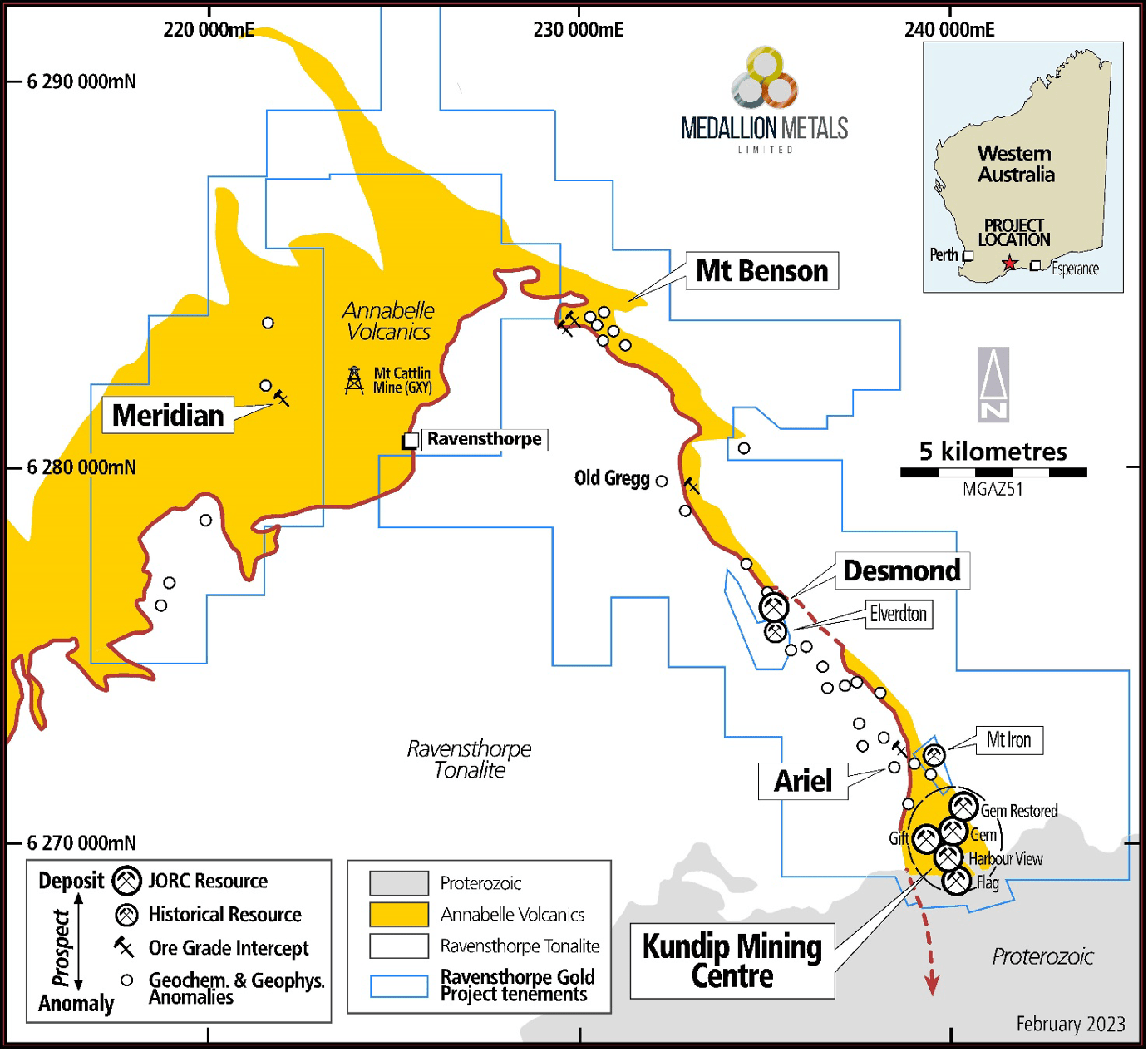

Medallion Metals has delivered a tantalising preview for its highly anticipated pre-feasibility study on the Ravensthorpe gold project in mid-2023, stamping its status as a deposit of scale and significance with a lift in resource ounces to a 1.62Moz gold equivalent.

The project, including the historic Kundip Mining Centre on WA’s south coast, features 1.3Moz of gold and 59,000t of copper at an unchanged grade of 2.6g/t gold equivalent.

Importantly, 60% (790,000oz gold and 36,000t copper metal) of that resource is in the indicated category.

That places those resources at a high enough confidence level to be converted into reserves when it comes to making a decision to mine what is fast becoming a new gold development of significant potential.

Since listing on the ASX around two years ago, 43,500m of new drilling (41% of it with high precision diamond rigs) has helped Medallion (ASX:MM8) add an impressive 860,000oz to its mineral resource base, 20oz per drill metre at a cost of just $15/oz AuEq.

“This result represents a significant milestone for the business and its shareholders as we continue to demonstrate that Ravensthorpe is an asset of scale and significance with enormous potential,” MM8 managing director Paul Bennett said.

“It is the culmination of a huge effort by the Medallion team and I pay credit to their professionalism and perseverance.

“The company is now well advanced on a trajectory to achieve critical mass to support the development of a long-life, low-cost gold and copper business in Ravensthorpe.

“We expect further growth in the size and confidence of resources as we plan more drilling throughout 2023 both at the Kundip Mining Centre and across our highly prospective tenement package.”

Compelling development case building

The updated mineral resource adds around 250,000 gold equivalent ounces on the previous estimate, with MM8 looking to establish a resource base capable of supporting an operation of around 100,000ozpa.

That’s an important measure for a gold deposit of scale in the modern day.

It would finally tap the potential of the overlooked mining region in WA’s south, better known for its nickel and lithium mines.

The project area boasts past production of over 128,000oz of gold and 20,000t of copper, at the intersection of the world class Southern Cross greenstone belt and Albany-Fraser Orogen.

There is more to come for Medallion, which has completed almost 54,000m of RC and diamond drilling since listing in March 2021.

The new resource estimate incorporates an extra 16508m of drilling throughout 2021 and 2022, including 7153m in 30 RC holes and 9355m in 23 diamond holes targeting high grade strike and depth extensions.

Assays are yet to be returned from the labs for another 4735m of drill core, which will be included in future updates.

That drilling and data acquired in exploration programs across 2021 and 2022 is being interpreted to plan future drilling programmes to increase the confidence in mineral resources at the Kundip centre, with material in optimised mining shapes planned to be maximised in the indicated category.

Medallion also plans to grow global mineral resources at the Ravensthorpe gold project, which is shallowly drilled and open in all directions.

The new resource estimate includes the maiden resource at the Gift deposit, adjacent to the Gem Restored and Gem orebodies, with the Kundip Mining Centre mineralised system now extending over 2.5km north to south and around 1.7km east to west.

Met test work has already shown the ability to yield consistently high gold and copper recoveries from a conventional, industry standard gravity-flotation-leach process.

This article was developed in collaboration with Medallion Metals (ASX:MM8), a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.