McLeod Hill emerging as ‘growth opportunity’ for Austral copper production

Austral is looking to grow its copper resources and increase production rates. Pic via Getty Images.

- McLeod Hill could add significant inventory for Austral’s Mt Kelly processing plant

- Austral’s looking to build on its current MRE of 55Mt @ 0.7% Cu across all tenements

Quality copper drill hits — including a highlight 5m @ 1.97% — could add quality and quantity to Austral’s 1.42Mt inventory at McLeod Hill.

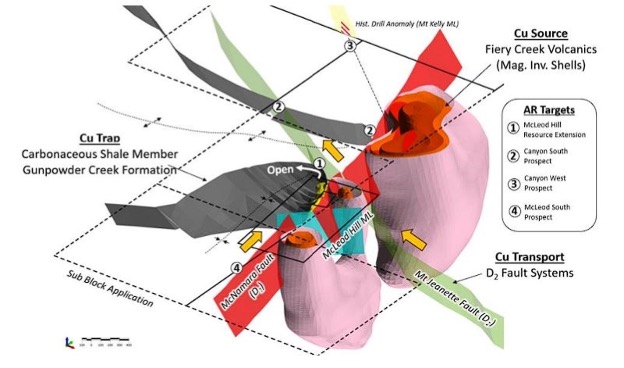

Profitable copper-cathode producer Austral Resources (ASX:AR1) is proving up its McLeod Hill Mining Lease (MHML) to add to a total 55Mt @ 0.7% Cu across 2,100km2 of tenure in the world-class Mt Isa copper district.

The historic MHML currently contains an MRE of 1.42Mt @ 0.49% Cu, 5km south of Austral’s Mount Kelly processing plant, which has a nameplate capacity of 30,000tpa.

Austral sees McLeod Hill as highly prospective to add tonnage to Mount Kelly, which is currently fed by the 4.41Mt at 0.85% Anthill mine.

Copper finds

Assays from an 18-hole RC drilling program for 1,556m have turned in sulphide intercepts such as 15m @ 1.10% Cu from 64m downhole, including 6m @ 1.78% Cu from 71m.

There was also near-surface copper-oxide intervals of 29m @ 0.79% Cu from 39m downhole, as well as a 52m @ 0.31% Cu hit from surface.

“McLeod Hill is interpreted to define 3 discrete zones of mineralisation with a surface zone of low-grade copper oxide (~ 0.3%Cu), a deeper oxide zone of ~0.60% Cu enclosing a higher-grade core of >1% Cu, and an underlying sulphide zone of >1% Cu,” Austral says.

Austral says further evaluation is needed as mineralisation is interpreted to continue, open and untested, northwest into where the Austral has been granted further tenure.

AR1 exploration manager Ben Coutts says the exploration results at McLeod Hill are positive for the overall economic potential of the prospect.

“The identification of multiple zones of mineralisation includes a higher-grade core of oxide near to surface, and grade is always king in improving prospect economics,” Coutts says.

“There is a strong well-developed regolith profile displaying the accumulation and preservation of oxide, another critical factor.

“These conditions have the potential to provide improved grade and volume into the McLeod Hill mineral resource and prospect economics.”

A growing copper producer

AR1 is perfectly placed to benefit from an expected upswing in copper prices.

Copper sales of 2,250 tonnes in the June quarter generated net revenue of A$27.3 million, operating cash flow of A$9.1 million and net mine cashflow of A$2.4 million.

It is eyeing an annual production increase to 25,000t copper once the large open pit at Lady Colleen come online.

A PFS on the potential operation is progressing well with metallurgical test-work underway, the company said last month.

This article was developed in collaboration with Austral Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.