Matsa’s value creation strategy has gold and lithium prongs to work with

Matsa’s gold and lithium projects in Australia and Thailand offer twice as many options to build value. Pic via Getty Images.

While the purpose of any publicly listed company is to create value for shareholders, Matsa is a dynamic explorer which differentiates itself from many of its peers by having two avenues to achieve this.

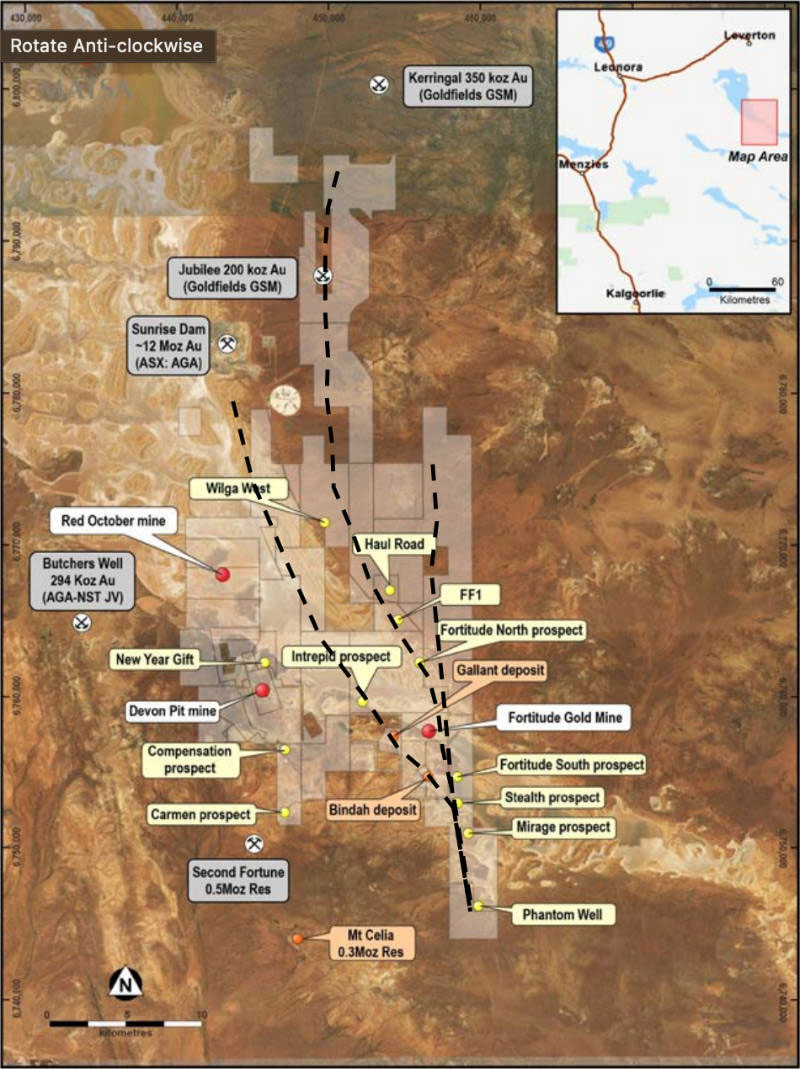

The first avenue and one that has several near-term value drivers is the company’s Lake Carey gold project in Western Australia’s northeastern Goldfields, which has an existing resource of 886,000oz of gold at a respectable average grade of 2.4 grams per tonne gold.

Matsa Resources’ (ASX:MAT) 449km2 tenement holding is the largest in the Lake Carey area outside of ground held by Goldfields and AngloGold. It is also adjacent to AngloGold’s Sunrise Dam operations.

Lake Carey consists of three operations – Fortitude, Red October and Devon.

The 1km long Fortitude open pit has gold resources of 489,000oz at 1.9g/t gold and is the subject of a mining study outlining production of 132,000oz over 30 months to generate a surplus of $95m using a gold price of $2,400 per oz.

This is decidedly conservative given that the gold price is currently at US$2,002.4/oz, or about $2,978.60 in Australian dollar terms.

Work is also underway to assess its underground potential.

Red October is a previously producing mine which produced 113,000oz of gold as an open pit between 1999 and 2002 before producing a further 229,000oz from 2012 when operations moved underground to 2021.

It still hosts a resource of 199,000oz at 6.2g/t gold which the company believes could be extended through additional exploration.

Speaking to Stockhead, executive chairman Paul Poli said that not only did the company have existing operations at the two operations, they were both fully approved and mine ready.

He added ongoing drilling at Fortitude North, which is 6km north of Fortitude is looking increasingly exciting, and that the company expected to achieve its gold exploration target of between 300,000oz to 600,000oz in the near term.

While Matsa is considering its options – including toll treatment – to develop Lake Carey, Poli believes that the company’s preferred option is to build its own processing facilities with a Pre-Feasibility Study completed in 2020 laying out a capital cost of circa $80m to do so.

The company is also involved with the Devon open pit, which is expected to produce 40,000oz of gold over 12 months and generate a cash surplus of $40.5m at a gold price of $2,250/oz and operating cash cost of $1,144/oz.

Devon has a granted mining lease and is currently undergoing final feasibility studies under its equal joint venture with Linden Gold Alliance.

Under the joint venture, Matsa is free carried by Linden for all costs associated with permitting, financing, development and mining of the Devon Pit.

Upcoming gold operations

“We would probably look at redoing in the third quarter of this year Feasibility Studies for Devon, for Fortitude and potentially Red October,” Poli told Stockhead.

“We would hopefully do a pre-Scoping Study for Fortitude North first quarter next year and we think that would demonstrate a sizable standalone project.

“We think that there are more substantial discoveries to be made. We have 28 other exploration targets yet to investigate.”

These targets are located on favourable structural settings along major faults.

Matsa is currently targeting a 1Moz resource baseline, though further increases to resources would certainly be welcome.

Thailand operations a second string in Matsa’s bow

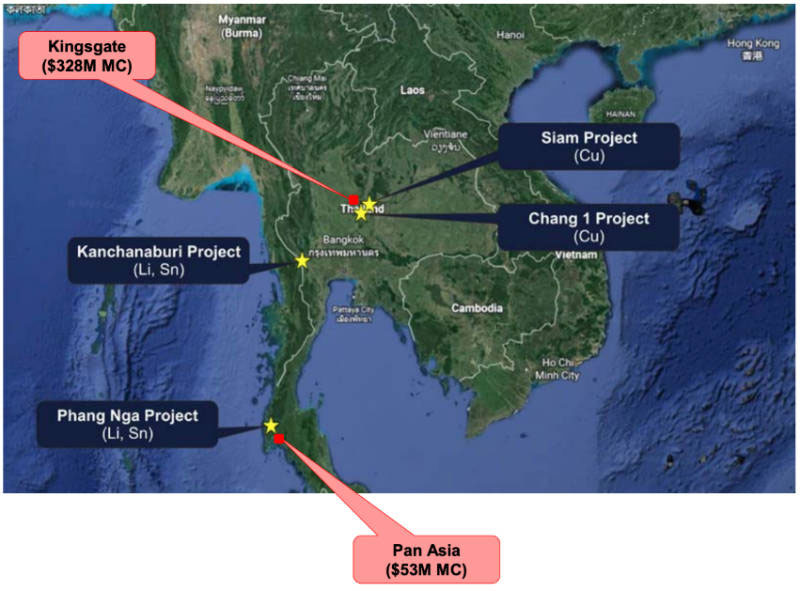

Matsa is arguably the largest holder of tenement applications for lithium ground in South East Asia – specifically in Thailand where its exploration activities have already uncovered lithium mineralisation.

These activities, which provide a twist of lithium to the otherwise gold-focused company, have every as much potential to transform the company.

While the company currently has 1,160km2 of ground under application, Poli flagged that this will continue to grow even as it advances its principal targets.

Of particular interest is the Phang Na project in the country’s southwest where fellow Australian Pan Asia Metals (ASX:PAM) has been plugging away at its Reung Kiet project.

For Poli, Pan Asia’s declaration of a lithium resource provides assurance that there is lithium at depth though he believes that Phang Na is more than capable of standing on its own.

After all, ore at the project is coarse grained and high grade with preliminary results returning assays of up to 2.35% Li2O contained in lepidolite and could potentially be used to produce a direct shipping ore (DSO) product with grades as high as 5.9% Li2O.

To put this in context, Chinese lepidolite processors are currently able to take ore grading 0.6% and upgrading it through grinding and flotation process to between 2.4% and 2.6% prior to processing into lithium chemicals.

“So when they saw our DSO ore that’s upgradable to 5.9%. They said that’s impressive,” Poli said.

“All the infrastructure we need to have a DSO mine is already in place.”

Mineralised samples have also been confirmed to be amenable to processing with existing lepidolite processing facilities in China.

Lithium future

While Matsa currently has Mineral Exploration Licences over its ground that enable it to carry out non-mechanical work such as IP surveys, soil sampling, hand auger sampling, costeaning, and hand trenching, it is currently waiting on further permits that will allow it to carry out drilling.

Poli expects these to be granted late this quarter, which will allow drilling of lithium targets in the third quarter of 2023.

“We are aiming to have a maiden resource within 6-9 months of drilling,” he added, noting that the company is in discussions with companies about potential cooperative agreements on exploration and development.

Discussions are also underway with a Thai company that is looking to provide feedstock for a planned billion dollar anode and cathode battery manufacturing hub that the Thai government is keen to establish for its motor vehicle industry, which is the 11th largest in the world.

Matsa could also have a third leg to stand on with copper projects where historical drilling has demonstrated strong potential already under application in Thailand.

Company leadership

Of course, all the best projects in the world go to waste without a strong leadership team at the reins.

Poli himself is a CPA who was the founder and managing partner of a taxation and business advisory firm for 19 years prior to founding and heading Matsa from 2009.

He headed the negotiations of several very large transactions on behalf of Matsa and related entities.

Company secretary and executive director Andrew Chapman is a chartered accountant with 25 years’ experience in publicly listed companies in the mineral resources, oil and gas and technology sectors.

He has extensive experience in corporate acquisitions, divestments and capital raisings,

Executive director Pascal Blampain is a geologist over 27 years’ experience across Australia and Papua New Guinea, holding senior positions with global miners such as Barrick Gold and Goldfields Australia.

He joined the board 2.5 years ago and heads the company’s technical operations.

In Thailand, Matsa’s management team is headed by Ratha Kheowkhamsaeng, a well versed executive who has been a director of 5 Thai and Thai/Japanese companies.

He brings his experience in local customs and culture and has vast experience in the law and business principles of Thailand.

Poli adds that the company’s geologists in both Thailand and Australia have worked closely with each other in the two countries, ensuring that information and geological standards in technical capacity and work and health safety standards have been cross pollinated to operations in both countries.

This article was developed in collaboration with Matsa Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.