Matsa eyes potential sale of Lake Carey gold project to AngloGold Ashanti

The companies have agreed to a three-month exclusivity period to conduct due diligence. Pic: via Getty Images.

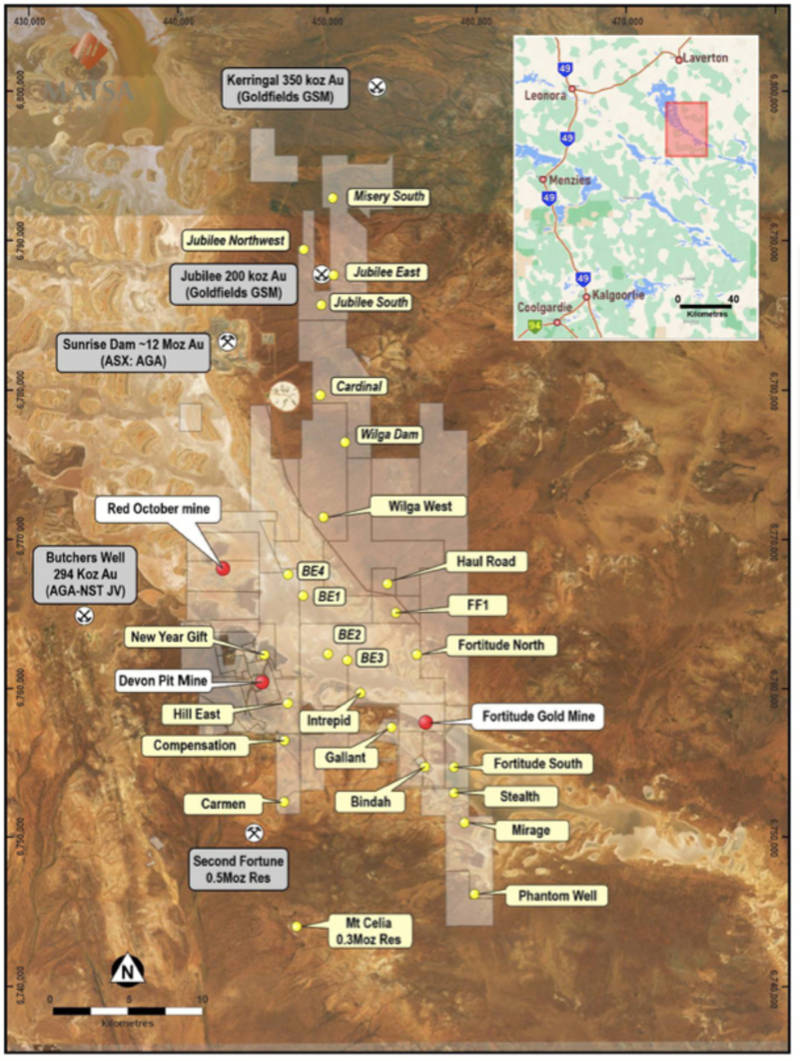

Matsa Resources has extended its confidentiality agreement with AngloGold Ashanti Australia (AGAA) to 31 July 2024 – including a three-month exclusivity period to conduct due diligence and negotiate the potential transaction of its Lake Carey gold project in WA.

AGAA is a wholly owned subsidiary of AngloGold Ashanti, an independent, global gold mining company, and in Australia operates the Sunrise Dam and Tropicana operations, both in WA.

The Lake Carey project consists of three gold mines including the underground Red October gold mine and open pit Fortitude and Devon gold pits.

The company already has a longstanding, professional relationship with AGAA, including the execution of an ore purchase agreement in 2017 for ore from its Fortitude mine and subsequently, the Red October and Red Dog gold mines, to be processed at AGAA’s Sunrise Dam processing facility – which is around 35kms from Matsa Resources’ (ASX:MAT) Fortitude project.

And in recent informal discussions, AGAA expressed an interest in reviewing the Lake Carey project, which hosts a global mineral resource estimate of 936,000oz at 2.5g/t gold, with a view to negotiate a potential transaction.

“It is heartening that AGAA considers it worthwhile to run a due diligence and discussion process over assets that are in a region that has seen significant interest and consolidation as evidenced by recent transactions such as Genesis Minerals (ASX:GMD) acquisition of St Barbara (ASX:SBM) Leonora assets (including a counter bid by Silver Lake Resources (ASX:SLR)), as well as Genesis’ takeover acquisition of Dacian Gold (ASX:DCN),” Matsa says.

“Further consolidation with the merger of Kingwest Resources (ASX:KWR) and Brightstar Resources (ASX:BTR) amongst other corporate activities.”

As part of the agreement between the parties, AGAA will also pay the costs of maintaining and dewatering the Red October Gold Mine by paying a lump sum of A$500,000 within seven days.

Potential +1Moz gold system at Fortitude North

The potential transaction is quite timely, because just last month the company flagged a potential +1Moz gold system at the Fortitude North prospect which could rerate the wider Lake Carey project.

Thick, high-grade mineralisation has now been defined over 1.7km and remains open, with highlights from the most recent drill program including:

- 25m at 3.3g/t gold from 147m

- 14m at 3.4g/t gold from 113m, and 35m at 3.0g/t gold from 150m

- 19m at 3.8g/t gold from 100m

This system will be substantially bigger and better that MAT’s nearby 489,000oz Fortitude gold mine, chairman Paul Poli said.

“With this new information and the fact that mineralisation is still open in the major directions, we are targeting a mineralised system which is potentially in excess of 1Moz at Fortitude North, all the ingredients are there,” he said.

A study on the 489,000oz Fortitude pit outlined production of 132,000oz across 30 months generating >A$95m surplus at A$2,400/oz.

Meanwhile, Matsa has a 50/50 profit sharing JV over the nearby high grade 42,000oz Devon gold project, where production is expected to kick off in 2024 and a DFS is due out late August.

An updated scoping study demonstrated a cumulative cash surplus of $50.4m over 16 months could be achieved producing 40,000oz at a gold price of $3000/oz.

This article was developed in collaboration with Matsa Resources Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.