Massive 400% Gecko resource boost could expand CuFe copper development options

CuFe has increased the Gecko Trend copper equivalent resource by 400%. Pic: Getty Images

- CuFe’s Gecko Trend resources explode 400% to 18.4Mt at 2.32% copper equivalent

- Broader Tennant Creek project now has a combined resource of 24.3Mt

- Expansion offers potential for new revenue streams from gold, bismuth and silver

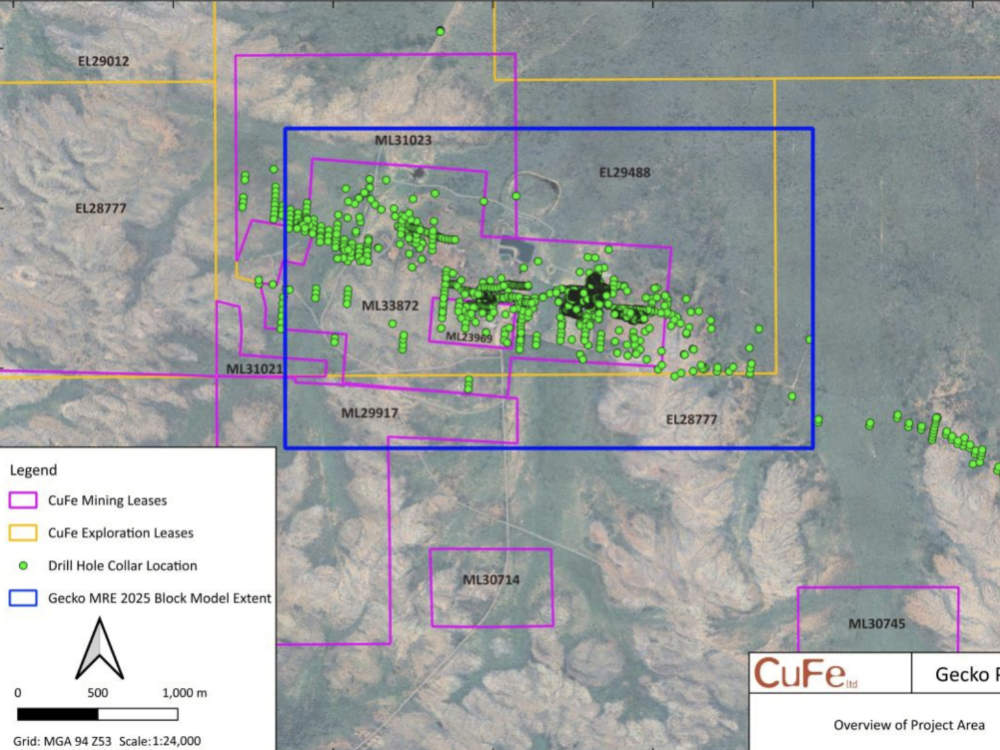

Special Report: CuFe has massively expanded the scale of the Gecko Trend within its Tennant Creek copper-gold project in the Northern Territory after expanding resources by 400% to 18.4Mt at 2.32% copper equivalent.

The upgrade uses a 1% copper cut-off that enables modelling to be based on the full resource, including valuable non-copper metals and more accurately recognising the impact of historical mining.

When combined with the Orlando deposit, it takes total resources at Tennant Creek to 24.3Mt at 1.8% copper and 0.56g/t gold.

This demonstrates the significant scale of CuFe’s (ASX:CUF) project, which has further upside potential from planned infill and step-out drilling around the current resource and greenfield exploration targets.

Adding interest, the increased tonnages provide the opportunity to assess development options including variants of those recently announced in the Orlando scoping study.

“This resource update has added a significant volume of copper metal to the project and delivers a result that has frankly exceeded our expectations when commissioning the review,” executive director Mark Hancock said.

“It rewards the considerable time and effort that the CuFe and MEC teams have spent sourcing and validating historical data, allowing the team to interpret, model and estimate the resource across the full drill hole database and in turn produce an estimate that best represents the true extent of the Gecko trend.”

He added the inclusion of gold, bismuth and silver into the resource allowed the company to investigate additional revenue streams as byproducts of mining the copper.

“By maximising the use of the historical data that has been captured over the past 50 years we have taken the global resource at the project from 7Mt when we acquired it to 24Mt on a very cost effective basis,” Hancock noted.

“Understanding the scale of the resource gives us confidence in our options in the region which will guide further studies as we move the project forward towards development.”

Tennant Creek project

CUF holds a 55% interest in the ~240km2 Tennant Creek property with Gecko Mining Company holding the remaining 45%.

It sits about 25km from the Tennant Creek town site and is close to a gas pipeline, grid power, the Stuart Highway and rail line to Darwin.

In late July, the company released a scoping study for the Orlando deposit that estimated net present value and internal rate of return – both measures of potential profitability – of $355m and 59% respectively.

Orlando will also deliver revenue of $1.26bn from the production of 39,449t of copper and 167,419oz of gold.

Total pre-production capital expenditure, which includes the construction of a new processing plant is estimated at $136m with payback in 1.9 years.

It assumes that 3.5Mt of the Orlando resource will be produced at feed rates of 1.33% copper and 1.8g/t gold – about one third of the total Tennant Creek resource of 10.35Mt at 1.53% copper and 0.92g/t gold.

This article was developed in collaboration with Cufe, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.