Martin Place Securities’ Barry Dawes thinks this REE acquisition could rerate CRML and EUR

Critical Metals Corp owns the flagship Wolfsberg lithium project, the first fully permitted mine in Europe. Pic via Getty Images

- Martin Place Securities analysts believe that CRML’s Nasdaq listing has elevated EUR’s balance sheet

- Executive chairman of Martin Place Securities Barry Dawes says the CRML acquisition of the world leading Tanbreez REE project as well as its plans for a lithium refinery in Saudi Arabia has a pass through value for EUR

- Dawes says the company could re-rate to $0.67 – a 36.7% increase from its current $0.49 share price at the time of writing

Special report: Martin Place Securities believes the listing of Critical Metals Corp on the NASDAQ has paved the way for the company to become a key part of US indices.

The Nasdaq listing of Critical Metals Corp (CRML) represented a pivotal milestone in the 12-year journey that executive chairman Tony Sage has navigated with the Wolfsberg lithium project in Austria.

CRML’s successful listing on the American exchange was indicative of the US’ strong appetite for lithium opportunities, such as Wolfsberg. European Lithium (ASX:EUR) retains an interest in the project via holding 83.03% ordinary shares in CRML.

Martin Place Securities analysts have previously valued EUR shares at least five times higher than current levels, saying the Nasdaq listing opens new opportunities for long term growth due to the budding relationships afforded by the US market.

But a new opportunity for CRML recently announced to the market has Martin Place Securities executive chairman Barry Dawes rating the stock even higher – the Tanbreez Greenland Rare Earth deposit.

CRML has acquired an initial 5.55% equity interest in Tanbreez for US$5m cash while EUR will retain a 7.5% ownership in Tanbreez. CRML ultimately plans to acquire a 92.% interest in Tanbreez.

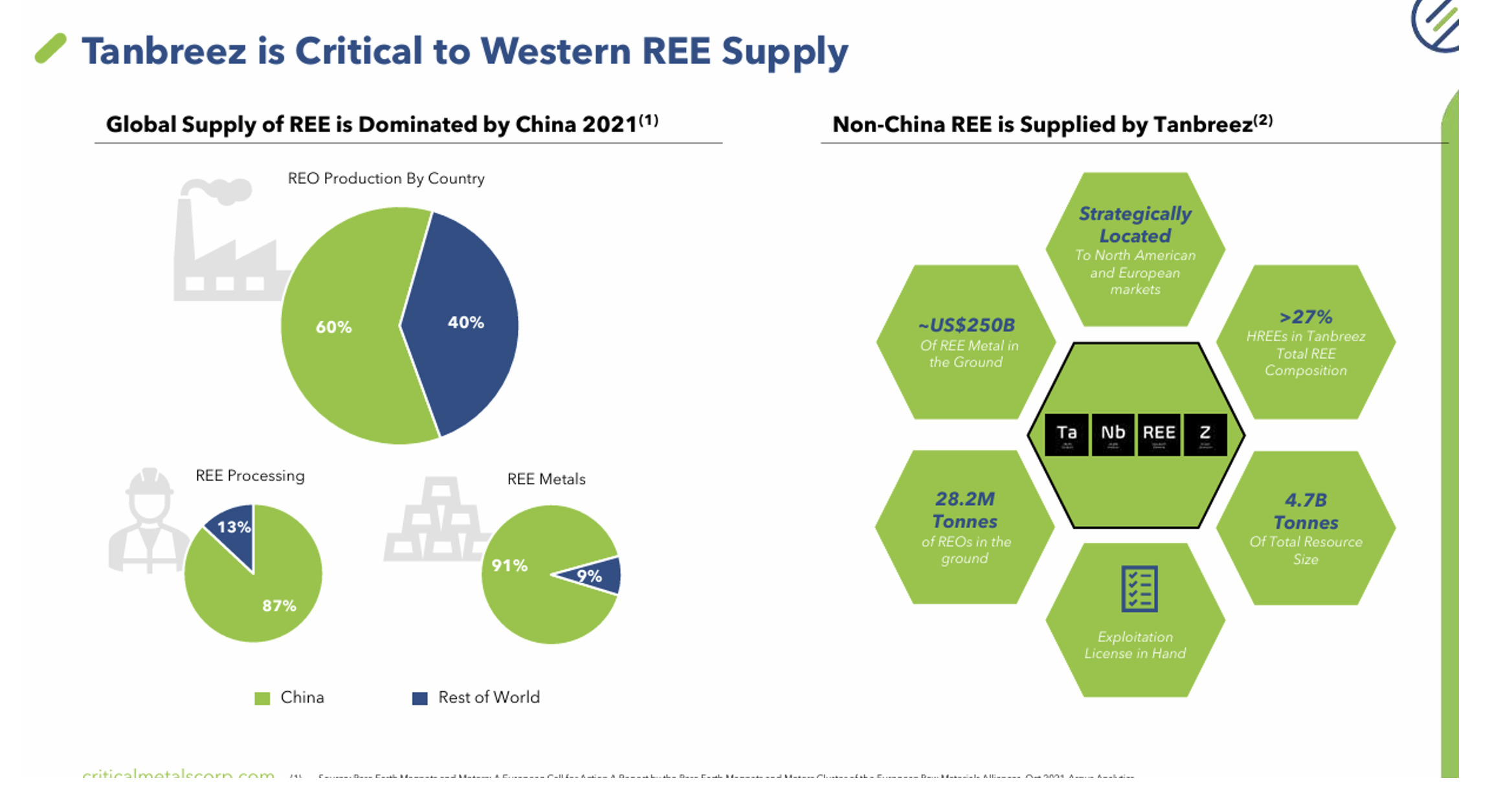

Dawes believes the Tanbreez rare earth deposit in Greenland could also lead to a significant re-rating in CRML, given its ability to provide a sustainable long-term supply of REEs outside China.

And BMW’s US$15m contribution to the Wolfsberg project earlier this month only adds another string to CRML’s bow, laying the groundwork for financing.

Asset stands tall amongst peers

Dawes says the pieces are coming together for EUR, with the Nasdaq listing providing the company with a vast balance sheet to pursue developments of its lithium and now REE assets.

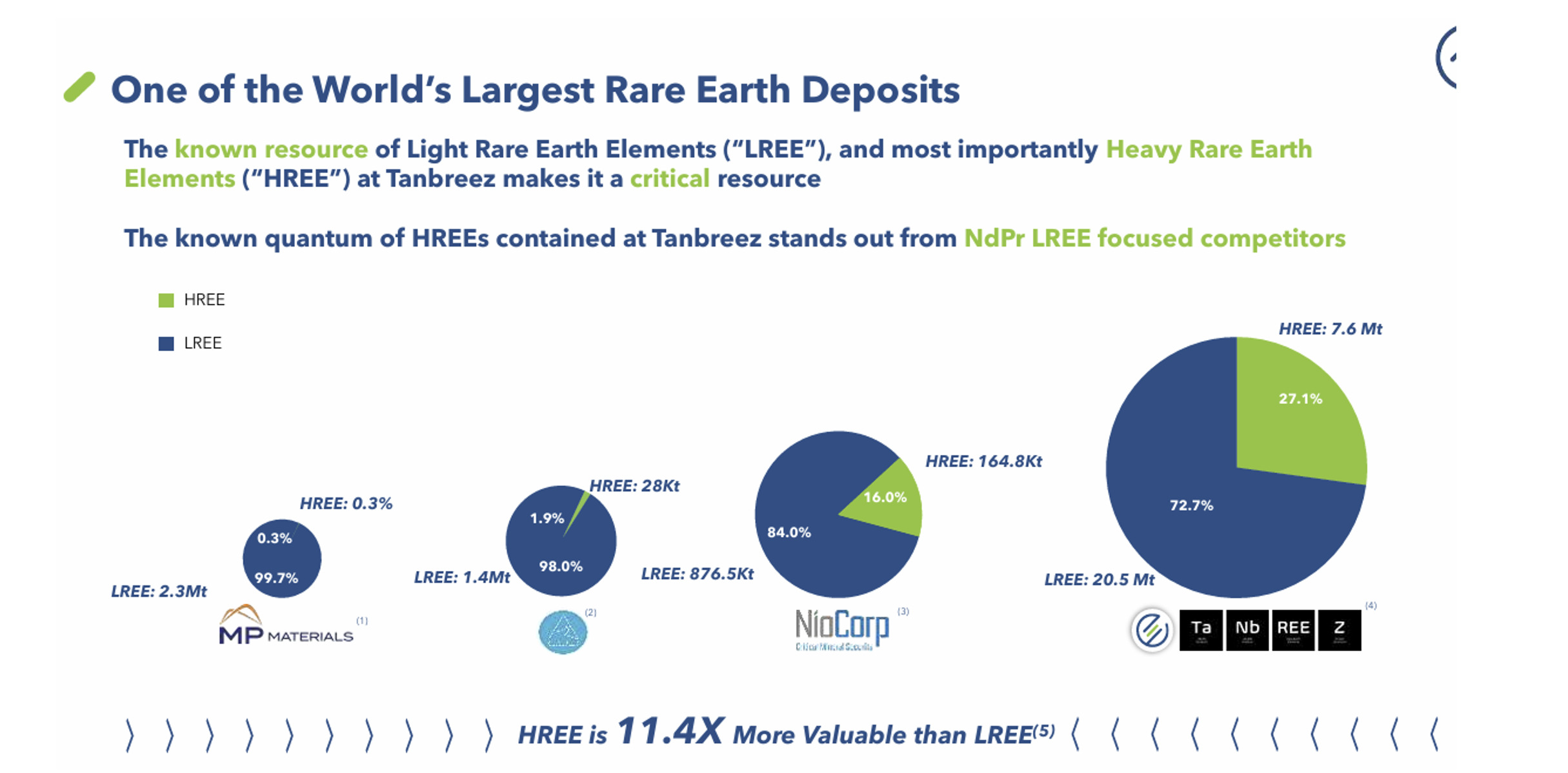

In an industry where competitors primarily target light rare earth elements (LREE), the Tanbreez REE project is unique not only due to its significant 4.7Bt multi-element resource, but also because of its more valuable heavy rare earth element (HREE) mix which totals more than 27%.

The asset is expected to benefit from robust regulatory tailwinds in both Europe and North American as well as long-term secular trends for next-generation technology for both commercial and government applications.

“All other REE deposits pale into insignificance against Tanbreez with the project holding 28.2Mt of total rare earth oxides, that’s 10x Lynas’ resources,” Dawes says.

With Saudi Arabia encouraging resources development using its world-class infrastructure and low-cost energy inputs, Dawes reckons EUR is perfectly placed to capitalise given its plans to build and operate a hydroxide plant in Saudi Arabia.

EUR signed a non-binding MOU with Obeikan Investment Group back in 2023 to enter a 50:50 JV for the co-development and co-operation of the hydroxide plant.

“Saudi Arabia has been encouraging industrialisation and resource development under its Saudi Vision 2030 plan to reduce reliance on oil revenues,” Dawes says.

“A current Saudi drive to invite Australian exploration and development expertise is offering 75% debt funding for capex, low energy costs and 2-3% interest rates for new mining development projects.

“Obeikan Investment Group would be well placed to assist in utilising these incentives.

“It is becoming clearer that long term availability of higher grade spodumene for lithium extraction is far more limited than realised and most other lithium sources are uneconomic.”

A new lithium opportunity in Europe

European Lithium is on the path to actively developing new lithium project in Europe, particularly in Ireland after acquiring LHR Resources, the 100% owner of the Leinster project.

The asset – south of Dublin in the Leinster Granite Massif within the same key tectonic zone and along strike to the Blackstairs Lithium (Ganfeng / ILC joint venture) Avalonia project – is subdivided into a North Leinster and South Leinster block.

Each block contains several developing prospect areas where significant lithium bearing spodumene pegmatites have been located in surface sampling and more recently in diamond drilling.

EUR will acquire the asset through the sale of 1.23m CRML shares for US$10m, the completion of the transaction is subject to usual due diligence.

EUR could rerate to $0.67

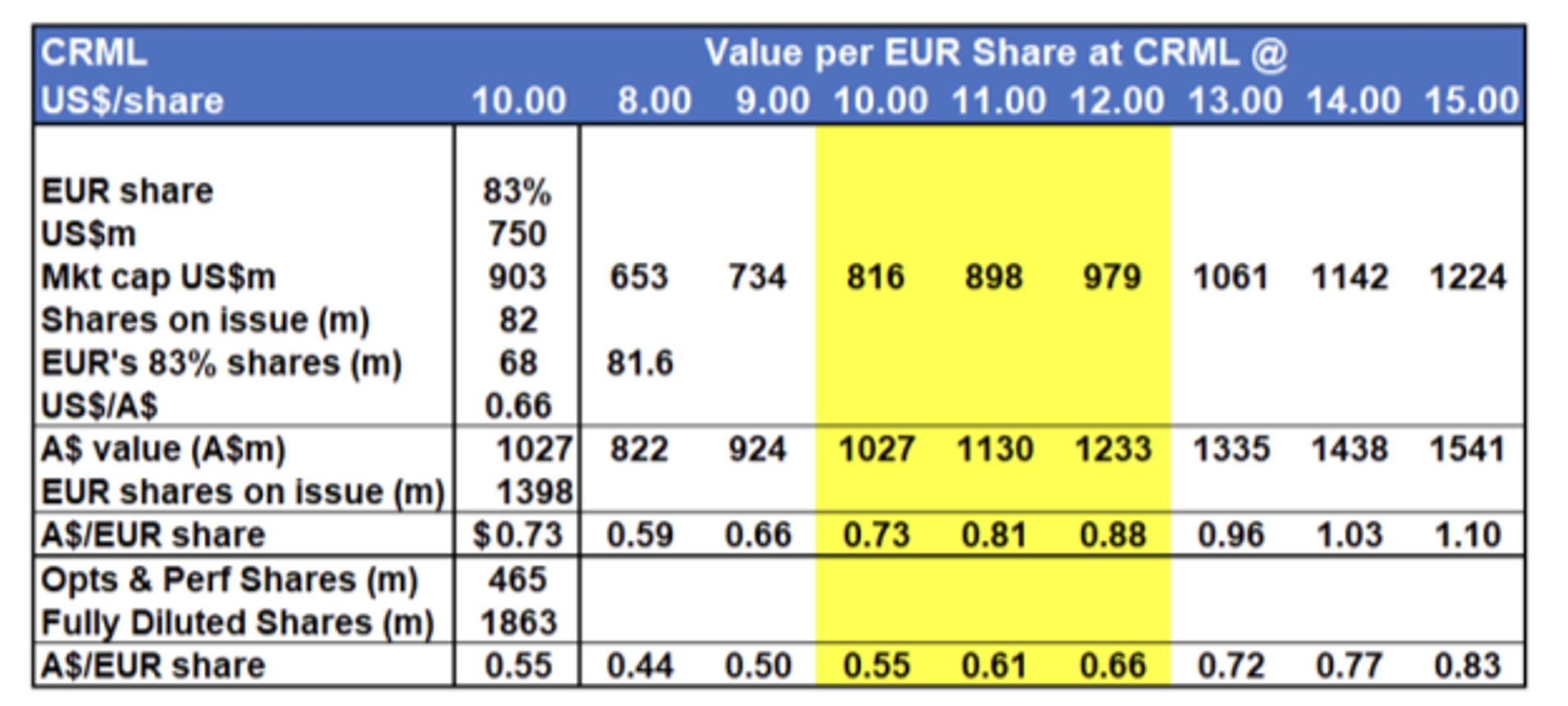

From Dawes’ point of view, all of this has a ‘pass through’ value for EUR, which he sees leads to a potential rerating in the company’s share price to $0.67, a 36.7% increase from its $0.49 share price at the time of writing.

“CRML closed at US$11.53 on Monday, breaking a three month down trend which shows the stock is already being re-rated,” Dawes says.

“Over $0.60 per EUR shares are fully diluted.

“As you can see in the above image, the yellow shading is likely to be moving to the right valuing CRML at $12 per share and EUR at $0.66,” Dawes says.

“Don’t miss out.”

This article was developed in collaboration with European Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.