Maronan Metals an ‘emerging silver giant’: GBA Capital

The project is in the mineral rich region of Cloncurry, Queensland. Pic: via Getty Images

- Maronan valued at 95c per share by GBA Capital research report

- Report expects feasibility studies in 2025/26 and production in 2030

- Polymetallic suite expected to make the project economically resilient

Special Report: GBA Capital sees Maronan Metals as Australia’s emerging silver giant, with a noted mining analyst placing a 95c per share valuation on the Queensland explorer.

That compares to 22c before the report came out, placing a potential 4x uplift on the silver and base metals hopeful.

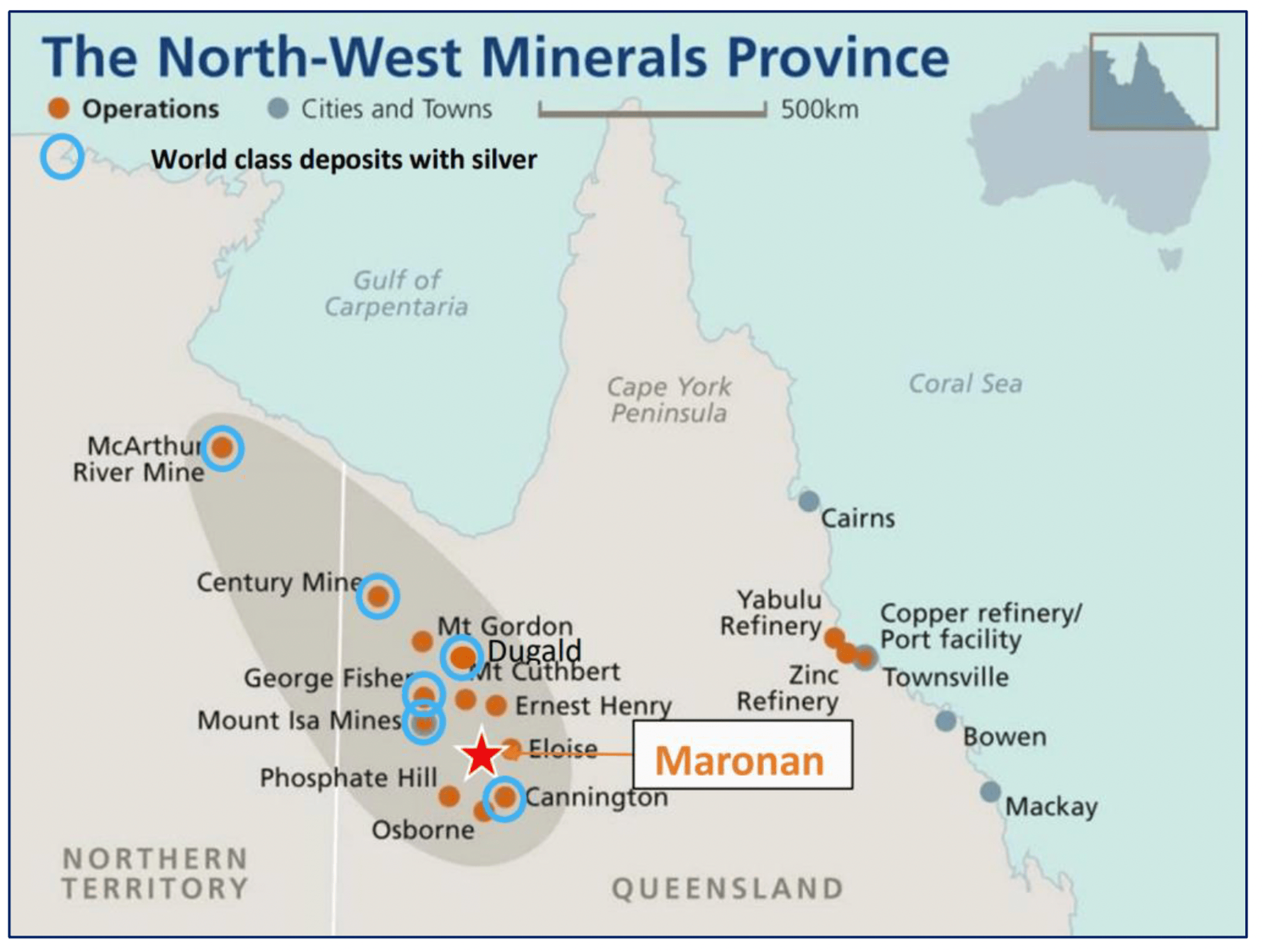

The company is developing its namesake project, the polymetallic Maronan silver-lead-copper-gold deposit, near Cloncurry in Queensland.

The region is known for its rich mineral deposits and long mining history, including multiple tier-1 lead-zinc-silver operations such as Mount Isa, Century and Cannington, as well as copper-gold mines like Ernest Henry and Eloise.

Maronan has a resource of 32.1Mt at 6.1% lead and 107g/t silver, as well as 32.5Mt at 0.84% copper and 0.61g/t gold, with a gold only 1.8Mt at 1.24g/t.

“Given its large scale, rich silver grades of +100g/t silver and favourable location, we expect Maronan to deliver positive studies in 2025/26 and reach production in 2030, with an earlier date and initial capex reduction if a trucking option is adopted,” GBA analyst Trent Allen noted.

“It’s rare to see an exploration project and think ‘this looks like a mine’: Maronan has been one of those positive occasions.

“We initiate research coverage with a valuation of A$0.95/sh.”

Feasibility studies in 2025/26

Numerous gold and base-metal mines operate successfully in the region, so there is a clear and well-regulated permitting pathway by which Maronan can reach production.

And while Maronan Metals (ASX:MMA) is yet to release feasibility studies, these are in progress and GBA’s financial model considers underground polymetallic production for +15yrs, at an average silver-equivalent rate of 13.5Moz.

That’s about the same in dollar terms as 45,000tpa of copper, or hypothetically 160,000ozpa of gold.

“Based on industry studies of similar projects, we expect capex could be A$350-450m, with site opex c.A$100/t – the easy-milling silver-lead mineralisation is an advantage,” Allan says.

Not to mention, as part of its Critical Minerals Strategy, the Queensland Government is making a $5bn investment in the CopperString 2032 project, which will build a high kV power connection between the North West Minerals Province and the east coast grid at Townsville – which the project could benefit from.

The state is also providing assistance to develop its critical minerals industry via its $170m Critical Minerals and Battery Technology Fund, bearing in mind a recent change of government with David Crisafulli’s LNP unseating Steven Mile’s Labor Party.

Polymetallic means resilient

Maronan is a polymetallic deposit but the most influential commodity in terms of the share price is silver, GBA says.

Silver is of approximately equal value to lead in terms of revenue in the first 5 years of production, but its price is far more volatile.

Prices have gained around 60% in the past 12 months – sitting at around US$33/oz – as the metal becomes recognised as being critical for its use as a conductor and in photovoltaics.

However, being able to produce both base and precious metals means the project could be economically resilient, Allen says, because a downturn in one commodity can be partly offset by an upturn in the other, allowing them to profit through most economic cycles.

“We like this company because we see in Maronan the opportunity for a relatively low risk, large and economically compelling mining project in eastern Australia,” Allan said.

“The company itself has been overlooked by investors, although the surging silver price is changing that. Subject to macroeconomic factors, MMA’s share price could approach our valuation over the next 12 months as the project moves through resource upgrades to economic studies and demonstrates a timeline to production.”

There’s also the added bonus of explorer Red Metal (ASX:RDM) (who spun out the project as Maronan Metals in 2022) retaining a 43.98% shareholding. RDM has a major rare earth project in QLD and might be expected to sell down some of MMA over time to help fund it.

This article was developed in collaboration with Maronan Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.