Mark Creasy’s Galileo Mining shoots skyward in ASX debut

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Mark Creasy’s Galileo Mining would have made its namesake astronomer proud with a stellar ASX debut today.

Galileo (ASX:GAL) raised $15 million selling shares at 20c apiece in an initial public offer to fund development of cobalt and nickel projects in Western Australia.

The stock almost doubled its issue price to 38c with about 7.5 million shares changing hands in early trade.

By 4pm AEST the stock had cooled to 32c — a 60 per cent gain on its first day.

It was a good day for ASX floats. Software maker PayGroup also today made a successful public debut, closing its first day of trade at 87c — a 74 per cent premium to its 50c issue price.

June is a big month for listings with at least 11 companies joining the ASX.

British-born millionaire Mr Creasy is Galileo’s biggest shareholder with a 31 per cent stake.

His 37.4 million shares were worth about $12 million at the end of Tuesday.

Mr Creasy has been credited with some of Western Australia’s biggest mineral discoveries, including the Nova-Bollinger nickel-copper-cobalt deposit, now owned by Independence Group (ASX:IGO), and the Jundee and Bronzewing gold finds.

Mr Creasy sold the Jundee and Bronzewing gold deposits in 1994 for $130 million, and the Nova-Bollinger mine, which was owned by Sirius Resources – a company he had a major stake in – was bought by Independence for $1.8 billion in 2015.

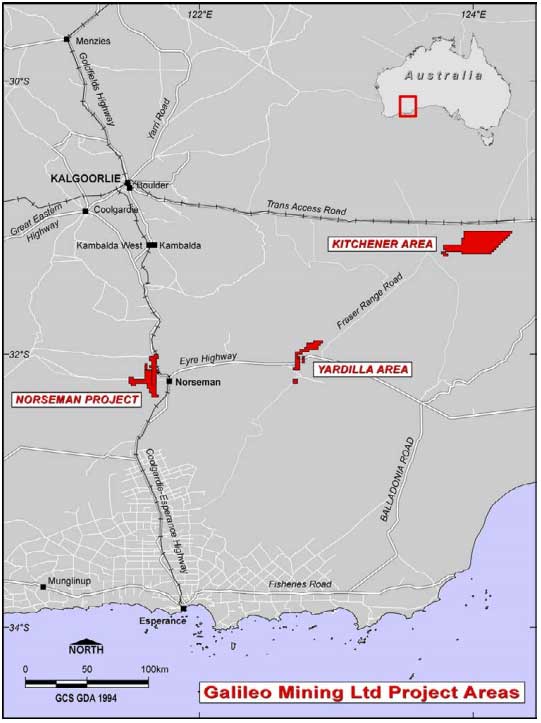

Galileo is focused on a cobalt and nickel project called “Norseman” which contains some 22,000 tonnes of cobalt and 106,000 tonnes of nickel.

The explorer will accelerate exploration at the Norseman project with drilling at key targets ahead of a scoping study.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

It also has a Fraser Range project which is said to be highly prospective for nickel, copper and cobalt.

Other significant investors in Galileo include ASX-listed miner Independence Group and Mineral Resources founder Chris Ellison.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.