Marindi boss is ‘stoked’ to be selling Pilbara gold project in a deal worth ‘well over’ $10m

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Pilbara gold player Marindi Metals has struck a cash and scrip deal worth over $C10 million ($10.2 million) to sell its Bellary Dome conglomerate gold project in WA’s Pilbara to Canada’s Pacton Gold.

Pacton, which is backed by renowned billionaire investor Eric Sprott, has agreed to make an initial payment of $C2 million in cash and issue roughly 10.1 million of its own shares. Pacton’s shares were last trading at about 75c, valuing the share issue at about $C7.6 million.

Marindi (ASX:MZN) said the share issue would give it about a 9.9 per cent stake in Pacton.

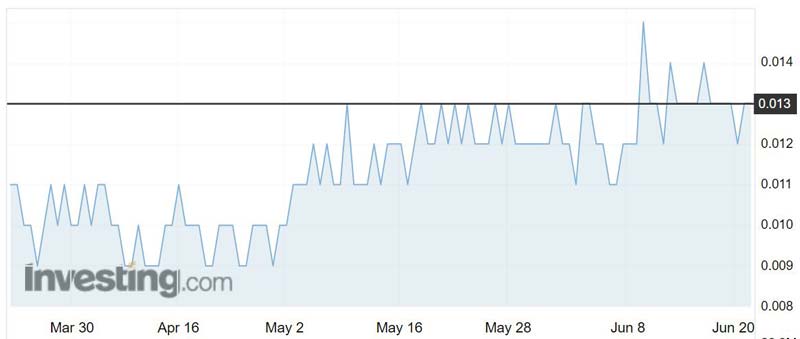

The news sent Marindi shares up 8.3 per cent to 1.3c on Thursday morning.

Under the deal, which is subject to Pacton completing due diligence on the Bellary Dome project, Marindi can also earn a further $C2 million worth of Pacton shares in milestone payments due 12 and 18 months after completion.

Marindi has also negotiated an anti-dilution right.

“It means that we stay at 9.9 per cent and if Pacton issues any more shares as part of a capital raising they have to top us at no cost,” newly installed managing director Simon Lawson told Stockhead.

“It puts us well over $10 million. For a struggling asset I am actually really stoked.”

The Pilbara conglomerate gold story really took off mid-last year after Artemis Resources (ASX:ARV) and its Canadian partner Novo Resources found gold nuggets that were eventually confirmed as conglomerate-hosted gold.

But the hype has since died down and some juniors are struggling to gain share price traction.

Mr Lawson says the deal with Pacton is a really good way to take an asset that was struggling to find traction in the ASX market and put it into a TSX-listed company.

“We thought about listing and we thought about all sorts of other things and this seemed to be the best solution,” he said.

TSX-V listed Pacton is a Canadian junior with partners focused on the exploration and development of conglomerate-hosted gold properties in the Pilbara.

The company recently raised about $C5 million and controls the third largest conglomerate-hosted gold property in the region.

Conglomerate gold refers to nuggets hosted in rock containing rounded gray quartz pebbles and other minerals.

The world’s most productive gold region, South Africa’s Witwatersrand Basin, is famous for its similar geological formation.

But conglomerate gold in the Pilbara has proved difficult to drill and players like Artemis and Novo have had to resort to digging out bulk samples in an effort to define a resource.

Marindi plans to put the cash towards advancing its Forrestania lithium and gold project in WA, where a major drilling campaign is currently underway.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.