Manuka strikes game-changing deal to add advanced New Zealand iron sands project to portfolio

Pic: Via Getty Images

Manuka (ASX:MKR) is diversifying its portfolio with the acquisition of an emerging vanadiferous titanomagnetite iron sands producer that is expected to become one of the largest exporters in the country.

Manuka Resources (ASX:MKR) has struck a deal to acquire an advanced offshore vanadiferous titanomagnetite (VTM) iron sands project in New Zealand that has already commenced its bankable feasibility study (BFS).

The company will acquire Trans-Tasman Resources in an all-scrip transaction comprising the issue of up to 180 million Manuka shares in a move that will reduce the company’s risk profile by broadening the range of commodities it produces.

Manuka emphasised though that it remained very committed to its assets in the Cobar Basin of NSW, where the company continues to produce silver and has budgeted $3.6m for exploration across its projects over the coming financial year.

Importantly, the STB project – which is slated to recover around 5 million tonnes of VTM iron ore concentrate per annum over an anticipated 20-year mine life – is expected to be a low-cost and low-emissions producer.

Manuka’s due diligence pegs C1 (cost of product to FOB) production costs at between $US21 ($30) and $US24 ($34) per tonne, which means the project is competitively positioned on the global cost curve. It is also positioned in the bottom quartile of CO2 emitters for iron ore producers globally, with an estimated 62kg of CO2 per tonne compared to the international average of 125-250kg of CO2 per tonne.

Trans-Tasman Resources is also planning to produce a vanadium-rich titanomagnetite (VTM) concentrate at grades of 56-57.2% iron, 0.5-0.54% vanadium pentoxide and 8.3-8.7% titanium dioxide.

While vanadium has long been used in steelmaking because of its ability to make steel stronger, it has been propelled to the forefront of the ‘green economy’ thanks to its advantage of improving energy storage and battery life via vanadium redox flow batteries.

“Low carbon footprint bulk commodities are increasingly sought after as the world continues its expected transition to a ‘green’ energy future,” Executive Chairman Dennis Karp noted.

“Exposure to vanadium as a commodity via a well advanced and expected low-cost multi-element project is considered to be a key strategic addition to Manuka’s portfolio.”

According to Manuka, the STB project concentrates are expected to contain over 11 pounds of vanadium per tonne. Vanadium is currently fetching $US7.70 per pound and could enhance the project’s economics as a by-product generating additional revenue.

Once in full production, the project is expected to become one of the largest exporters in New Zealand, directly employing 250 operational and 50 administrative staff. It will also create a further 165 indirect regional jobs in support, engineering, logistics and port operations.

Extensive work already done

Trans-Tasman Resources has spent over $75m on the STB project so far, having completed a prefeasibility study (PFS) and commenced a BFS. Manuka expects to finalise the BFS within the next 12 months.

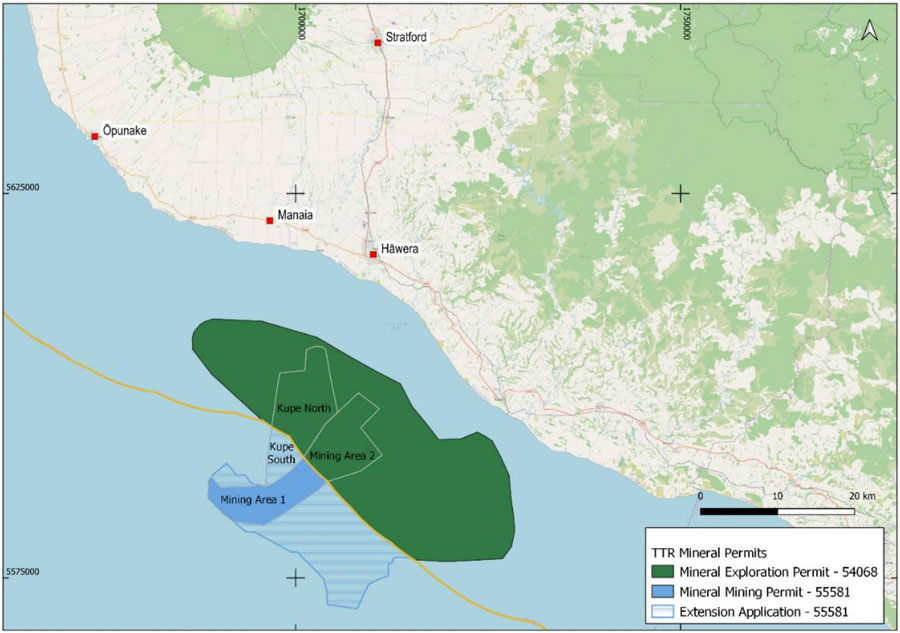

Trans-Tasman Resources has already defined a 3.8-billion-tonne JORC-compliant resource, which is hosted within a mining permit and exploration permit in the South Taranaki Bight off the west coast of the North Island of New Zealand.

The company was granted a Marine Consent and Marine Discharge Consent by the New Zealand Environmental Protection Authority (EPA) in 2017.

While this Consent was subject to third party challenge, the New Zealand Supreme Court has subsequently referred the Consent back to the EPA for final reconsideration on five narrowly defined matters. The process is expected to be completed during the first quarter of 2023.

Concurrently, Manuka will complete further metallurgical test work aimed at optimising the flowsheet for processing of the VTM concentrate, as well as the recovery of the vanadium and titanium, in the second half of this year.

The company is also planning to undertake marketing studies to build on earlier work completed during the PFS.

Utilising proven tech

The technology that will be used to recover the ore from the seabed has been developed by De Beers Marine SA over the past 40 years in the company’s diamonds operations off the Namibian coast of Southern Africa. They have built and operated seven of these vessels.

De Beers Marine and Royal IHC – a Dutch supplier of marine technology with dredging expertise – have collaborated to develop the necessary intellectual property for the proposed seabed recovery solution.

De Beers Marine has also provided a commissioning and operating solution to Trans-Tasman Resources for the first two years of production with an option for to extend this arrangement.

End users already showing interest

The STB project is already on the radar of global steel mills and potential offtakers.

Metalcorp Group, the metals and minerals subsidiary of Monaco Resources Group, has already expressed strong interest in assisting to bring the project to production.

Manuka plans to engage with global steel mills and offtakers to continue to build the portfolio of parties that expressed interest in being involved in project development since the PFS phase.

The company noted that during the PFS phase, Trans-Tasman Resources secured funding, sales commitments, and MoU’s for over and above the proposed 5Mt of expected

The acquisition is subject to shareholder approval.

This article was developed in collaboration with Manuka Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.