Manuka expects some serious cash flow from its gold, silver operations

Manuka is certainly no Vanilla Ice, it expects to hit the big time and keep going. Pic: Getty Images

Special Report: Manuka Resources isn’t going to be just a “one-hit-wonder”, with fresh numbers showing just how much initial cash it expects to make from its gold and silver operations in NSW, with plenty of prospects in the pipeline to grow the coffers.

Manuka Resources (ASX:MKR) is already generating cash from its Mt Boppy mine in the Cobar Basin with production kicking off in the second quarter of this year.

Gold production from the existing reserve at the mine is expected to run through to Q2 2021, and generate $25m in earnings before interest, taxes, depreciation and amortisation (EBITDA).

Manuka began producing gold from stockpiled Mt Boppy ore processed through the Wonawinta plant in April and has since transitioned to treating newly mined ore from the Mt Boppy pit at Wonawinta.

But the company has highlighted three other potential revenue streams that could be serious money-makers for the company.

The Wonawinta silver project is slated to come into production in Q3 2021 and continue through to 2026, during which time internal management targets expect to add around $135m to Manuka’s coffers.

Manuka will start by processing the silver stockpiles in the first nine months and then move onto the mining of the higher-grade oxides currently in the company’s resource model, at an average grade of 76 grams per tonne (g/t), which will sustain production for another four years.

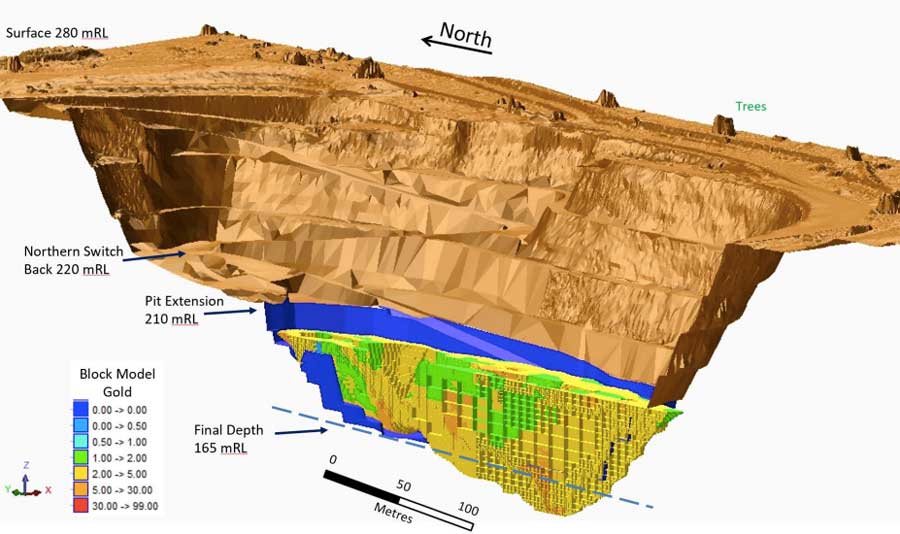

Mt Boppy Mark II

But there is also plenty of blue-sky potential for finding another Mount Boppy from Q4 2020.

Mt Boppy historically produced around 500,000oz of gold at an average grade of 15g/t since 1895 but little drilling has been done below a depth of 120m.

However, a resource extension program already underway has delivered top high-grade hits of 21m at 20.7g/t, including 10m at 38.48g/t, from 57m and 14.5m at 14.5g/t from 59m.

And over at Wonawinta, Manuka has confirmed the potential for silver, lead and zinc in the sulphide deeps.

Manuka has high expectations it can monetise the sulphide deeps, with the current substantial resource ending in sulphide mineralisation.

Including stockpiles and shallow oxide material, Wonawinta contains total JORC compliant resources of 38.8 million tonnes at 42g/t silver for 52.4 million oz.

Within this is a higher-grade component of 4.5 million tonnes at 97g/t silver for 14 million oz.

“We’ve entered into the most exciting period of Manuka’s history,” executive chairman Dennis Karp said.

“There are three factors currently in our favour – one we’re mining and in production, two we have now commenced exploration programs on both projects, and three the underlying commodity markets are hugely in our favour.

“We await the outcome of the exploration results over the next two to three months with great anticipation.”

ASX’s only exposure to near-term silver production

In a recent research report, MST Access analyst Michael Bentley ascribed a fully diluted risk-weighted valuation of 94c to the company, citing the low-risk, low capex near-term cash generation from Mt Boppy and Wonawinta and strong markets for gold and silver as key factors in reaching that valuation.

Manuka’s share price is currently trading around 51.5c.

Manuka Resources (ASX:MKR) share price chart:

“The near-term cash flow from both Mt Boppy and Wonawinta generates strong value for MKR, with significant potential upside from exploration for both extensions of mine life and increased production,” Bentley said.

“The presence of an existing fully refurbished plant at Wonawinta gives MKR options to process both gold and silver as well as third-party processing deals.”

Bentley noted that Manuka provides the ASX’s only direct exposure to genuine near-term silver production and presents a rare investment opportunity.

This article was developed in collaboration with Manuka Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.