Mako, Aurum merger creates new force for West African gold exploration

The merger will create an emerging exploration and development gold business in West Africa with cash of more than A$20 million. Pic: Getty Images

- Mako Gold and Aurum Resources have entered into a Bid Implementation Agreement (BIA)

- The offer represents a 112% premium for MKG shareholders based on the 30-day VWAP of A$0.00855

- Aurum has six company-owned drill rigs operating at Boundiali and has ordered two new diamond drill rigs to deploy following completion of the merger

Special Report: Mako Gold and Aurum Resources have reached an agreement to create a well-funded, stand-out emerging exploration and development gold business in West Africa.

Mako Gold (ASX:MKG) geologists have been working hard at proving up the Komboro prospect within the flagship Napié project in Côte d’Ivoire, where detailed geological mapping and rock chip sampling recently returned 170g/t gold.

Those results demonstrated the prospectivity of the northern part of the Napié asset and when combined with high-grade results from previous scout drilling, highlighted the potential to significantly grow the resource beyond the current 868,000oz at 1.20 g/t gold gold resource.

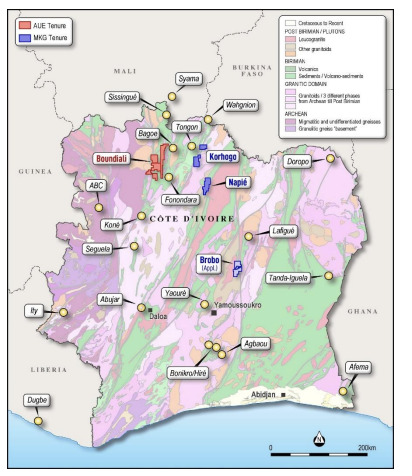

Mako’s string of exploration success from its detailed geological mapping and rock chip sampling were undoubtedly the right bait for Aurum Resources (ASX:AUE) whose neighbouring Boundiali gold project resides on the same greenstone belt as Resolute’s (ASX:RSG) 11.5Moz Syama and Perseus’ (ASX:PRU)1.4Moz Sissingue assets.

Deal supports 112% premium on 30-day VWAP

The two companies have now entered into a Bid Implementation Agreement (BIA) for an agreed merger which sees Aurum set to acquire 100% of the issued shares in Mako and 100% of two classes of unlisted options by way of an off-market takeover bid.

Representing a 112% premium for MKG shareholders based on the 30-day VWAP of A$0.00855, the merger will create an exploration and development gold business in West Africa, underpinned by a strong cash balance of more than A$20 million to push the flagship Napié and Boundiali projects forward with exploration activities in northern Côte d’Ivoire.

The newly formed company will be driven by a highly experienced board and management team with extensive gold experience from grass roots discovery, through to resource drill-out, feasibility studies, project finance and production.

Two assets with long-life potential

“We see strong similarities between Napié and the Abujar Project where the Aurum executive team, when running Tietto Minerals, were able to rapidly grow resources to 3.8Moz and propel Abujar into production before being acquired in mid-2024 for over A$768 million,” Aurum managing director Dr Caigen Wang said.

“The Aurum team is excited to apply our skills to Napié, which we consider has great potential to quickly evolve into a multi-million-ounce project with a dedicated owner-operated multi-rig drilling programme which can be delivered at a cost significantly below standard contract rates.

“Between driving growth at Napié and being well on the path to delivery of a maiden resource at our own Boundiali project later this year, we see strong potential for Aurum to become a strong emerging gold developer in Côte d’Ivoire with two assets with long-life potential in close proximity to each other.”

Finer details of the offer

Mako shareholders will receive 1 Aurum share for every 25.1 Mako shares they hold representing a strong premium to Mako’s trading price over an extended period.

Based on the five-day volume weighted average price for Aurum shares of 0.455 on 11 October, the share offer represents:

- 91% premium to Mako’s last traded price on 11 October of $0.0095;

- 100% premium to Mako’s 5-day VWAP of $0.00908;

- 112% premium to Mako’s 30-day VWAP of $0.00855; and

- 103% premium to Mako’s 60-day VWAP of $0.00891 per Mako share for the period up to 11 October.

Aurum will also make off-market takeover bids for the Class A Options on issue and the Class B Options.

Upside growth at Napié, rapidly evolving Boundiali

“We have always believed our Napié project has potential to host multi-million ounces of gold, and pleasingly, due to relative sizes of Mako and Aurum, upon close of the proposed merger, Mako securityholders will remain a meaningful part of the expanded group,” MKG managing director Peter Ledwidge said.

“They will share in the continued upside to the growth in Napié, as well as gain exposure to the rapidly evolving Boundiali project where Aurum expects to deliver its maiden resource in late 2024.

“We recommend all securityholders embrace this merger as a catalyst to unlock value from Napie.”

This article was developed in collaboration with Mako Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.