Maiden resource a major milestone on the horizon for Ivoirian gold explorer Mako

Explorers like Mako are proving Cote d’Ivoire is becoming a major gold destination.

Seasoned Canadian geologists Peter and Ann Ledwidge first arrived in Africa, rock hammers in hand back in the mid-1990s.

It proved a happy hunting ground.

With the Australian base metals explorer Orbis Gold they helped give the company’s board a fresh slate and revolutionised the region’s gold future by heading into Burkina Faso, not yet the African gold power it is today.

The Ledwidge’s historic Boungou and Nabanga discoveries turned Orbis from a microcap into something special – a US$139 million takeover target for Toronto-listed SEMAFO.

Boungou is today being milked by global top-10 producer Endeavour Mining.

As managing director and general manager of exploration respectively of Mako Gold (ASX:MKG) the husband and wife team form part of an incredibly diverse and experienced crew of African gold experts looking to repeat the feat at the Napié project in Cote d’Ivoire.

After a little over three years on the ASX and countless hours of exploration on the ground in West Africa, Mako is on the cusp of its biggest development yet.

Its maiden JORC resources are due for the Tchaga and Gogbala deposits by mid-2022, a clear rerating opportunity for the $33 million capped gold explorer.

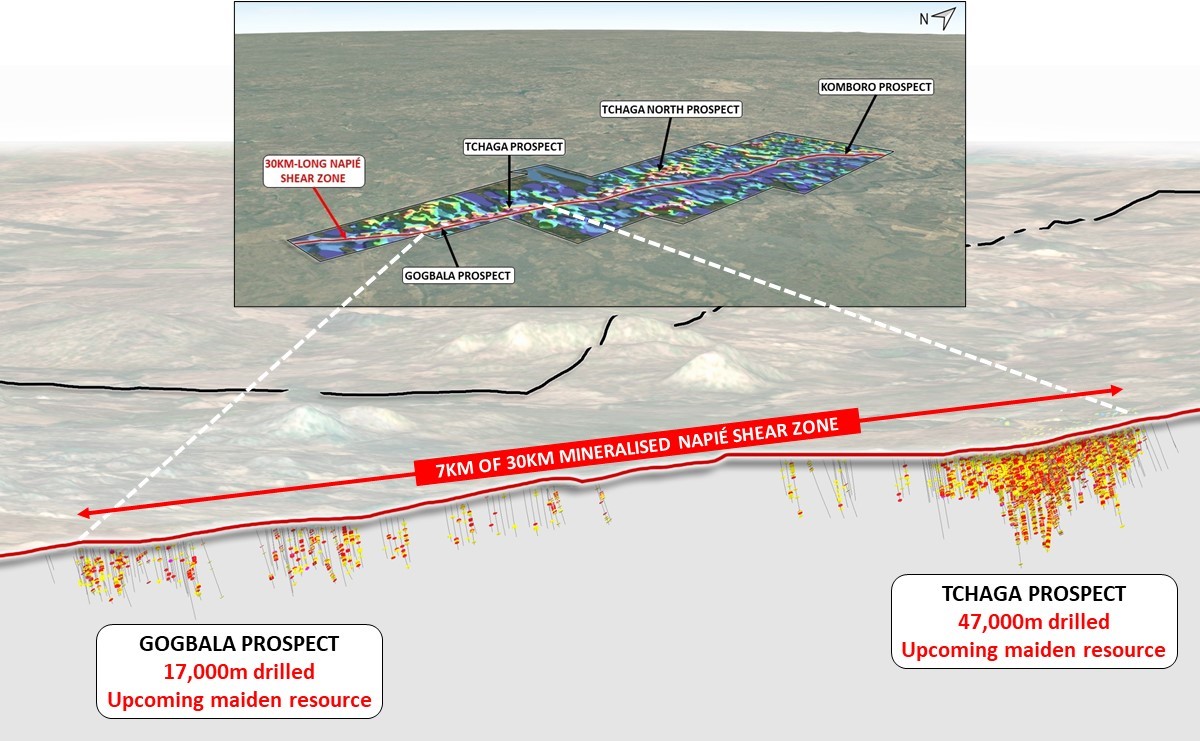

Ambitious exploration effort at Napié

And Mako has been all guns blazing at Napié, where it pulled off a deal last year to take its share of the project, previously a farm-in JV with Ivoirian gold miner Perseus (ASX:PRU), from 51% to 90%.

What followed was a $10 million capital raising and the sale of its Niou project in Burkina Faso to Nordgold to bankroll its most ambitious exploration program to date, a 40,000m drill drive that will take Tchaga and Gogbala through to a maiden resource announcement.

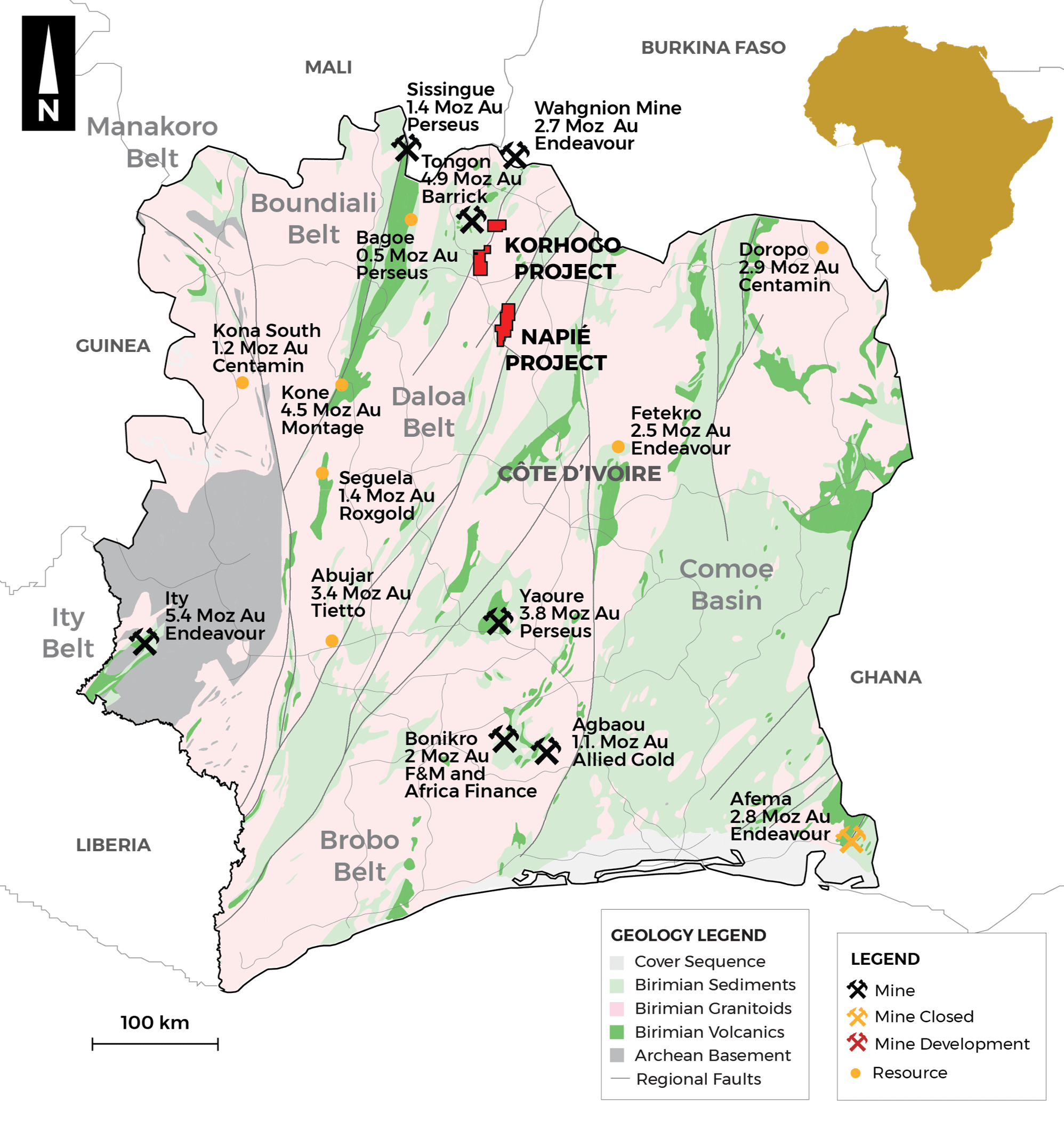

Mako will also complete 7,000m of auger drilling and 10,000m of aircore holes into the early stage Korhogo project to the north, just kilometres from Barrick Gold’s 4.9Moz Tongon mine and Endeavour’s 2.7Moz Wahgnion mine.

Tchaga was the first major discovery Mako made at Napié, where around 50,000m of drilling has been completed to date.

Gogbala starting to deliver

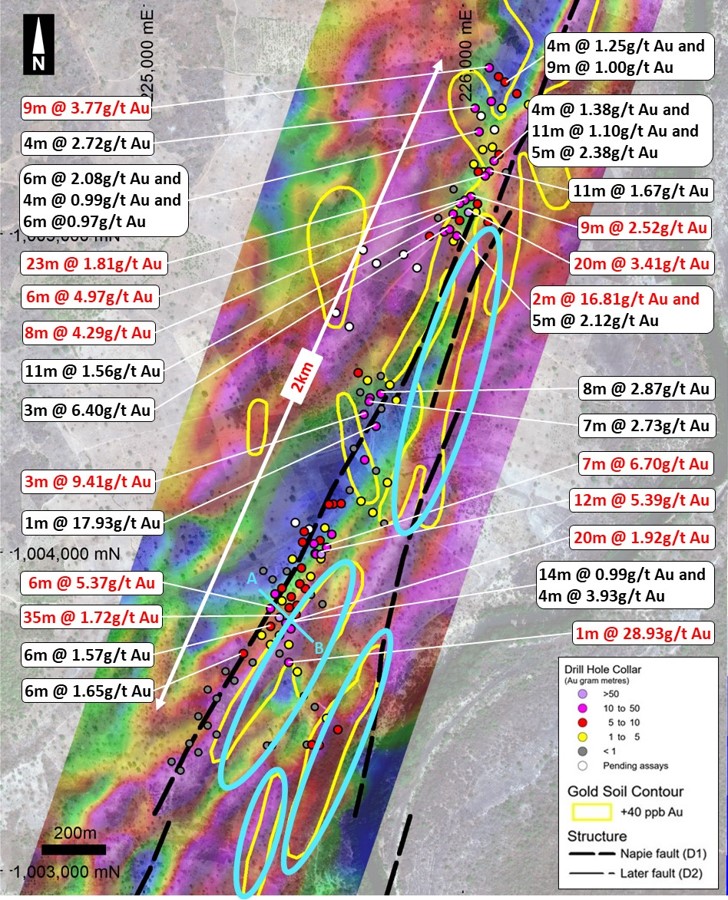

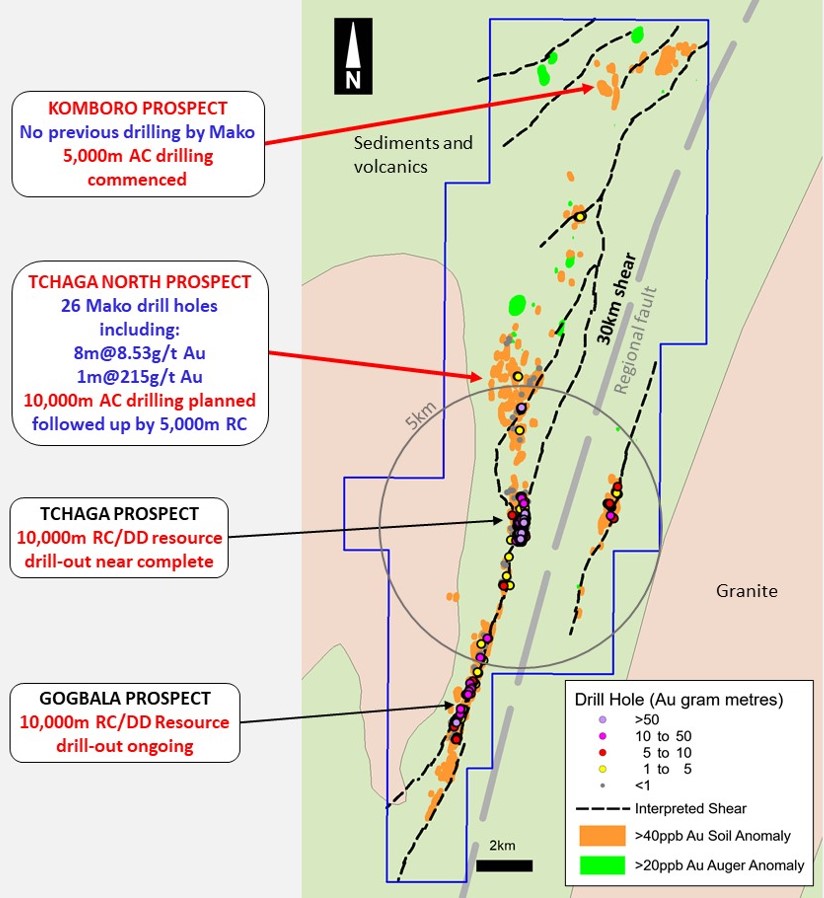

That was going to be the sole focus of the initial resource. But the 2km long Gogbala prospect to the south of the 30km shear zone which runs through Napié has quickly emerged as “Tchaga 2.0”.

“Last year, we said we were going to announce our resource that was only going to be on the Tchaga prospect,” Peter Ledwidge told Stockhead.

“We were still getting some good results on that drilling south, so we thought let’s wait a bit…

“But then the real deciding factor was that we started drilling Gogbala, again about 4-5km to the south. And we hadn’t really done any significant drilling there since 2018 and 3 holes in 2020. It basically started looking like Tchaga 2.0.

“So rather than announcing a small resource last year, we thought, let’s be patient and announce a more significant resource on two of the four prospects that are likely to add significant ounces.”

With drilling success at both Tchaga and Gogbala, the prospect that Mako could deliver a resource upwards of half a million ounces is a real possibility.

There remain a large number of lightly drilled and even untested zones along the 23km soil anomaly running through Napié .

As with many West African gold discoveries, Napié is shallow with a 30-40m deep oxide profile.

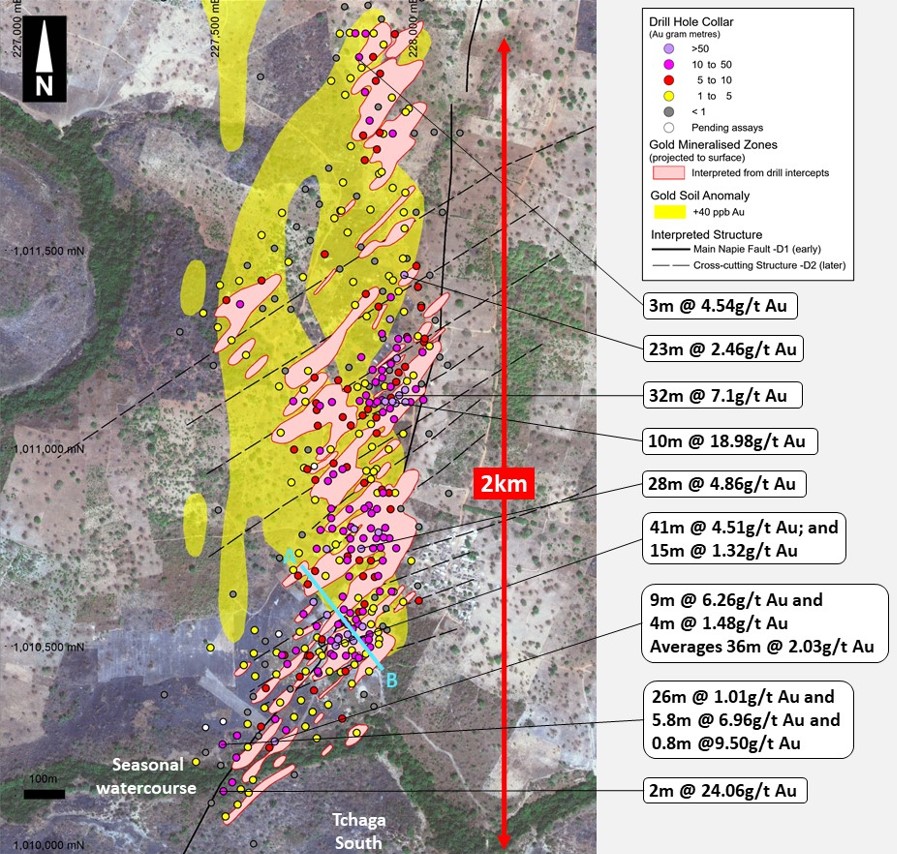

High-grade mineralisation starts at surface at Tchaga and the resource model will likely extend to around 200m below, with Gogbala tested down to around 100m.

Deeper diamond drill holes heading to 300m and 150m at Tchaga and Gogbala, respectively, should paint a picture of the potential for blue sky at depth.

Longer term Ledwidge believes Napié could host at least 1Moz and beyond, enough to head into mining studies, something that will be proven through the drill bit.

Mako following Tietto, WAF footsteps

Pretty much every successful West African gold company has started where Mako is right now.

West African Resources (ASX:WAF), owner of the Sanbrado and Kiaka mines in Burkina Faso, was trading for just 22c in early 2019.

It is up more than 400% since and trading at a market cap of $1.2 billion.

The maiden resource at Napié’s core Tchaga and Gogbala prospects represents Mako’s own opportunity for a major rerate.

One only needs to take a look at another Ivoirian explorer Tietto Minerals (ASX:TIE) and its 3.34Moz Abujar project, located along the same fault at Mako’s Napié, to see the long-term potential of West African gold stocks.

“Let’s look at Tietto and where they are, so Tietto is in the same belt as us along that same fault,” Ledwidge said.

“And if you look at them three years ago, they were trading below 8c. Now they’re in the 50c mark and they’ll probably go up over $1 before you know it.”

Impressively for a company of Mako’s size, its register is 36% held by institutions, indicating the strong conviction some of the brightest minds in gold investing have in its potential.

Dundee Goodman and Deutsche Balaton both have a slice of the Mako pie.

“One of the validations for that is when you get solid funds like Dundee Goodman and Delphi (Deutsche) they get in at 8c and they’re not looking to get out at 10c,” Ledwidge said.

“They want a five or 10 bagger and they’re willing to wait a couple of years for it.”

Cote d’Ivoire the place to be

While some West African nations have been characterised in recent years by political instability, notably Mali, Burkina Faso and Guinea, Cote d’Ivoire has been comparatively stable, well governed and building an enviable infrastructure.

Its relatively young gold industry is the fastest growing in the region, and along with a modern and predictable mining code and reliable government, the country produces so much clean hydroelectricity its power supply is an export industry.

At Napié, a developed road containing an access line to hydroelectric power runs straight through the project, reducing Mako’s reliance on costly off-grid energy supplies like diesel.

It is relatively free of the challenges presented by operating in neighbouring states like Burkina Faso, where Islamist insurgencies in the north have led to rising security costs for miners and explorers.

“We perceive Cote d’Ivoire, basically to be like Burkina was 10-15 years ago,” Ledwidge said. “Very under explored, and it is a destination of choice for West Africa.”

Drilling to continue in 2022

Recent drilling at Gogbala has delivered some of the best results to date, confirming similarities to the premier Tchaga deposit.

An ongoing 10,000m reverse circulation drilling program has returned hits including 20m at 3.41g/t from just 19m deep, with one 2m intersection grading as high as 14.12g/t.

Three other holes have recovered more than 20m of consistent gold mineralisation, including a 35m hit at 1.72g/t from 42m.

Drilling from a 10,000m program at Tchaga continues to impress as well, striking 2m at 24.06g/t from 112m and 5.8m at 6.96g/t from 135m, including 1m at a hefty 34.62g/t from 137m. This is in addition to previous outstanding intercepts such as 10m at 18.98g/t Au from 7m and 41m at 4.51g/t Au from 17m.

Outside of the key deposits, 10,000m of aircore drilling recently started at the Tchaga North prospect, where Mako has previously drilled 26 drill holes and hit high grades of up to 215g/t, with a 5,000m follow up RC to come later.

“We’re optimistic that with our air core program on the rest of Napié we can make new discoveries for some blue sky and advance those discoveries really quickly to the resource stage,” Ledwidge said.

Ledwidge is also optimistic Mako can make a discovery at Korhogo, a 100% Mako-owned project 15km to the north of Napié where the depleting reserves at Barrick’s nearby Tongon mine could present toll milling opportunities.

“We flew the airborne geophysics and then we did the first pass 400m by 100m spaced soil,” he said.

“We were going to do follow up soils, but after our crew being on the ground and analysing areas where we got soil anomalies, we’re just about to start a 7,000 meter auger drill program in select areas.

“And then once we’ve got that done we’re going to launch a 10,000m aircore program.

“If all our ducks line up in a row, then we hope to be doing aircore drilling in about April and then once we get results on that, hopefully announce a discovery.”

Management, in country staff bring track record of success

The Ledwidges aren’t the only executives at Mako with experience from the Orbis Gold days.

In fact, the whole board brings a wealth of knowledge from the African gold sector.

Non-executive chairman Michele Muscillo, a corporate law partner with HopgoodGanim was also a director of Orbis and holds a number of other directorships with Aeris Resources (ASX:AIS), Xanadu Mines (ASX:XAM) and Cardinal Resources (ASX:CDV), the latter of which was acquired by China’s Shandong Gold amid a takeover battle with Russia’s Nordgold.

Non-executive director Steven Zaninovich has extensive West African gold experience as well, and served as COO of Gryphon Minerals, owner of the Wahgnion mine, before its takeover by Teranga Gold, subsequently acquired by 1Mozpa producer Endeavour Mining.

On the ground Mako has an entirely local workforce, led by operations manager Ibrahim Bondo, previously logistics manager with Orbis, and chief geologist Boukare Guigma, another ex-Orbis man who has worked with the Mako team for over a decade

Ledwidge noted the team’s experience through the mining cycle from discovery, study and mining phases to corporate M & A.

This article was developed in collaboration with Mako Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.