Magnetic’s Lady Julie gold project looks a real winner with PFS outlining low costs and high margins

High returns and low costs have elevated Magnetic’s Lady Julie project as one of Australia’s most exciting undeveloped projects. Pic via Getty Images

- Magnetic Resources unveils PFS for Lady Julie, outlining attractive pre-tax IRR of 85% and NPV of $547m

- EBITDA estimated at $982m, AISC at just $1,445/oz

- Project economics are calculated using a conservative $2,800/oz gold price, well below current spot prices of ~$3,280/oz.

- Mining proposal will now be prepared to advance a mining lease application

Special Report: With gold prices reaching a record high of US$2,100/oz, Magnetic Resources simply couldn’t have picked a better time to unveil an absolute cracker of a pre-feasibility study for its Lady Julie project in Laverton, WA.

The numbers speak for themselves with the PFS envisaging the project as having low-cost, high-margin gold production of 720,000oz over the nine-year mine life, delivering pre-tax internal rate of return (IRR) and net present value (NPV) – both measures of profitability – of 85% and $547m respectively.

EBITDA has been estimated at a meaty $982 million thanks to the low life-of-mine average C1 (operating) cost of $1,434/oz (all-in-sustaining cost of $1,445/oz) that includes sustaining capital of $8 million.

Development capital is a very manageable $93.4 million – including a 15% contingency provision for the plant cost estimate – for a standalone 1.8Mtpa processing plant and three months of pre-production activities, with payback estimated at 15 months.

And here’s the kicker – the lip-smackingly attractive economics are the result of Magnetic Resources (ASX:MAU) taking a conservative tack when preparing the PFS by using a $2,800/oz gold price.

Adopting a higher $3,100/oz price point, which is still lower than the current spot price of US$2,154.93/oz ($3,279.95/oz), quickly sends pre-tax IRR up to 108% and NPV to $690m while EBITDA climbs past the $1 billion mark to $1.19 billion.

A golden Lady

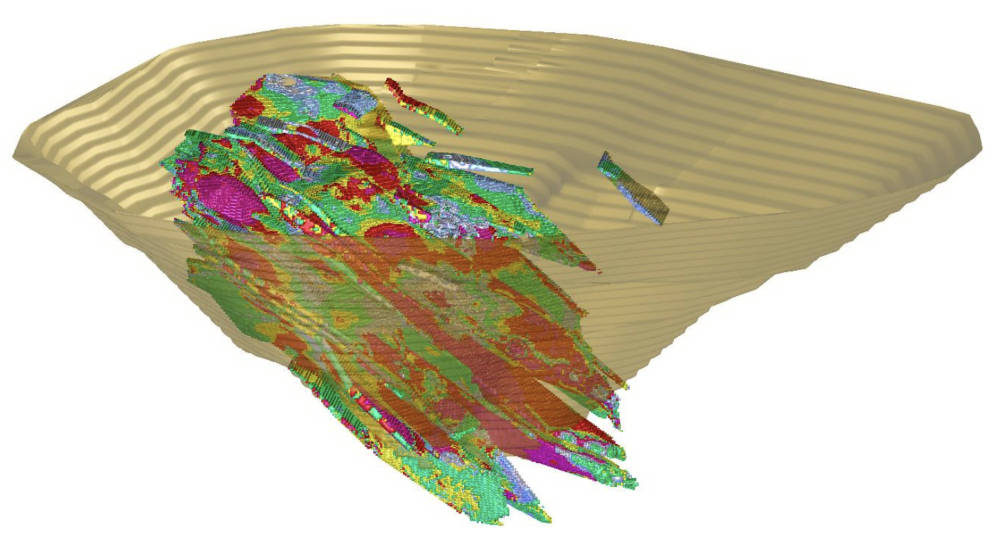

The Lady Julie project is underpinned by an open-pit mining inventory of 13.6Mt @1.78g/t gold, or 773,000oz of contained gold.

This includes about 77% indicated resources and 23% measured resources, a conservative measure that grants a high degree of certainty for MAU’s mine plan.

Because the ore is free milling and similar to many other deposits in the Eastern and Northern Goldfields, well tested and understood metallurgical processes are all that is required for a robust operation.

Processing will require crushing and grinding, followed by gravity separation and finally cyanide leaching. Recoveries of up to 92% have been demonstrated in test work.

Adding further interest and further highlighting the conservative approach taken, MAU noted that cost estimates are based on the current inflationary environment and supported by industry quotes for personnel, equipment and consumable unit costs.

“The excellent PFS outcome demonstrates that Magnetic’s Lady Julie gold project is one of the highest margins, undeveloped gold projects in Australia,” MAU managing director George Sakalidis said.

“The project’s low-cost profile and strong financial return metrics are primarily driven by the extraordinary near-surface, high-grade nature of the Lady Julie Central and Lady Julie North 4 deposits. This low-cost profile places the project in the bottom half of the cost curve of gold producers in Australia.

“The PFS focuses on mining the indicated and inferred resources of Lady Julie North 4, Lady Julie Central and Hawks Nest 9. Lady Julie North 4 is by far the largest contributor to the study producing over 11.5Mt of ore during its operation.

“Further refinement of the project’s economics will be carried out in 2024 with scope to further improve the economics of the project from boosting process recoveries and modifying processing scenarios.

“More significantly, potential exists to further increase production and mine life estimates from the inclusion of resources drilled since the last update provided in November 2023.”

Project funding and strategy

MAU believes the technical and economic attractiveness of the PFS makes it likely that the Lady Julie gold project could be financed through a combination of debt and equity.

While no formal discussions have been held with potential financiers, which is typical for a project at the current stage of development, the company expects debt could be secured from a range of sources, including Australian banks, resource credit funds, export credit agencies, government agencies, or in conjunction with product sales or offtake agreements.

It may also consider a formal strategic partnering process whereby alternative funding options, including undertaking a corporate transaction, a joint venture partnership, a partial asset sale and/or offtake pre-payment, could be undertaken if it maximises shareholder value over the long term.

MAU adds that demand for gold is expected to be strong and that funding for quality resource projects is likely to be available, particularly when they have the potential to be a mid-tier gold mine in Western Australia – one of the world’s best mining jurisdictions with a stable political and regulatory environment.

Next steps

MAU will now prepare a mining proposal for submission to advance a further mining lease application and regulatory approval to allow for mining.

Further activity will also be carried out to further expand resources at Lady Julie and the broader Laverton and Homeward Bound South projects.

This article was developed in collaboration with Magnetic Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.