Magnetic Resources’ metallurgical testing boosts gold recoveries at Lady Julie North 4

Mining

Mining

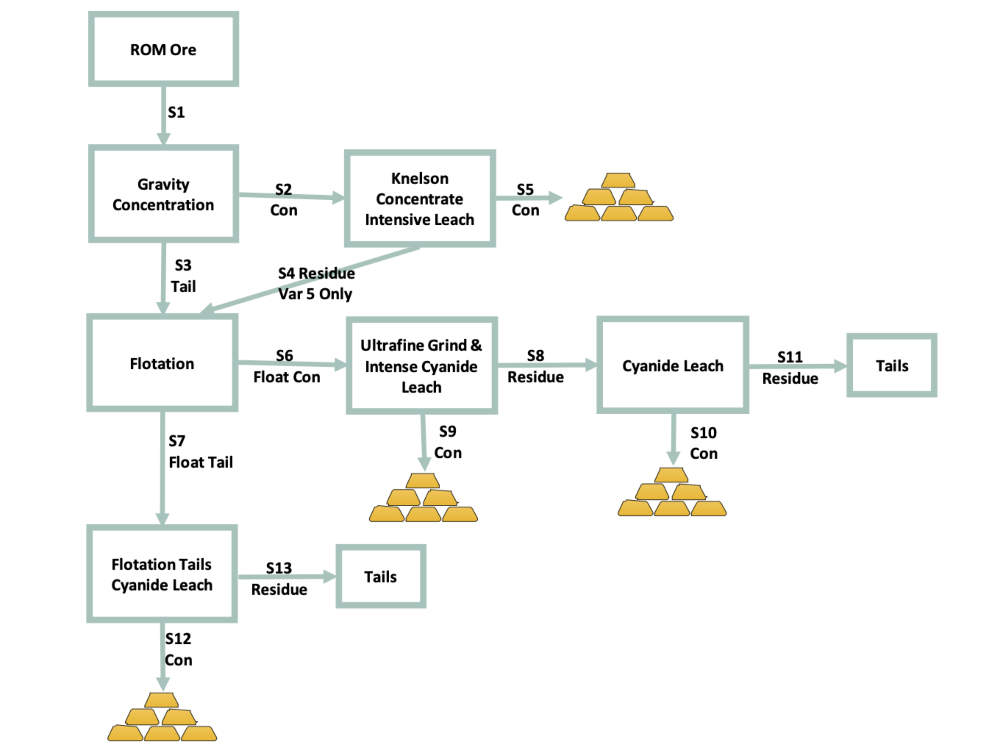

Special Report: Metallurgical testing of composite samples sourced from Magnetic Resources’ Lady Julie North 4 deposit continues to return encouraging results with the latest work achieving recoveries averaging 93% gold.

This recovery across all oxidation stages in seven composites was achieved after flotation and fine grinding, beating out the 88% average for conventional gravity and cyanide leach.

Notably for Magnetic Resources (ASX:MAU), the results build on previous metallurgical testing that had demonstrated that higher gold recoveries can be realised through the addition of flotation and fine grinding in the process circuit.

Adding interest, preliminary optimisation of flotation and fine grinding has shown that the introduction of a cleaner circuit into flotation reduces concentrate mass as well as there being little difference between leaching for eight hours compared to 48 hours.

It also found that fine grinding to 20 microns rather than 10 microns had no meaningful impact on overall gold recovery.

“These are very pleasing results with strong potential to boost the gold recovered from, and therefore economic value of LJN4,” Managing Director George Sakalidis said.

“Whilst the latest work suggests we may need to reconsider parts of the process plant design, this is likely to be a modular addition using well-known and proven technology.

“As we move to complete the feasibility study, I am excited by the further upside potential being demonstrated by these metallurgical results.”

Lady Julie North 4 hosts a recently upgraded resource of 23.6Mt grading 2.04g/t gold and is the central deposit at the company’s Lady Julie project that has a broader resource of 28.11Mt at 1.93g/t gold.

Three quarters of the global Lady Julie resource is contained within the higher confidence indicated resource, which has enough certainty for mine planning.

Deeper diamond drilling has also confirmed that mineralisation extends at depth with the northern part of the 750m LJN4 deposit now considered to have a down-dip dimension of at least 1000m whilst starting from a shallow – easily accessible – 30m depth.

This promising enlargement of the northern zone led MAU to start a feasibility study to incorporate both the open pit and the underground.

A scoping study had previously found that a concurrent underground operation producing 550,000tpa of higher-grade ore will add significantly to the Lady Julie project value.

Under an economic update from August 2024, Lady Julie is expected to produce gold at an annual rate of 104,000oz for eight years to generate total EBITDA of $1.49bn using a $3200/oz gold price.

Development capex is estimated at $111.3m assuming a standalone 2.2 Mtpa processing plant and three months pre-production activities while all-in sustaining costs are expected to be $1386/oz.

Pre-tax net present value and internal rate of return – both measures of profitability – are forecast at $925m and 135% respectively while payback is expected in a very short 12 months.

These estimates are now extremely conservative given the current gold spot prices of US$2952.55 ($4651.22).

To top it off, Lady Julie itself is part of the broader South Laverton project area that has a global resource of 33.14Mt at 1.81g/t gold, or 1.93Moz of contained gold, offering further development potential in a region renowned for hosting multi-million-ounce mines like Granny Smith, Wallaby and Sunrise Dam.

Magnetic shares are up close to 20% YTD, but some analysts are far more bullish on the company, which has emerged as one of the best M&A and development prospects on the ASX.

Argonaut has a $3.50 price target and spec buy label on the $1.35 a share stock, with analyst Patrick Streater telling clients in a note that “improvement in recoveries through addition of a flotation and grind circuit could ultimately benefit project economic outcomes.”

This article was developed in collaboration with Magnetic Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.