Magnetic Resources cranks up Lady Julie inventory to 2.14Moz, lifts resource confidence

Magnetic Resources’ Lady Julie upgrade highlights its “excellent development” prospects. Pic: Magnetic Resources

- Magnetic Resources upgrades Lady Julie resource by ~22% to 2.14Moz on the back of infill drilling

- Drilling has also increased mineralisation confidence with 81% of LJN4 resource in the indicated category

- Feasibility study nearing completion and permitting process advancing

Special Report: Magnetic Resources has boosted contained gold resources at its Lady Julie project in WA’s Laverton region by ~22% to 2.14Moz just days after signing a key native title agreement.

The resource upgrade to 35.69Mt at 1.86g/t also takes overall resources in the Laverton region to 40.72Mt at 1.77g/t for 2.32Moz of contained gold.

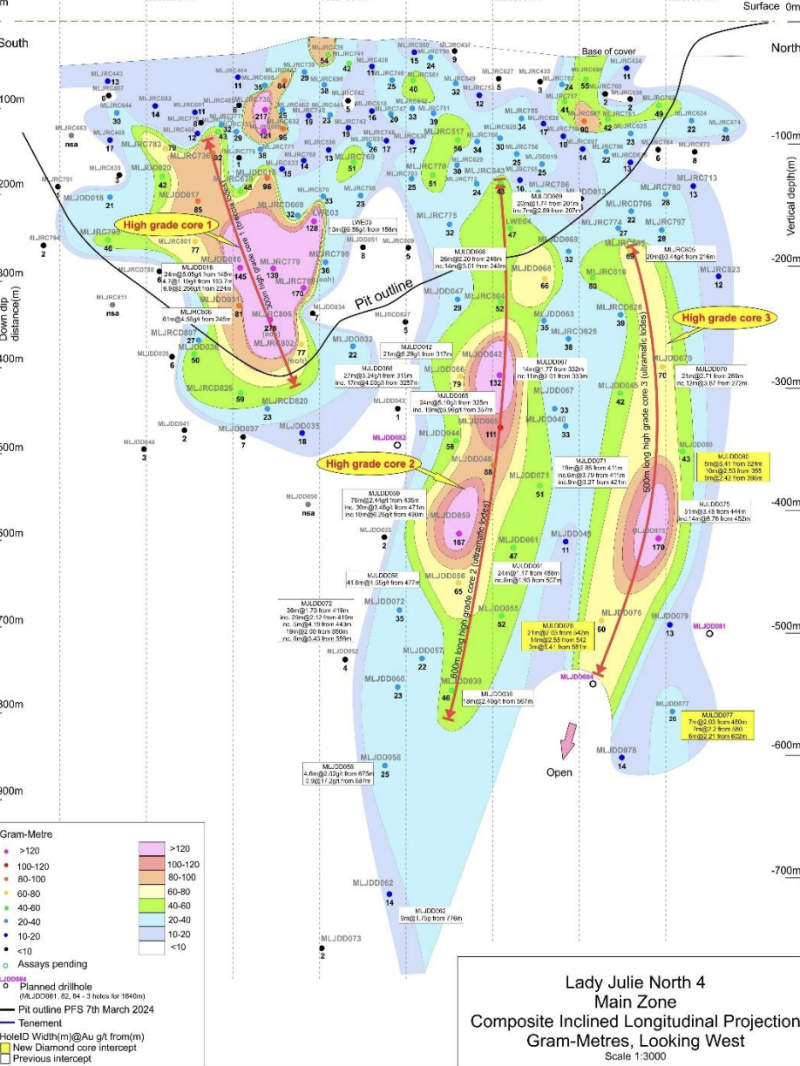

Magnetic Resources (ASX:MAU) noted the upgrade was due to the success of recent infill drilling at the key Lady Julie North 4 deposit which hosts most of the resource (31.18Mt at 1.93g/t for 1.94Moz), up 25% from the January 2025 update.

Infill drilling also significantly improved confidence in the continuity of mineralisation and the resource estimate with 81% of the LJN4 resource now in the higher confidence indicated category that possesses enough certainty for mine planning.

Additionally, the company has completed a review of the structural geology at LJN4 resulting in an improved and more continuous ‘fit’ of the mineralisation wireframes to drill hole intercepts.

Managing director George Sakalidis said LJN4 was an exceptional orebody that continued to deliver.

“This upgrade is clearly a significant increase, and regular significant upgrades have been made for a number of years,” he noted.

“It’s gone from 0.1Moz on June 27, 2022, to 0.85Moz on November 23, 2023, to 1.55Moz on January 20, 2025, to just under 2Moz now.

“LJN4 represents an excellent development proposition and has expanded considerably from the Lady Julie gold project pre-feasibility study (released to the ASX on March 7, 2024), both in scale and detail, with the depth of information now available providing increased confidence in the viability of the proposed development and associated value available to be unlocked.

“With the feasibility study nearing completion and permitting process advancing, Magnetic is rapidly evolving to a position of being ‘shovel ready’ for development.”

Lady Julie project

The Lady Julie project is proposed to be commercialised through the construction of three open pits, with a concurrent underground mine, a CIL processing plant and associated infrastructure.

This is the model being developed under the feasibility study.

The company signed a native title agreement last week that removes any objection to the issue of mining leases under application over the project.

While the upcoming DFS will paint a clearer picture of the project’s economics, the economic update to the PFS in August 2024 sketched out some very impressive numbers.

Under that older estimate, Lady Julie is expected to produce gold at an annual rate of 104,000oz for eight years from an open pit to generate total EBITDA of $1.49bn using a very conservative $3200/oz gold price.

Pre-tax NPV and IRR – both measures of profitability – are $925m and 135% respectively.

Development capex was estimated at $111.3m assuming a standalone 2.2Mtpa processing plant while all-in sustaining costs were estimated at $1386/oz.

There is potential for further growth with MAU noting the central core zone 3 within LJN4 is still open at depth.

This article was developed in collaboration with Magnetic Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.