Magmatic explodes onto WA gold scene with Weebo deal

There’s a new star on WA gold’s red carpet, with Magmatic picking up the Weebo project in the Northern Goldfields. Pic: Getty Images

- Magmatic Resources adds second string to its bow with WA gold deal

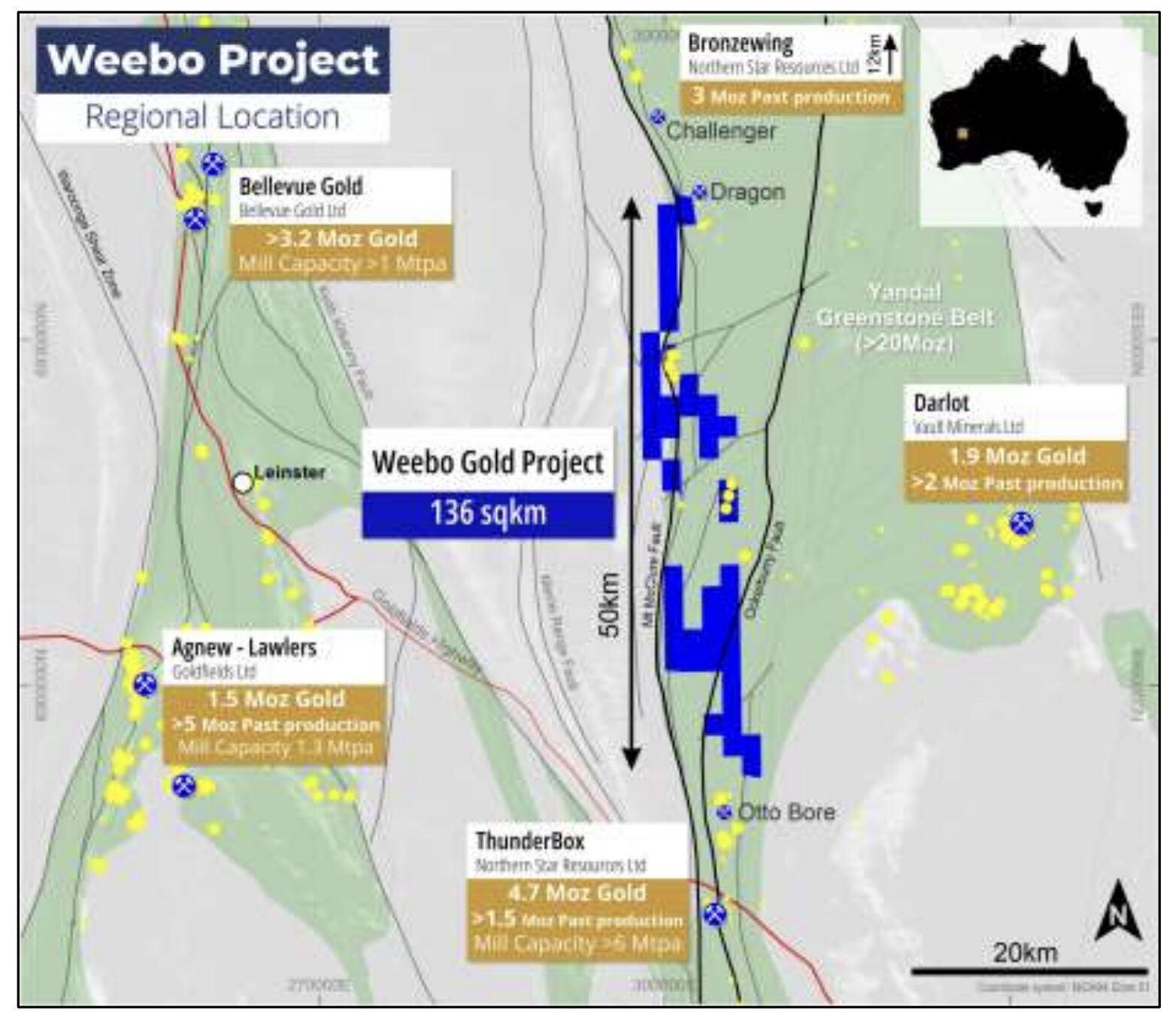

- Weebo gold project underexplored and surrounded by multi-million ounce mines in WA’s Northern Goldfields

- Drilling to take place in the September quarter

Special Report: As gold prices soar towards fresh record highs, traversing US$3450/oz, junior explorer Magmatic Resources has found a cheap entry-point to stake its claim in one of WA’s hottest gold regions with the acquisition of the Weebo gold project.

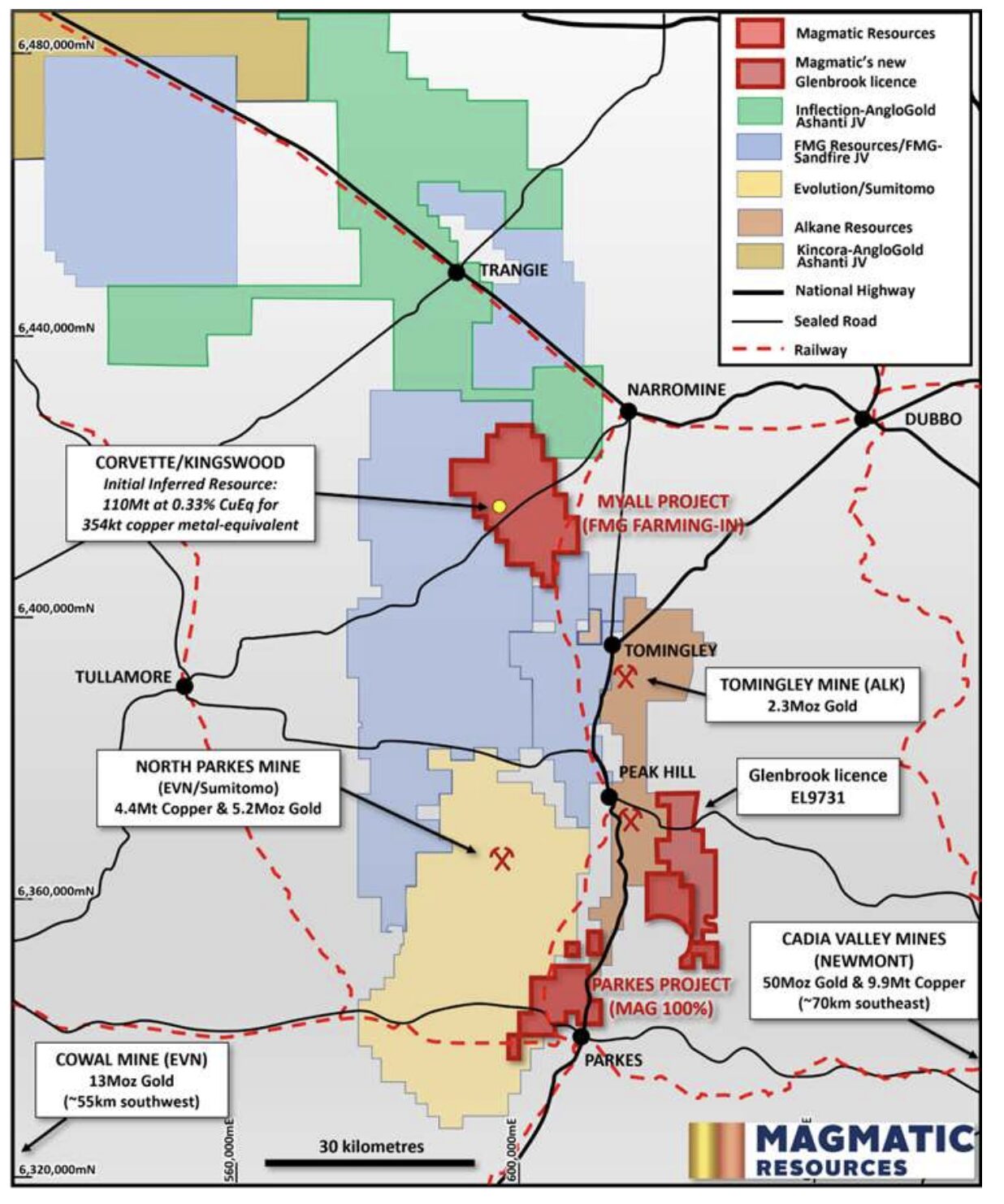

With M&A activity raging of all kinds in the West Australian gold space, Magmatic (ASX:MAG) has added a tantalising west coast arm to its Aussie operations to complement its potential Tier-1 gold and copper prospects in New South Wales.

The deal will see Magmatic pay in $50,000 cash and 36 million in company shares, valued at $1.44m on Monday morning, with a further 14m shares contingent on milestones for an incredible 136km2 of ground at Weebo, covering a 50km north-south strike wedged between five of WA’s largest gold mines.

They include Bellevue Gold’s (ASX:BGL) operation of the same name, known to be on the market, as well as Vault Minerals’ (ASX:VAU) Darlot, Northern Star’s (ASX:NST) Thunderbox and Bronzewing, and Gold Fields’ Agnew-Lawlers.

That’s in excess of 15Moz of gold resources and historic production surrounding a vast and underexplored tract of WA’s hot Northern Goldfields.

“The company is extremely pleased to add to its portfolio of projects with this exciting new gold property superbly located in the heart of WA’s Yilgarn Goldfields,” MAG managing director David Richardson said on the two-stage deal.

“The prospectivity of this area is highlighted by the proximity to five large gold mines and we believe the project area is underexplored, offering a great opportunity for new discoveries.

“We have already put a local exploration team in place and expect to commence exploration drilling in the coming quarter.”

History on Magmatic’s side

Weebo may be underexplored but it’s not without walk up, shallow gold targets.

With heritage clearances in place, drilling is already being planned to begin next quarter.

And there are already significant results to follow up, having been drilled by fellow ASX explorer Midas Minerals (ASX:MM1) when it had an option over the ground in 2021 and 2022.

They include the Ockerburry and Scone Stone prospect, the former a mineralised structure defined by drilling over at least 5km.

But half of that has only been conducted with shallow aircore drilling, especially in the south, with higher grades identified related to cross faulting within a broad, low-grade halo. Best hits include:

- 4m at 29.9g/t Au from 8m;

- 23m at 1.0g/t Au from 63m;

- 16m at 2.8g/t Au from 52m; and

- 2m at 18.4g/t Au from 8m.

Over at Scone Stone, drilling has outlined an 800m long north-east trend of potential intrusive origin, wedged between an ultramafic unit to the west and mafic unit to the east.

Mineralisation of that nature has been closely watched in WA since De Grey Mining’s discovery of the Hemi gold deposit in the Pilbara in 2020, turning the nanocap into a $6bn takeover prey for Northern Star.

Best results from Scone Stone include:

- 6m at 4.4g/t Au from 54m;

- 3m at 6.7g/t Au from 43m;

- 29m at 1.1g/t Au from 98m;

- 3m at 15.6g/t Au from 69m; and

- 9m at 4.6g/t Au from 64m.

First pass drilling is also “warranted” for the Otto prospect, where lower grade gold has been found in limited wide-spaced drilling around an aero-magnetic target some 5.5km north of Northern Star’s Otto Bore mine.

A string of other prospects, including Sholls Find, Wheel of Fortune, Sir Samuel and more have also shown potential to host deeper gold around historical workings, with the first two already boasting heritage clearances and Wheel of Fortune identified as a drill priority.

First pass aircore drilling will be completed at those three prospects, with RC drilling planned at Scone Stone and Ockerburry to determine the nature and orientation of the mineralisation, both of which also have heritage clearances in place.

It’s a terrific time to drill, with Aussie dollar gold trading in excess of $5300/oz.

Big hitters

A number of other conceptual targets will be assessed by Magmatic, especially those under transported cover which were hidden from previous explorers.

Some heavy hitters will come on board with the deal, which was brokered with local prospectors through privately owned Northern Goldfields Resources.

They include NGR executive Michael Jackson, who has more than 30 years’ experience as a senior geologist. Jackson will join Andy Viner, a current technical consultant to MAG and former director, together leading the western operations of the firm.

NGR’s key personnel also includes Craig Nelmes, who spent more than a decade at De Grey Mining as a corporate and financial executive until March 2024, and will assist managing director David Richardson and the western operations team in a consulting role.

Magmatic already has strong strategic backing, with Andrew Forrest’s Fortescue (ASX:FMG) its major shareholder and farm-in partner on the Myall project in NSW’s Lachlan Fold Belt.

South African gold giant Gold Fields has also been among its largest shareholders since the explorer’s IPO.

Work in the East Lachlan Fold Belt is continuing as MAG adds another string to its bow at Weebo.

“Magmatic is also committed to advancing our three projects in the East Lachlan NSW and are currently progressing a major drill program at the Myall project (farm-In and JV with FMG Resources Pty Ltd),” Richardson said.

“Our four projects give shareholders exposure to both the gold and copper markets, with two potential Tier 1 gold-copper projects and now, two near-surface gold projects in the heart of two of Australia’s most well endowed mining regions.”

This article was developed in collaboration with Magmatic Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.