Low debt, growing dividends, new discoveries: Here’s why Aussie gold miners look like good investments

Pic: Getty

Metals Focus’ quarterly analysis on the world’s leading gold mining companies shows record low levels of debt — which should allow for higher dividends, exploration spending, and M&A activity.

Gold producers are making bank. The latest report from Metals Focus shows bigger dividends and sustained high profits in Q4 20, which have been used to reduce net debt for the group of companies to its lowest levels since 2011.

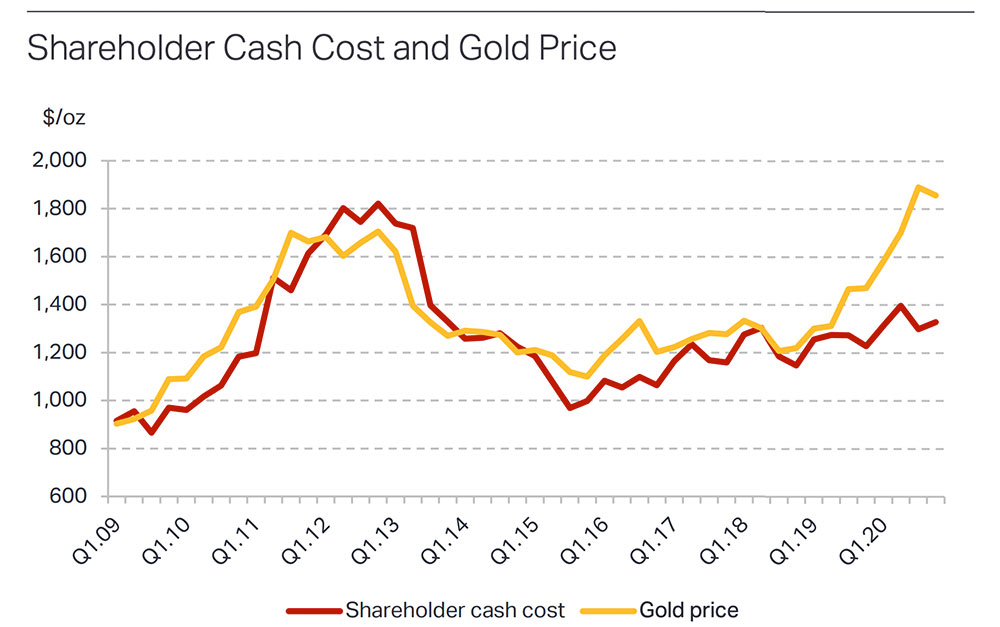

Metals Focus has developed a metric called “shareholder cash cost”, which allows for a consistent comparison across these companies.

Cashflow remaining after this cost is available to pay dividends, repay debt, or for corporate activity. The strength in the gold price since Q2 2019 has far exceeded increases in costs over the same period.

Check this out:

The fact that this extra cash has gone towards paying down debt is actually great news in more ways than one for Australia’s biggest miners — like Newcrest (ASX:NCM), Northern Star (ASX:NST), Evolution (ASX:EVN), and Regis (ASX:RRL) — and their investors. Here’s why.

Great for dividends… and everything else

Treating yourself after those dividends land in your account… from r/ASX_Bets

Debt reduction is now largely complete, which should allow for higher dividends, exploration, and may also encourage M&A activity in the sector, Metals Focus says.

Paying down debt during times of higher gold prices represents a “vastly different business model to the pre-2013 period”, when companies were happy to incur growing levels of net debt and new equity to fund new projects.

Lower debt means more free cash to increase dividends and explore for the mines of the future, Metals Focus says.

“All the companies in the peer group are now paying regular dividends,” it says.

“However, with an estimated implied dividend yield of 2.8% for the peer group, they are still relatively low.

“Despite the fall in gold price so far this year margins for the peer group will remain strong at current prices and therefore there is still scope for dividend increases in 2021.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.