Loudens shaping up as a high-grade bonus at the Pilbara Gold Project

Pic: Schroptschop / E+ via Getty Images

Special Report: The latest Conglomerate gold exploration results suggest it could be a bonus source of high-grade feed to De Grey’s potential 2 million tonnes a year Pilbara Gold Project.

Fresh bulk sampling results from De Grey’s (ASX: DEG) Loudens Patch prospect indicate an average coarse gold concentrate grade of around 3 grams per tonne.

Conglomerate gold refers to nuggets hosted in rock containing rounded grey quartz pebbles and other minerals.

For comparison, conglomerate gold rush pioneer Novo Resources has a weighted average grade for conglomerate sampling of 2.4 grams per tonne, financing and marketing specialist Red Cloud Klondike Strike said.

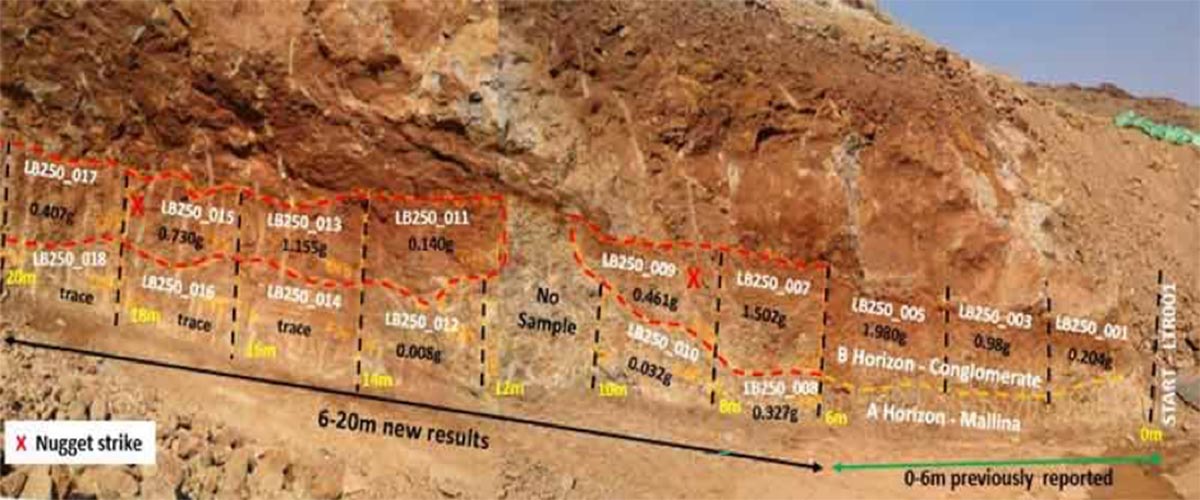

At Loudens West, visible coarse gold now extends for 20 metres in the first trench LTR001 and in the initial 4 metres of the second trench LTR002, which is only 60m away.

Check this out:

But these impressive results don’t include the finer gold content – smaller than 1.2mm — which remains to be assayed.

A continuation of sampling along LTR002 trench will commence shortly and before De Grey begins trial trenching at Loudens South.

Conglomerate gold a nice bonus for De Grey

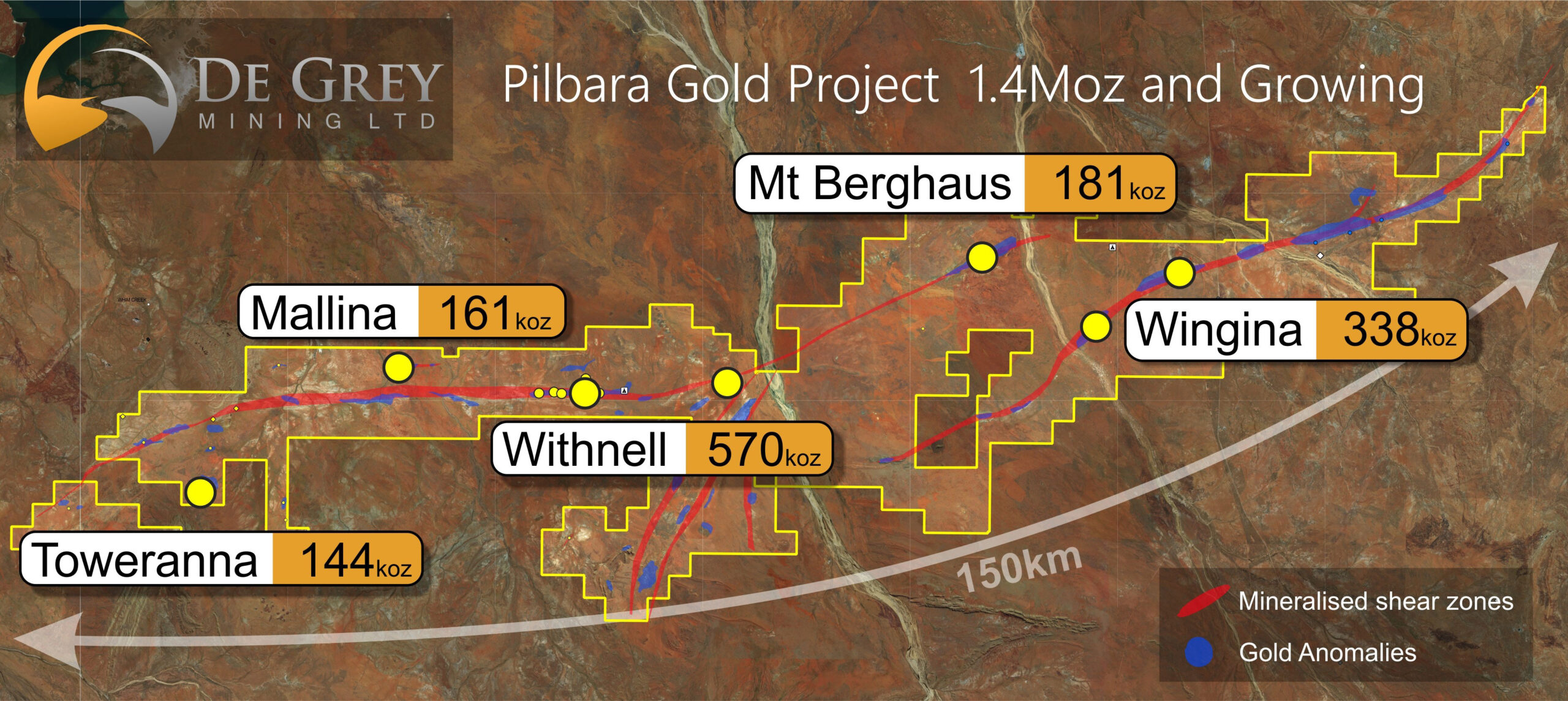

The explorer already has a hefty 1.4-million-ounce conventional gold resource at the Pilbara Gold Project (PGP).

But with a massive two-million-ounce gold resource targeted by the end of the year, De Grey says it wants to double its PGP development study from 1mtpa to 2mtpa.

The maths is pretty clear, doubling the plant size, could boost annual gold production well beyond the previously stated 65,000 ounces in the scoping study –, potentially putting it in a select club upon the start of production.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with De Grey Mining, a Stockhead advertiser at the time of publishing.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.