Lost lodes take Latitude’s WA gold resource past 1.1Moz. That’s 44pc growth

Pic: Tyler Stableford / Stone via Getty Images

Assessing a scenario through different eyes can sometimes lead to spectacular results – exactly the case for Latitude Consolidated at its Murchison project in WA.

Latitude (ASX:LCD) today announced it had grown the global mineral resource at its Murchison gold project in WA by 44%, taking it to more than 1.1 million ounces – 13.1 million tonnes at 2.6 grams per tonne gold for 1,115,000oz.

The jump comes on the back of a whopping 125% increase to the Turnberry deposit mineral resource, which now measures 11.3 million tonnes at 1.7 grams per tonne gold for 610,000 ounces. Importantly, 58% of the resource falls into the high confidence indicated category.

The sizeable increase at Murchison doesn’t come on the back of spectacular drill results – it represents a reassessment through different eyes of what the project could be.

Today’s announcement marks the first mineral resource update at the Murchison project since May 2019, when it was considered a non-core asset by previous owners Silver Lake Resources (ASX:SLR).

Latitude struck a landmark deal with Silver Lake late last year to acquire the asset, which includes the shuttered Andy Well mine and infrastructure made famous by Doray Minerals in the early part of the 2010s, and the Gnaweeda gold project of which Turnberry is part.

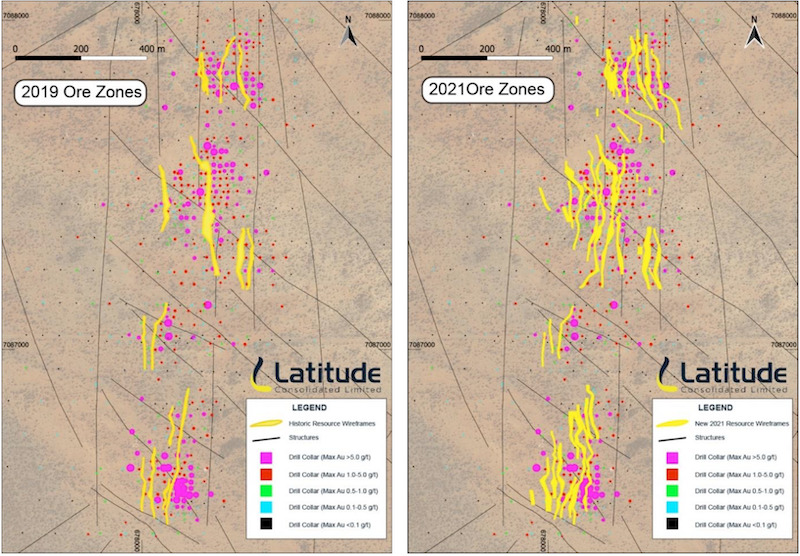

The previous owner’s mineral resource was designed to be high-grade to meet the relatively small throughput rates of the Andy Well mill – a factor which meant some 27 of 43 gold lodes at Turnberry were not included in it.

Looking back over 64,736m of assay data, including 60,849m of RC and 3887m of diamond drilling, led Latitude to today’s findings.

“The previous resource was suited to the small, high-grade project that Andy Well was, but not suited to a large, open-pittable mining scenario that Turnberry is,” Latitude CEO Tim Davidson said.

“We’ve looked at it through the lens of not being constrained by having to put it through the Andy Well mill, what the optimum-sized resource would be.

“We’ve reframed what we’re looking at. When you do that it changes the way you construct the resource – the previous estimates tried to model a very narrow, low-tonnage, high-grade, mineral resource suitable for a low throughput milling scenario.

“That left a lot of otherwise really economic material – that was present in the drilling – out of the resource.”

The project averages 1850 ounces per vertical metre from surface to a depth of 200m where drilling density reduces significantly, has a current strike length of 1.5km, and remains open to the north, south and at depth.

It has never been mined.

“It’s not a small resource, so modelling it as a high-grade, low tonnage scenario wasn’t really fit for purpose,” Davidson said.

Latitude’s reassessment of the mineral resource at Murchison was carried out by Hawker Geological Services and reviewed by CSA Global prior to its announcement to market.

Could be more out there?

Latitude has a 10,000m drilling campaign of its own underway at the moment – with no initial holes drilled at Turnberry.

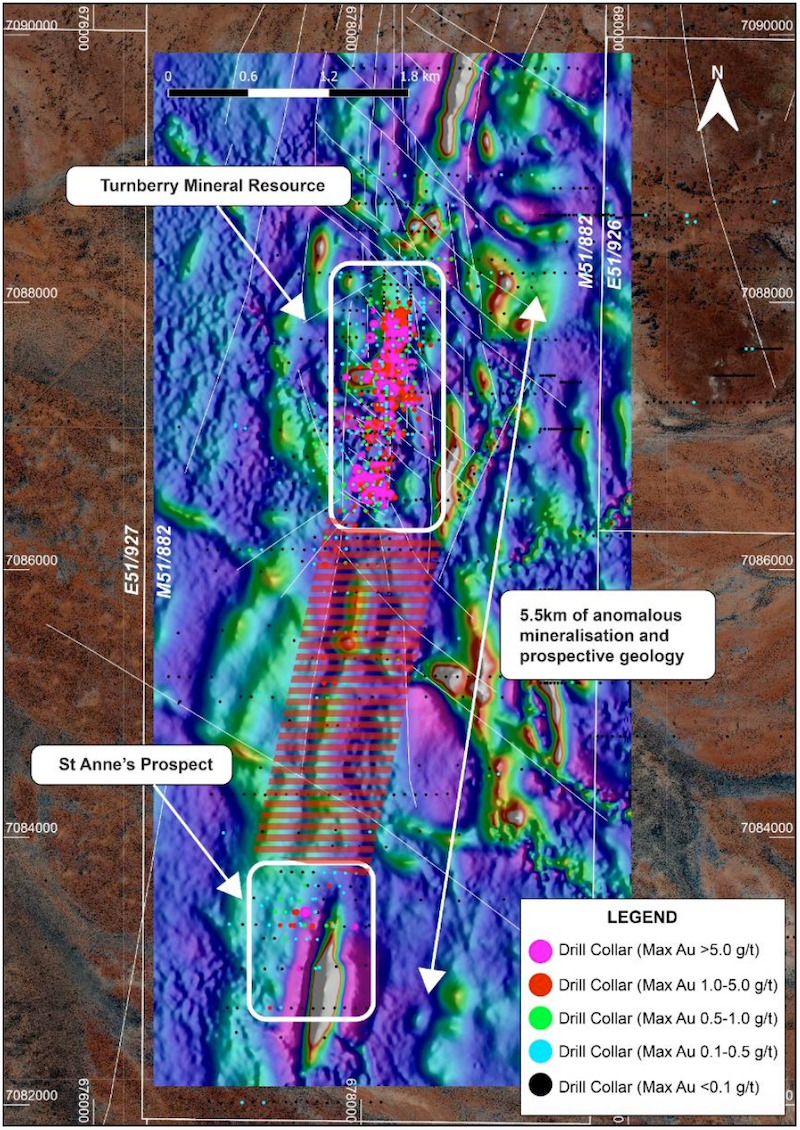

The focus instead has been on the high-grade underground mine at Andy Well, and the 5.5km corridor between Turnberry and the exciting St Anne’s prospect to the south.

Previous drilling at St Anne’s has returned assays including 20m at 2.4 grams per tonne gold from 47m, including 8m at 5g/t; and 15m at 1.5g/t from 104m including 4m at 4.7g/t.

“The drill program is not to increase the size of the Turnberry resource, it’s more to demonstrate how big the mineralised system to the south of Turnberry could be,” Davidson said.

“This program won’t allow us to increase the size of Turnberry from what we’ve just announced, but we’re hoping it will start to show investors the potential scale in the ground at Murchison.

“There’s a 600,000-ounce resource to the north at Turnberry, and we’re seeing similar grade and characteristics at the other end of the zone at St Anne’s, with mineralisation and prospective geology in between as well.

“It just warrants a lot more follow-up work.”

Latitude’s share price was up close to 25% at time of writing.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.