Lord Resources gallops ahead on Horse Rocks strategic partnership with Mineral Resources

Shares in Lord Resources have more than doubled after MinRes farmed into its Horse Rocks lithium project. Pic via Getty Images

- Mineral Resources is farming into Lord Resources’ Horse Rocks lithium project

- Horse Rocks is just 8km from Mineral Resources’ Mt Marion lithium mine,

- Previous exploration completed by Lord has identified multiple stacked LCT pegmatites that display extensive fractionation

- Further farm-in stages allow MinRes to increase its stake up to 85%

Special Report: Lord Resources has received a clear vote of confidence for its Horse Rocks lithium project from mining heavyweight Mineral Resources, which has executed a farm-in agreement to earn 40% of the WA asset.

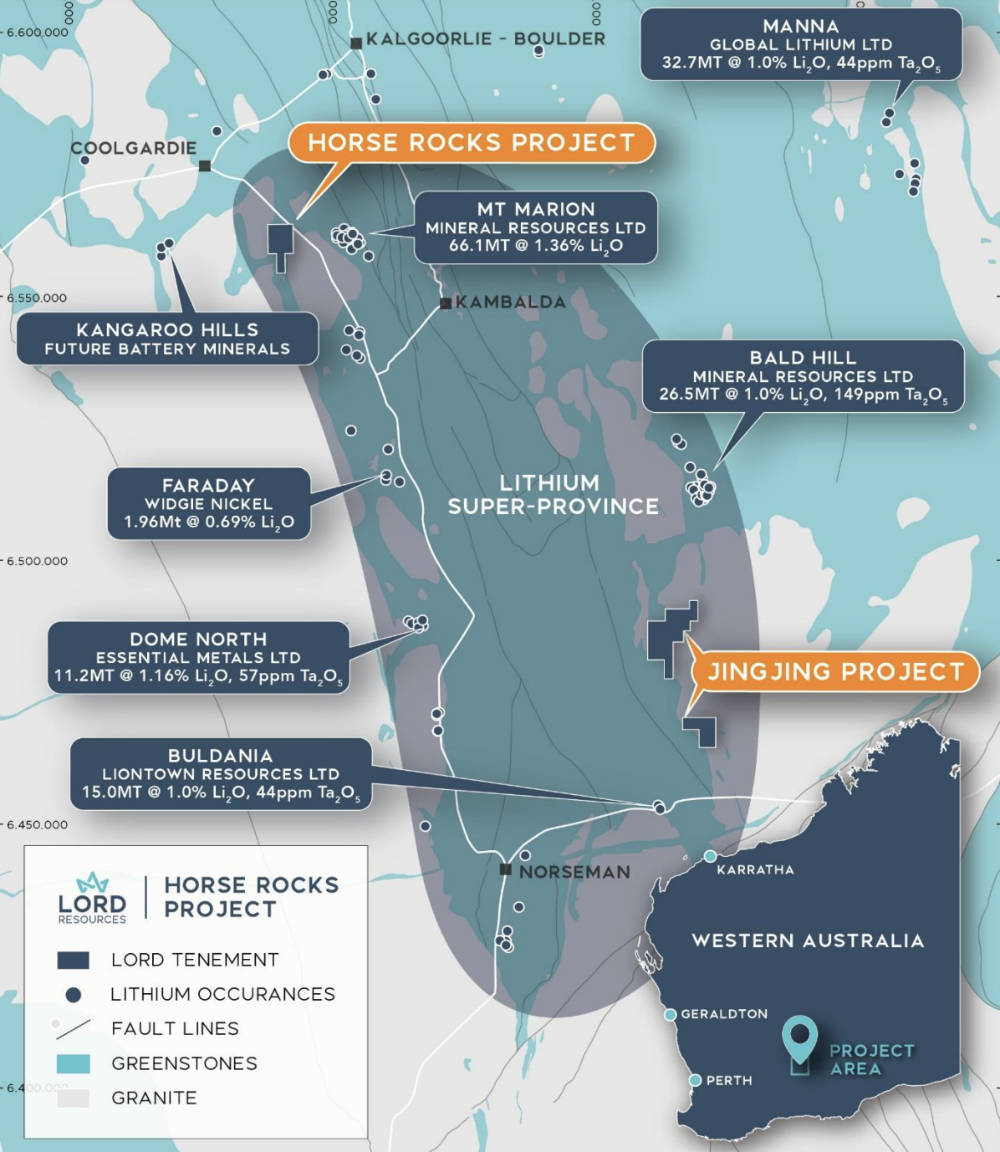

Horse Rocks is within 8km of Mineral Resources’ (ASX: MIN) operating Mt Marion lithium mine, which is almost certainly one of the reasons behind the farm-in decision.

It is also close to MinRes’ recently acquired Bald Hill lithium mine and processing plant and Liontown Resources’ (ASX:LTR) undeveloped Buldania project, a clear indicator the project is within potential “world-class” lithium territory.

Maiden drilling by Lord Resources (ASX:LRD) in August 2023 intersected fine-grained weathered spodumene while Phase 2 reverse circulation drilling supports the idea that a larger spodumene-dominated target could be nearby.

The latter drilling also found that pegmatite fractionation – an indicator that lithium is present – in multiple stacked pegmatite swarms increases to the northwest of the site outwards from the source granite and in an unexplored area.

Investors clearly were in favour of the agreement with shares in LRD up +115% this morning to 11c.

Lord’s Horse Rocks and Jingiing lithium projects. Pic: Supplied (LRD)

Exploration farm-in

These results – and possibly the proximity to Mt Marion – led MinRes to execute the farm-in agreement which will see the major spend $1 million on exploration to earn an initial 40% interest in the Horse Rocks project.

LRD says the strategic partnership will build on previous exploration it had completed to advance the project through non-dilutive financing.

It also allows the company to maintain exposure to a high-value project while ramping up exploration on its Jingjing lithium project.

“We are extremely excited to secure a strategic partnership with MinRes,” LRD managing director Barnaby Egerton-Warburton said.

“The agreement validates the strong work Lord has already completed at the Horse Rocks lithium project and provides the opportunity to collaborate with a world-class exploration team drawing on their knowledge and expertise of this highly prospective lithium region.

“We also look forward to ramping up exploration at our Jingjing lithium project, which will provide a two-headed lithium exploration strategy.”

Further investment

Should MinRes complete this initial investment, it will have the option to further increase its stake through a further two farm-in stages.

Stage 2 will see the creation of a joint venture and allow MinRes to increase its interest in Horse Rocks by a further 30% through funding another $5 million in exploration.

Under the final stage, MinRes can earn another 15% by funding expenditure through to a decision to mine.

Once the Stage 3 farm-in is completed, LRD will have the option to remain in the joint venture and contribute its 15% share of future costs, or convert its interest into a 1.5% royalty.

This article was developed in collaboration with Lord Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.