Long-lost golden potential buoys Metalicity at Kookynie

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: Over the years between 1896 and 1922, the Cosmopolitan gold mine near Kookynie in WA – now owned by Metalicity – was among the state’s biggest and best.

Over that time, Cosmopolitan delivered around 360,000 ounces at a head grade of nearly 15 grams per tonne. Those are not numbers to be dismissed, by current standards anything above 5g/t is considered high grade.

Since 1922 no official mining has taken place at Cosmopolitan, and limited exploration has been carried out. That’s years before The Great Depression, only a few years after The Great War, and the same year Tutankhamun’s tomb was discovered.

It’s a seriously historic project.

Some 99 years later, in 2021, Metalicity (ASX:MCT) is set to add a new chapter to the story. Cosmopolitan is among the more intriguing targets on the company’s prospective Kookynie gold project, and just one of a number that the explorer turned attention to this year and plans on progressing in the new year.

“At this stage Cosmopolitan is the jewel in the crown at Kookynie,” Metalicity managing director Jason Livingstone told Stockhead.

“We’ve got a number of prospects, but this is one we’re yet to fully explore and evaluate and among the most interesting there.”

Analysis of historical sampling at Cosmopolitan announced in June this year uncovered seven samples of 2m or more where gold grades were higher than 200g/t, including one hit of 3.2m at 428.6g/t.

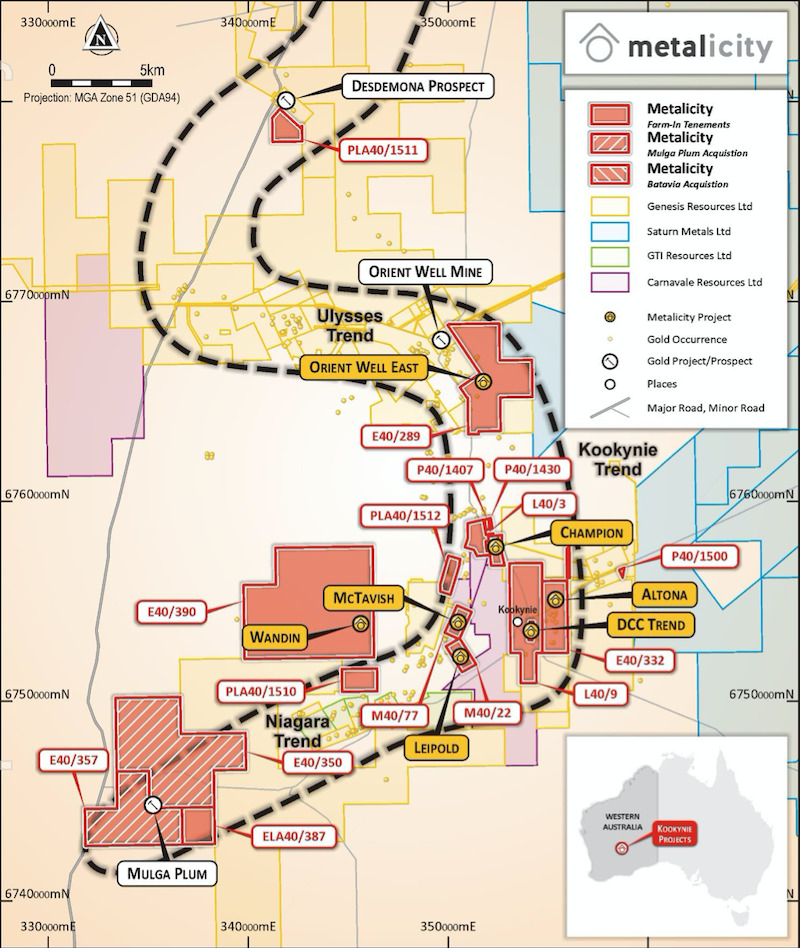

Other known mineralised areas at Kookynie include Leipold, McTavish, Altona and the DCC Trend – all of which have undergone historic mining with relatively little modern attention.

Resource definition work took place this year around the likes of Leipold, McTavish, Champion, Altona and Cosmopolitan.

Leipold and McTavish both made headlines for stunning near surface gold intercepts, including one hit of 1m grading 100.77 grams per tonne gold from 67m at the former.

But it was far from the only exciting development.

In September, Metalicity added some 21 targets identified outside those known mineralised areas. Take this into account, and you start to get a feel for the significance of what the company may be working with at Kookynie.

The market took interest. The next day, the explorer announced it had raised $5 million by way of a share placement to accelerate its drilling efforts.

It begs the question – how has something so potentially prospective sat dormant for so many years?

The answer is in the rocks. This year’s surveying revealed that then anomalies on site sat beneath a thin cover of transported sediments – enough to prevent surface geochemical anomalism.

Livingstone said based on his experiences this year, the project reminded him of some of those he’d worked with in Africa over the years – prospective but unloved.

“The vast majority of my career has actually been in Africa, where I have seen a lot of projects like this,” he said.

“For whatever reason they’ve sat languishing for decades, usually in that case because of sovereign risk or land mines, or something along those lines.

“To come back to Australia and actually work on a project that is just so prospective, and it comes down to a dismissal of the host rocks.

“A lot of these prospects are actually hosted in granite, not your typical greenstone. That’s why it’s been so unloved for so long – it didn’t fit the typical mould of eastern goldfields gold exploration.

“I’m preaching from my own soapbox here, but I believe that Kookynie is not just a project – it’s a gold province.

“We’re just starting to scratch the surface of what’s actually left there.”

In November, Metalicity added further gold rights to its Kookynie portfolio in a deal with Ardea Resources. Its landholding in the region now exceeds 10,000 hectares.

It is currently waiting on assays from a swathe of drilling in the area.

Further drilling beckons

If Metalicity is sitting on a gold province at Kookynie, then 2021 looms as a watershed year for the company.

“There will be a lot of exploration in 2021, that’s exactly what we have to do,” Livingstone said.

“One thing we’ve done in the last three or four months is to evaluate some of the more regional prospects to get a better understanding of how they tie in with the geophysics, coupled with resource definition works around the likes of Leipold, McTavish, Champion and Altona.

“Atona is turning out to be quite an interesting prospect in itself. It sits 1.5km east of the old Cosmopolitan gold mine and was operated around the same time, producing around 90,000 ounces at a head grade of 30 grams.

“Very little exploratory work has been done on this prospect over the last 30-40 years.

“It’s a peculiar project which has been untouched, per se, but at the same time it’s a bloody great gold project.”

Pull it all together, and there could me major discovery news coming out of Kookynie in 2021 and beyond.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.