Lode Resources lifts lid on bonanza-grade silver-antimony at Montezuma

The Montezuma project’s polymetallic riches are being revealed in Tasmania. Pic via Getty Images

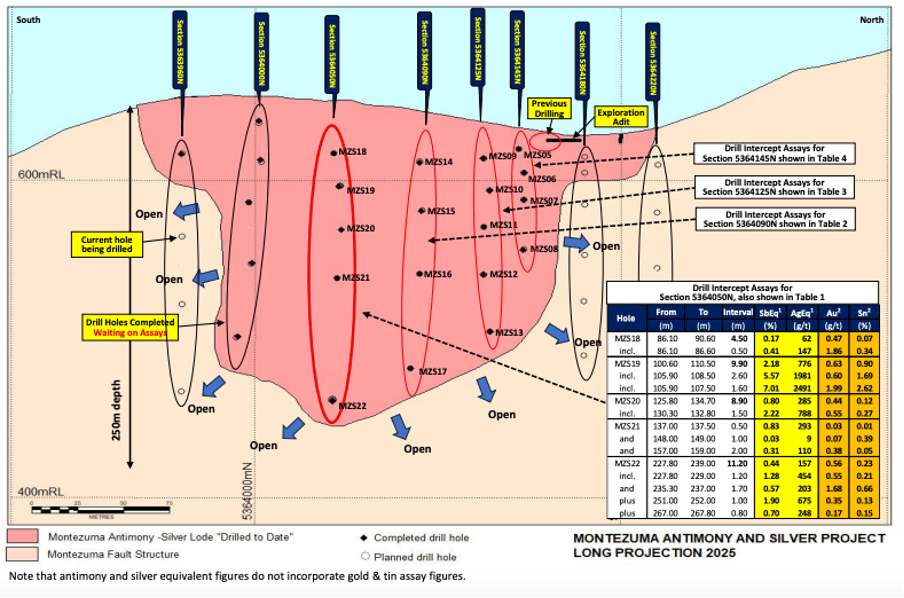

- Drilling at Montezuma returns standout intercept of 9.9m at 776g/t silver equivalent, including 2.6m at 1,981g/t and 1.6m at 2,491g/t

- Continuity of mineralisation across 220m strike length and depth confirmed, with bulk tonnage potential supported by multiple wide intercepts

- Strong antimony and silver mineralisation complemented by gold, copper, lead and tin

Special Report: Lode Resources has struck its most highly endowed intercept yet at the Montezuma antimony and silver project in Tasmania, with assays returning eye-popping grades of up to 2,730g/t silver equivalent.

The fourth batch of assays from the company’s ongoing drill program at the project in Tasmania’s premier West Coast mining province has returned not just high-graded but also confirmed the continuity of mineralisation across a 220m strike length and 220m depth.

Also highly encouraging for Lode Resources (ASX:LDR) is that mineralisation is still open in all directions as the company continues the 50-to-60-hole program for 8,000m to 10,000m. This add significantly to the potential for a bulk tonnage resource scenario at Montezuma.

Silver and antimony are by far the most dominant metals, but significant gold, lead, copper and tin values have highlighted the polymetallic nature of the mineralisation in Montezuma’s lodes.

High-grade hits, open mineralisation

The standout result was 9.9m at 776g/t silver equivalent including 2.6m at 1,981g/t and 1.6m at 2,491g/t.

Other notable intercepts included 8.9m at 285g/t silver equivalent, with a high-grade internal hit of 1.5m at 788g/t; and 11.2m at 157g/t silver equivalent including 1.2m at 454g/t, 1.7m at 203g/t and 1.0m at 675g/t.

Samples of up to 675 g/t silver equivalent from another hole marked the deepest intercepts to date at 220m vertical depth, confirming the mineral system continues at depth and remains completely open.

Bulk tonnage potential firming up

With four out of five holes returning wide intercepts – ranging from 4.5m to 11.2m – Lode says there’s increasing evidence to support a bulk tonnage resource scenario.

The presence of “daughter structures” around the main lodes adds even more scope to the scale potential.

This can be seen especially where the footwall and hanging wall structures merge. For example, the deepest drill hole to date intercepted multiple mineralised zones within close proximity. Three of the five mineralised zones, together with intervening low-grade zones, bulk out to 31.6m at 0.38% antimony equivalent or 136 g/t silver equivalent, plus 0.27 g/t gold and 0.20% tin.

Metallurgy advancing

Meanwhile comprehensive flotation tests at ALS Metallurgy in Burnie are progressing well and Lode hopes to report on preliminary findings in the coming weeks as it aims to tap into soaring silver and antimony prices.

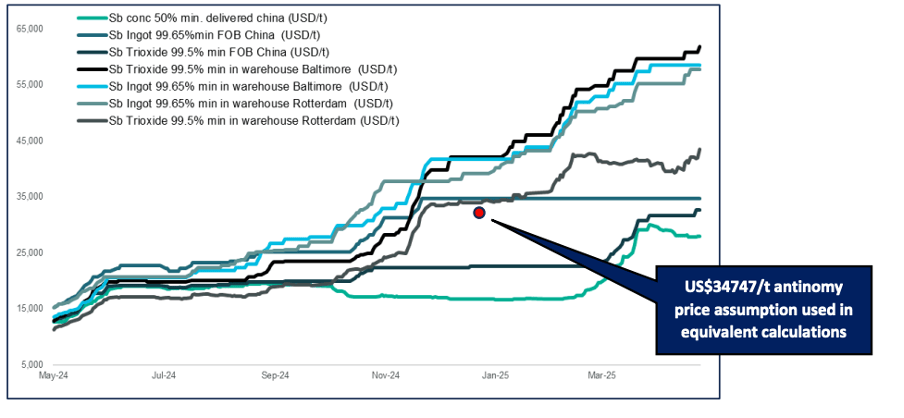

Critical mineral antimony has especially skyrocketed since the Chinese ban of exports into the US last December.

Lode’s managing director, Ted Leschke said, “Ongoing drilling is continuing to expand the dimensions of a highly endowed antimony and silver deposit at Montezuma.

“Both these metals are critical to the renewables economy and are experiencing record high prices. Silver has reached levels above US$40/oz – almost a 300% increase since mid-2020. Western market antimony prices are above US$50,000/t, more than a 400% increase since early 2024.”

Scale, grade and polymetallic options

Lode is reporting both antimony equivalent (SbEq) and silver equivalent (AgEq) grades due to variable metal dominance across intercepts. By combining grades into a single silver equivalent figure, the company is highlighting total metal endowment – a key consideration for potential investors or suitors.

Metal equivalent conversion factors were calculated using a preliminary flotation test carried out by ALS Metallurgy (Burnie) in September 2019, where recoveries achieved were 74.5% antimony, 77.9% silver, 75.8% lead and 84.8% copper.

Lode believes that all the elements included in the metal equivalents calculation have a reasonable potential to be recovered and sold, making the project a compelling multi-commodity play.

Key part of critical portfolio

Montezuma complements Lode’s 100%-owned Magwood antimony project in the north-east of New South Wales and Uralla gold project in the New England Fold Belt.

Magwood was Australia’s largest primary antimony production source throughout the 1960s and 1970s and had such strong grades that the then-owners never undertook exploration drilling at the deposit.

This article was developed in collaboration with Lode Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.