Lode Resources gets big-name neighbours

Pic: Rebecca Van Ommen / The Image Bank / Getty Images

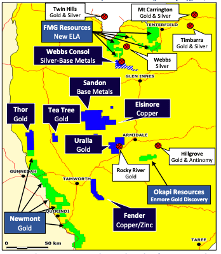

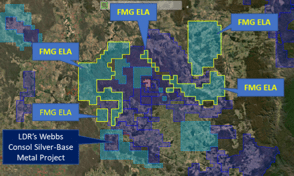

FMG has pegged ground around Lode Resources’ Webbs Consol Silver Base Metals Project in the mining giant’s first foray into the New England Fold Belt in NSW.

In a sign the Andrew Forrest-chaired company may be hoping to emulate Lode Resources’ (ASX:LDR) string of recent successes, the exploration licence application made this month includes multiple areas across about 840sqkm of very similar geology to Lode’s project.

Lode is about to start Phase II drilling at Webbs Consol where it has so far unearthed 50m grading 284 grams per tonne of silver equivalent (g/t) from only 17m and a massive aggregate of 5.9m at 1,074 g/t silver equivalent from two very high-grade intercepts. While results have been measured in terms of silver equivalence, Webbs Consol has also yielded high grade zinc, which plays a major role in batteries storing renewable energy.

Executive Chairman Andrew Forrest of FMG (ASX:FMG) aims to be an industry leader in decarbonisation and silver is essential to this given it’s an irreplaceable component of photovoltaic cells used in solar energy as well as EVs and their charging stations.

FMG’s move follows the world’s largest gold miner, Newmont Corporation, being granted several exploration licences spanning 160sqkm in the New England Fold Belt last year.

New interest in old mining area

The multi-billion dollar companies’ stakes in the ground signify a significant confidence boost in the potential of finding world-class orebodies in the underexplored mineral belt.

Lode has more than 1,800sqkm under exploration in the area across its seven 100% owned projects, including the Uralla Gold Project – plus a fresh $1.63m for further exploration and development from last week’s placement.

“The New England Fold Belt’s most significant mining period was from 1850s up to WWI,” Lode’s Managing Director Ted Leschke said. “Back then estimated output at today’s prices was US$7 billion or up to 20% of the entire state’s GDP for that period.

“The region has missed the past several exploration booms, with the last big push in the 1970s. This was a time when maps were still coloured in by hand and most of the work was regional and rudimentary. Exploration activity has been fairly limited since.

“The lack of exploration meant new metal deposits were not discovered, which in turn meant even less exploration expenditure – quite simply it became a self-fulfilling situation.

“Since then there have been large advances in technology, such as more advanced geophysical techniques, the advent of GPS and personal computers, better drilling rigs and other equipment.”

Current in situ resource value in the New England Fold Belt is estimated to be just 2% of the entire state of NSW due a lack of exploration and the region has just one exploration hole for every 13 holes drilled in the analogous Lachlan Fold Belt. But all that may be about to change.

From red dirt to green energy

Fortescue CEO Elizabeth Gaines would not comment to Stockhead on the exploration leases in the New England Fold Belt in particular. However she did echo Dr Forrest’s statements about FMG’s strategy to use its exploration expertise to target world-class opportunities for commodities that support decarbonisation and electrification.

“Fortescue’s core mining business, and the basis for its continued success, has been the exploration and development of iron ore in Western Australia’s Pilbara region,” Ms Gaines told Stockhead.

“Fortescue is transitioning to an integrated, global green energy and resources company. Leveraging our world leading track record of innovation and infrastructure development, Fortescue Future Industries will position Fortescue at the forefront of the renewable energy industry.

“With our exploration knowledge and expertise, Fortescue continues to explore for critical minerals in Australia and globally through its tenure footprint with a focus on copper, lithium, nickel and Rare Earth Elements.”

Other recent Australian exploration activity by the world’s fourth largest iron ore miner has been primarily focused on early-stage target generation for copper-gold in the Paterson, Rudall and Goldfields regions in Western Australia. FMG has also lodged applications to explore vast tracts of another underexplored region – WA’s south coast, which is prospective for critical minerals including lithium.

Additional exploration activity is underway in New South Wales and South Australia, including through the farm-in and joint venture agreement with Tasman Resources in South Australia.

Overseas Fortescue is now well-established in South America. In Ecuador it has concessions prospective for copper in exploration phase covering 135,000ha and in Argentina it holds 323,000ha of tenements prospective for copper-gold. The company is also assessing exploration and development opportunities in Peru, with a focus on the Canariaco copper project, as well as Chile and Brazil.

Elsewhere FMG is pursuing opportunities in Portugal and Kazakhstan.

This article was developed in collaboration with Lode Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.