Lode Resources confirms bulk tonnage potential at Montezuma antimony and silver project

Pic: Getty Images

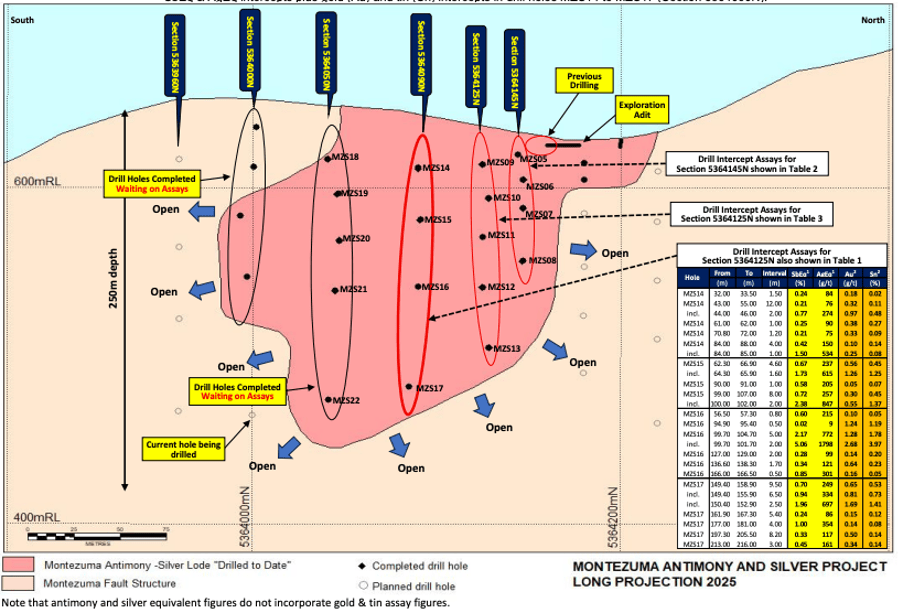

- Drilling at Lode Resources’ Montezuma project has uncovered high-grade antimony-silver-gold-tin mineralisation

- Multiple mineralised “daughter” adjacent to the footwall and hanging wall structures add scale potential to the project

- Drilling is continuing and metallurgical testing is under way as Lode moves ahead to progress the critical minerals project

Special Report: Lode Resources has bulk-tonnage potential in view at its Montezuma antimony and silver project in Tasmania after drilling confirmed multiple stacked mineralised structures.

Lode Resources has flagged the potential for a bulk tonnage resource scenario at its Montezuma antimony and silver project in Tasmania, with the latest drilling highlighting multiple mineralised structures.

The company says the presence of “daughter” structures next to both the footwall and hanging wall zones could significantly increase scale, with one drill hole in particular already demonstrating bulked-out critical minerals potential.

Lode (ASX: LDR) has now delineated high-grade mineralisation across a 200m strike and to depths of 200m, and this is still open in all directions.

Among the standout intercepts are 5m at 2.17 per cent antimony equivalent, 772 grams per tonne (g/t) silver equivalent, plus 1.28 g/t gold and 1.78 per cent tin. This includes 2m at 5.06 per cent antimony equivalent, 1,798 g/t silver equivalent, plus 2.68 g/t gold and 3.97 per cent tin.

Three of the five mineralised zones, together with intervening low-grade zones in one drill hole, bulk out to: 31.6m at 0.38 per cent antimony equivalent, 136 g/t silver equivalent, plus 0.27 g/t gold and 0.20 per cent tin.

Tipping scales

Lode Resources’ managing director Ted Leschke said: “Our Montezuma drill programme continues to produce exciting results. All holes have intercepted multiple zones of strong mineral endowment and now we are seeing the potential for bulk tonnage resources which could materially increase project scale.

“In addition to high-grade antimony and silver mineralisation there are consistent zones of strong tin and gold mineralisation adding significantly to the overall metal endowment.”

A 50-60 hole, 8,000-10,000m drill program is ongoing to target strike and depth extensions at Montezuma, where antimony and silver dominate but gold, lead, copper, and tin add to the project’s polymetallic upside.

Further metallurgical work on the ore is also advancing, with the metallurgical division of ALS Burnie commissioned to undertake flotation tests and Quantitative X-ray Diffraction (QXRD) analysis, including recovery of tin and gold.

Part of critical portfolio

Montezuma complements Lode’s 100% owned Magwood antimony project in the north-east of New South Wales, as well as its other projects including the Webbs Consol silver base metals project and Uralla gold project in the New England Fold Belt.

Magwood was Australia’s largest primary antimony production source throughout the 1960s and 1970s and had such strong grades that the then-owners never undertook exploration drilling at the deposit.

Antimony and silver are both considered critical minerals and the prices of both have been on a tear recently, especially antimony since the Chinese ban of exports into the US last December.

This article was developed in collaboration with Lode Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.