Lode hits exploration trifecta as zinc prices hit 15-year high

Pic: Getty

Preliminary test work on Lode Resources’ Trough Gully project has delivered extremely high recoveries of zinc, copper, gold and silver providing early indications that the project could be developed as a low-cost, high-margin operation.

Lode Resources (ASX:LDR) shares took off on Thursday following the results of initial flotation test work on Trough Gully mineralisation showing extremely high recoveries of up to 97.5% for zinc, 98.8% for copper, 97.2% for gold and 98.8% for silver.

Shares rocketed as much as 47% on the previous day’s close, notching an intra-day peak of 25c.

Lode Resources (ASX:LDR) share price chart

Managing director Ted Leschke said whilst there was much work still to be done, high metal recoveries, high-grade mineralisation and strong metal prices were the “trifecta aspiration of every exploration company”

“We are highly encouraged by the preliminary metallurgical test work on Trough Gully mineralisation as well as the high-grade drill results in initial drilling,” he said.

In addition to the very high recoveries, phase one drilling at Trough Gully has returned high-grade, shallow intercepts including 7.3m at 9.47% zinc equivalent from 92.1m and 6.9m at 9.21% zinc equivalent from 50.9m.

Zinc equivalent grades of over 9% are considered high-grade by industry standards.

At the same time, zinc prices are close to 15-year highs on supply shortages and dwindling stockpiles.

Such high metal recoveries mean Trough Gully and the greater Fender project could be brought into production utilising low-cost industry standard flotation.

While Trough Gully was historically operated as a copper mine, the contained zinc by value in two of the drill holes is actually 35% higher than the contained copper value.

Lode says this indicates the zinc potential of both the Trough Gully and Webbs Consol base metals projects may have been highly underestimated.

“Zinc was obviously not a focus for the old timers in the late 1800s and early 1900s and the almost non-existent recent modern exploration at the Trough Gully and Webbs Consol base metals project has meant this potential has not been fully explored,” Leschke said.

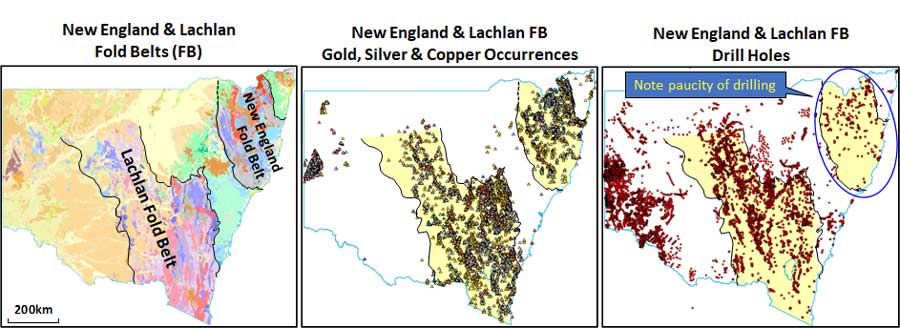

“We have a large, highly prospective and extremely underexplored ground position in the New England Fold Belt that we plan to continue to aggressively explore as we work towards proving up the next big modern discovery in the region.”

The New England Fold Belt was mined from the 1850s up until World War 1. It’s estimated output at today’s s prices was $US7bn or up to 20% of NSW’s entire GDP for that period.

The Hillgrove gold mine is currently the only operating mine in the New England Fold Belt.

The current in situ resource value is estimated to be just 2% of the entire state due to a lack of exploration. The New England Fold Belt has just one exploration hole for every 13 holes drilled in the Lachlan Fold Belt.

Lode now plans to carry out down hole electromagnetic (DHEM) and fixed loop electromagnetic (FLEM) surveys to test for extensions at depth and along strike.

This article was developed in collaboration with Lode Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.