Lithium Universe wants to capitalise on North America’s supply chain gaps: Here’s how

Lithium Universe is looking to strengthen North America's lithium supply chains.

- The North American lithium market is in need of local production and refinement capability

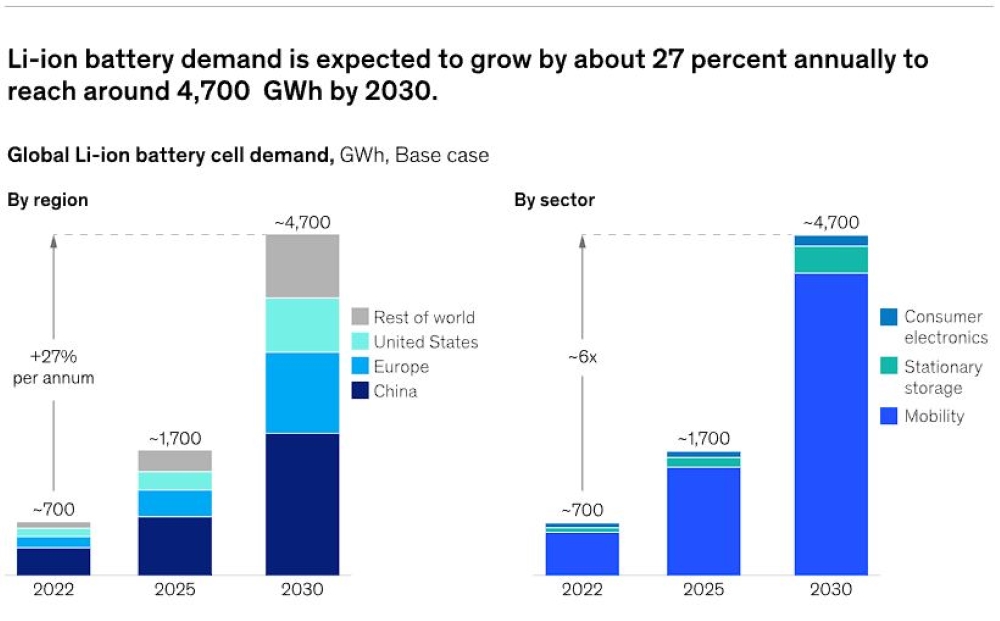

- Global demand is forecast to triple by 2030

- Junior stock Lithium Universe plans to build a 16,000tpa lithium refinery in Quebec to bridge the downstream supply chain gap

The North American market’s insatiable appetite for locally produced lithium products could be a boon for Canada’s emerging lithium downstream supply chain.

Development of a lithium industry is accelerating at pace in Canada, with two mines in production and a bunch on the way – yet refining capabilities still need to catch up.

OEMs are setting up shop in places like Quebec and Ontario with billion-dollar battery manufacturing plants yet there’s a current lack of ability to refine the raw materials locally.

Car manufacturers such as Stellantis, Ford, Honda and General Motors, as well as battery makers LG Energy Solution, POSCO and Lion Electric Co are all looking to feed into the North American market.

Demand to stay high and supply chain concerns

Despite currently deprssed prices global demand for Li-ion batteries is projected to rocket up to 2030, according to McKinsey, increasing from 700GWh in 2022 to 4.7TWh by the end of the decade.

The Atlantic Council says the US in particular desperately needs to hasten the development of supply chains for critical minerals and especially lithium to end its reliance on China.

“The US has a lithium problem. More precisely, US demand for lithium is growing exponentially while access to secure supplies is becoming more tenuous,” it writes.

“A better solution is to develop new supply chains that don’t depend on China or Chinese companies for critical minerals, including lithium.”

Lucky for them, Canada is right next door and while its lithium production and downstream processing abilities are still emerging – the country is incentivising exploration and development with a multi-billion-dollar critical minerals strategy.

Developing projects in Quebec, Lithium Universe (ASX:LU7) non-exec directors Patrick Scallan and Jingyuan Liu spoke to Stockhead about how companies like theirs can take advantage of the nascent ex-China supply chain.

Changes in lithium over the decades

Scallan says the lithium mining sector has gone through major changes over the decades and it’s now all about volumes, processing and refinement – something that China recognised early doors, while the West is seen to have been caught with its pants down.

“When we were mining 30 years ago we used the mineral as an ingredient for glass and ceramic manufacture,” Scallan says.

“Now it’s just about all converted into lithium hydroxide or lithium carbonate and then used as an ingredient in various applications.

Moving forward to today and Scallan notes that current trends don’t seem to have changed too much, yet perhaps of some note being the preference of lithium hydroxide over lithium carbonate (or vice versa) for battery manufacturers.

“That, combined with current depressed prices are the biggest changes I’ve seen this year so far,” Scallan says.

Canada to the rescue

LU7’s Liu says North America is positioning itself well to take advantage of moves by both the US and Canada to ensure downstream supply chains.

“Australia, Africa and Brazil produce spodumene concentrate, but have limited or no conversion capacity, so the spodumene is being shipped to China for conversion,” Liu says.

“We believe the next emerging lithium supply country is Canada, specifically Quebec where there’s a lot of lithium resources and potential to be the next lithium supply star.”

Significant issues can be the slow process of getting a project off the ground into production and building processing facilities to supply battery-grade material for the OEMs.

Québec Lithium Processing Hub strategy

“That’s where Lithium Universe has got a great opportunity. We’re going to be building a refinery at Bécancour where we can control that gap between those trying to develop a resource and the downstream processing that’s already being invested in, in southern Canada,” Scallan says.

It’s secured a site just for a 16,000tpa lithium carbonate facility just 1km from GM/POSCO’s and Ford/EcoProBM’s two cathode factories to produce battery-grade lithium as part of its Québec Lithium Processing Hub (QLPH) strategy.

There’s over 20 large-scale battery manufacturers on North American’s east coast and LU7’s choice of location couldn’t be poised any better to take advantage it seems.

“Québec’s low-cost hydroelectricity, high environmental standards, and educated workforce, as well as the location’s logistical advantages, including a deepwater port and easy rail access to the rest of North America, were key factors in the decision,” LU7 says.

At Stockhead we tell it like it is. While Lithium Universe is a Stockhead advertiser, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.