Lithium prices will stay high for now, but ‘lack momentum for further increases’ in 2023: Platts

Pic: Via Getty

- S&P Global says that near-term, record lithium pricing remains supported on strong fundamentals

- In 2023, S&P sources expect Chinese lithium prices to fall back to a “reasonable” range on growing mine capacity and lower production costs

- However, this assumes new production comes online as expected, and that it can be economically converted into battery grade Li chemicals

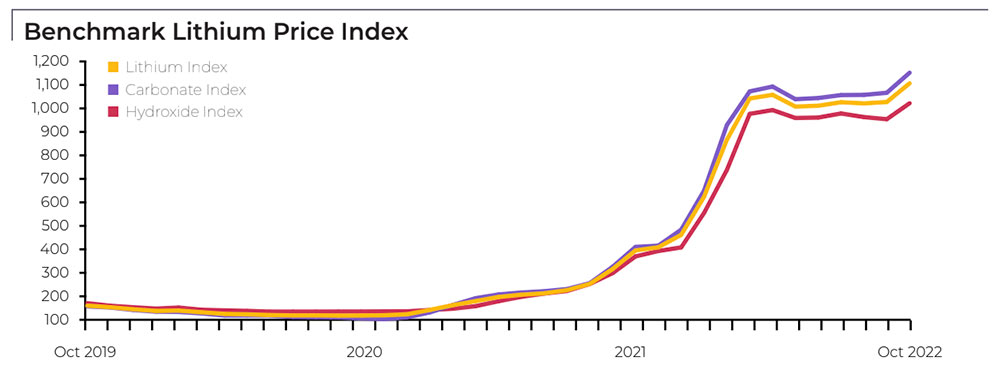

Lithium prices in China continue to hit new record highs heading into the final weeks of 2022.

According to the latest Benchmark Mineral Intelligence data, lithium carbonate is selling for $US77,900/t, up 124% year-to-date.

Hydroxide is up 171.2% over the same period to ~$US77,275/t.

S&P Global says that near-term pricing remains supported on strong fundamentals, with the latest auction price of Pilbara Minerals’ (ASX:PLS) spodumene, plus supply tightness in the domestic market, expected to keep Chinese lithium chemicals prices at elevated level.

PLS’ 12th spodumene auction on November 16 received its highest-ever winning bid at $US7,805/ton for ~5.5% lithium oxide – 7.6% higher than the previous auction in October.

“[This is] underscoring a continued bullish sentiment for the lithium market despite prices having more than doubled since the start of the year,” says S&P Global.

“As the auction price is often used as a guidance for lithium prices going forward, market views for the near-term outlook will likely continue to strengthen, sources said.

“The bid of $US7,805/mt for spodumene is equivalent to the production cost of Yuan 582,000/t (~$US81,400/t) for battery-grade lithium carbonate after factoring in 13% value-added tax and Yuan 30,000/t of processing and refining fees.”

Adding upwards pressure on prices in the short term is reduced output from domestic Chinese brines producers over the upcoming winter.

This just adds “further support … for domestic lithium chemicals prices at a time when downstream demand remains strong, sources said”.

S&P Global also dismisses the recent price drop on the Wuxi Stainless Steel Electronic Exchange Center, which was attributed to talks of output cuts amid Chinese leading battery makers.

“Sources expected a limited impact on the spot market due to strong fundamentals,” it says.

READ: Why yesterday’s lithium crash doesn’t mean the price party’s over

But lithium price momentum IS slowing, S&P says

No one expects these prices – which are earning producers like PLS and Allkem (ASX:AKE) outrageous super profits — to remain as high over the long term.

Platts says prices are already starting to lack upwards momentum as downstream consumers show less buying interest at current levels, market sources said.

In 2023, these secret sources expect Chinese lithium prices to fall back to a “reasonable” range on growing mine capacity and lower production costs.

“Soaring prices and tight upstream supply have sparked a flurry of investments in mines over the past two years,” S&P Global says.

“This is not limited to existing industry players like mining companies and vehicle makers, with other industries also wanting to get a cut of the increasingly lucrative market.

“As the investment and exploration of lithium mines continue to accelerate, global lithium resources could increase significantly in the second half of 2023, which will reduce the production cost for lithium chemicals to some extent.

“Sources expect the increasing capacity of spodumene, lepidolite and brine to ease the supply tightness of raw materials, combined with the supplementary supply from recycled batteries.”

However, this assumes operations come online as expected, and that this added production can be economically converted into battery grade hydroxide and carbonate.

My take on the GS forecast

1) #Lithium production doesn’t = battery-grade (BG) supply

2) #RKEquity BG demand is 40kt > than GS forecast in 2022 = actual restocking of *BG* in 2022 is *much* lower than GS number

3) 2023 & beyond inventory build will grow as EV sales ⬆️(not shrink) pic.twitter.com/dMP4ZGRlaT— Rodney Hooper (@RodneyHooper13) November 15, 2022

The market could still be looking at a deficit of 605,000 tons of LCE by 2030 if capital investment falls short of the required $37.8 billion, according to S&P Global.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.