Lithium prices crashed in 2023, but these figures show white gold is still the market’s biggest bet

Picture: Getty Images

- Lithium prices have tumbled in 2023, but new data shows the money men continue to bet on the battery metal

- BDO’s Sherif Andrawes says financiers and punters are looking at long term demand for lithium by backing equity and debt raisings in the metal ahead of traditional stayers like gold

- Weak IPO market and falling cash balances should see even more lithium and gold M&A in 2024

As gold prices picked up steam and lithium prices began to crash, the flow of money into ASX explorers ran the opposite direction in a sign investors continue to view lithium as the commodity of the future.

Oversupply in China and the consequences of a small, volatile market have seen spodumene concentrate prices fall to a little over US$1000/t, just 12 months after rising to upwards of US$8000/t in an unprecedented bull run.

Chemical prices have fallen from around US$80,000/t to a little over US$15,000/t in the same time.

The fall has revived memories of the bear market from 2018 to early 2020, when against many industry projections, but inline with the warnings of some investment banks like Morgan Stanley, spodumene prices fell to around US$500/t and only the strong survived.

That situation resulted in a tightening of the belt from majors that led to a shortage as EV sales hit an inflection point as well as a pullback in investment as junior explorers moved on from lithium exploration.

But risk capital for lithium miners, juniors and IPOs is still hot.

That’s the story told in financial services firm BDO’s latest Explorers Quarterly Cash Update, with junior lithium financing beating traditional leader gold even as the battery metal began to tumble into freefall and bullion held near record high above US$1900/oz.

BDO’s head of global natural resources Sherif Andrawes said investors continued to punt on a massive uptick in electric vehicle demand going forward.

“There is a long term view that even despite the short term prices coming down and a lot of volatility in the lithium price, the long term demand for lithium will be there,” he told Stockhead.

“Certainly in most overseas jurisdictions the price of lithium stocks hasn’t reflected what’s happened in Australia, which is really interesting.

“You’ve got a somewhat unique market here.”

M&A moves the needle

Andrawes noted another big factor is the quality of assets in WA, where the hard rock lithium industry supplies over half of the world’s lithium raw materials in the form of 6% and below lithium concentrate called spodumene.

Then there is the manic efforts of majors like Gina Rinehart, Albemarle, SQM and Mineral Resources (ASX:MIN), offering massive premiums for takeovers or minority stakes in lithium juniors.

Most notable is Azure Minerals (ASX:AZS), which despite being pre-resource and owning just 60% of its Andover JV with Mark Creasy’s Creasy Group, saw SQM and Gina’s Hancock Prospecting bury the hatchet to jointly bid $3.70 per share yesterday — valuing the one time micro-cap at ~$1.7 billion.

It was one of three major lithium fundraisers in the September quarter, pulling in $106.5m in an equity placement and option exercises to bankroll drilling at Andover, where the Tony Rovira led company expects to post a world class pegmatite resource next year.

NT miner Core Lithium (ASX:CXO) also rose $111.37m in equity despite (and because of) a challenging start to life at its Finniss mine, while Liontown Resources (ASX:LTR), which ended the quarter as the subject of a failed $6.6b takeover bid from the world’s largest lithium producer Albemarle, pulled in $128.6m in borrowings.

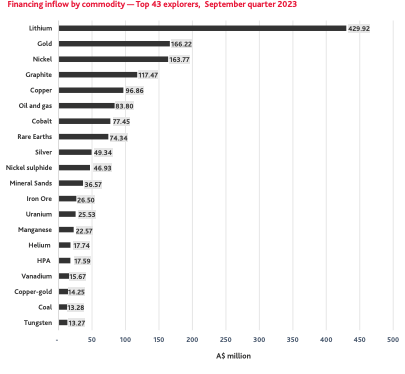

All up among companies raising upwards of $10m in the quarter, lithium stocks raised almost $430m, well above gold’s $166m, nickel’s $164m, graphite’s $117.5m and copper’s $97m. While lithium companies pulled in 27% less than the previous quarter, they remained resilient in a tough market.

“While acknowledging the overall reduction in funds raised for lithium, it is noteworthy that companies with advanced-stage lithium assets managed to secure funding, ensuring

progress toward production,” BDO said in the report.

“This is particularly encouraging given the prevailing macroeconomic conditions such as the declining lithium price over the past year. Even in times of declining lithium spot prices, explorers continue to be a destination for capital as investors are taking a long-term view of future demand.”

IPO rap

IPOs, a harbinger for risk appetite on the ASX, tell a similar story.

Having climbed to as high as 26 a quarter in 2021, 2023’s weaker capital markets have seen the number of new listings slide to just four in the June quarter and seven in the September quarter.

“IPOs were still pretty quiet and we had seven in the quarter, which is more than the previous quarter, but still pretty low historically,” Andrawes said.

“I know that there have been quite a few in the pipeline that have hit the pause button and we had quite a few in this quarter as well, which kind of hit the pause button moving into 2024.

“Unless you’re in lithium in particular, but generally in energy transition minerals, it’s pretty hard to raise money through IPOs.”

Those may wait for a brighter market environment later in 2024 when interest rates begin to come under control.

Four of the seven IPOs were in the clean energy space, including lithium focused James Bay Minerals (ASX:JBY) and Pioneer Lithium (ASX:PLN), and niobium/copper explorer CGN Resources (ASX:CGR).

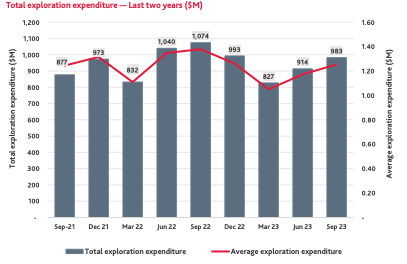

Paradoxically exploration spending remains strong, with money spent by explorers lodging Appendix 5B reports up 8% to $1.25m per company in the September Quarter and $983m all up, with BDO regarding a 19% rise in exploration spending a “genuine upswing”.

Only three quarters in the past two years — June through December 2022 — have seen explorers hit the drill bit harder.

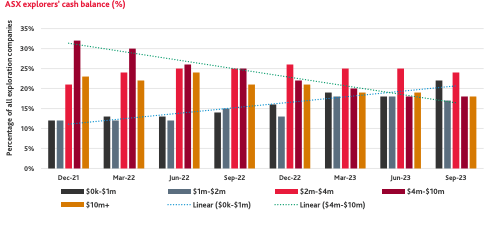

At the same time cash reserves have come down, with 22% of companies holding less than $1m in their coffers, up from 12% in December 2021, and the proportion of companies carrying $4-10m has almost halved from 32% to 18% over the same period.

Could things change?

Andrawes says strong gold prices — which have threatened all time highs since Hamas’ invasion of Israel and the subsequent bombing of Gaza, helped by an apparent cooling in the US Fed’s stance on lifting interest rates — could see a return of interest for gold raisings and potential IPOs.

Expect majors with swelling bank accounts and stronger share performances against junior miners and developers to pounce on M&A as well.

“A little less has been raised, cash is coming down a little bit, but expenditure is going up,” Andrawes said.

“That all feeds towards M&A activity and I think that’s probably what we are seeing at the moment, we’re seeing it obviously in lithium and we’re seeing it in other things like gold as well.

“We’re probably going to see a period of probably a few less IPOs and a few more takeover schemes coming through over the coming quarter or two.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.