Lithium investors – we just got a date on when EVs will be cheap enough for the masses

Mining

Mining

Investor confidence could be returning to the beaten-up lithium small cap space — general market volatility aside — as metal prices stabilise and a slew of significant global announcements puts electric vehicle (EV) adoption on the fast track.

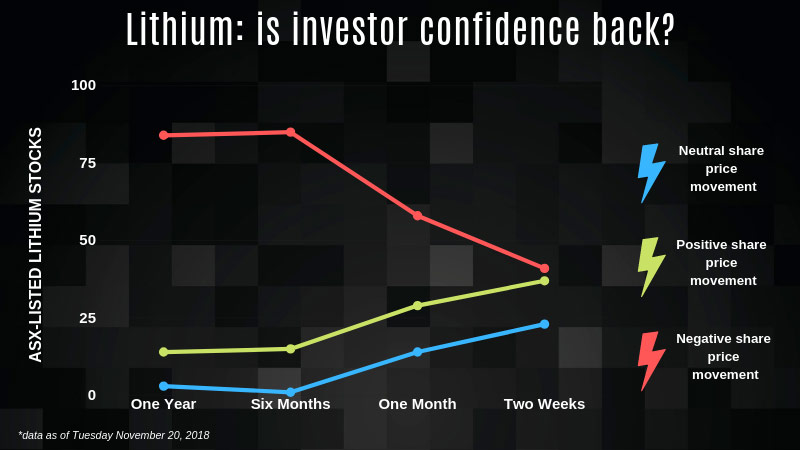

Over the last year just under 14 per cent of the lithium-facing stocks on our list have made share price gains (see graph below).

But this has been trending up over the last month or so, and in the last fortnight more than 36 per cent had made share price gains (to Tuesday November 20).

The number of stocks moving into negative territory has also dropped significantly over this time.

Canaccord Genuity mining analyst Reg Spencer says lithium stocks had taken a beating this year because investors don’t understand the “depth and complexity” of the lithium supply chain.

The supply chain from “mine or brine to market” could take up to a year — and that was before potential bottlenecks in processing, he said.

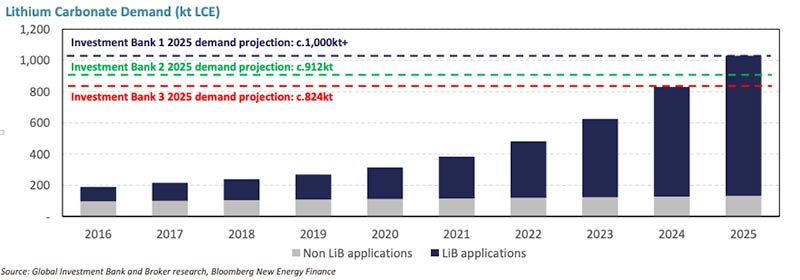

Cannacord forecasts at least 400,000 tonnes a year of lithium will be needed for EV batteries by 2025.

Scroll down for a table showing the recent performance of lithium-facing ASX stocks >>>

“Now compared to the lithium market last year, which was approximately 200,000 tonnes — noting that global non-battery use of lithium was about 110,000 tonnes a year,” Mr Spencer said.

Canaccord has revised its own supply and demand forecasts five times since May 2016.

“The last time we revised those numbers in April this year, we now expect the market not to hit oversupply until 2020,” Mr Spencer said.

“But given all these risks to new supply availability, capital, and technical challenges, how confident can we be that we are going to see this oversupply?”

Roskill analyst David Merriman recently told Stockhead that lithium prices are expected to fall back slightly into 2019, before increasing towards the end of the year and beyond to support significant new supply.

Australian lithium producers are still making very healthy profit margins at current prices.

“Despite expansions at existing producers and the commissioning of new market entrants, supply will struggle to keep pace with rapid demand growth, driven by electrification of vehicles and energy storage during the early 2020s,” Mr Merriman says.

Volkswagen Group — which owns Audi, Bentley, Bugatti, Lamborghini, Porsche, SEAT, Škoda and Volkswagen — recently announced it was going to spend more than $68.5 billion in the coming five years on EVs, autonomous driving, new mobility services and digitalisation.

Roskill battery analyst Jose Lazuen told Stockhead this announcement implies that the VW ID – Volkswagen’s first mass market competitor to the Tesla Model 3 — will start rolling-off the assembly line by 2022.

“This is exactly the year when we assume a real inflection point in EV demand — when EVs become truly affordable,” Lazuen says.

The 150GwH of battery capacity that VW says it will need by 2025 represents 11 per cent of global automotive lithium-ion demand by 2025.

According to Roskill modelling, this is “a realistic figure” for one of the world’s top 3 automakers.

VW’s announcement has been seen by some Wall Street analysts as a “no-way-back” strategy, Mr Lazuen says.

“VW has renounced its highly successful heritage of combustion vehicles in favour of an electrified future which, by the way, will be very dependent on Asian batteries,” he says.

To help reduce this dependence, Lazuen says German battery company Varta has announced future mass production of EV batteries alongside chemical giants BASF, carmaker Ford, and possibly VW — partially funded through a huge German government grant.

“This news is important because it helps us understand what the stakes are for the German auto-industry as a whole, and how they are mobilising to be able to compete with Asian battery and automakers in an electrified future,” he says.

“When you consider the pressure that EU emissions targets are putting on automakers (95g/Km of CO2 by 2020, and less than 60g/Km by 2030), then you understand that — as of today — there is simply no combustion car for sale that can comply with those targets.”

“When you think that countries like China, Japan and Korea have historically mirrored the EU emissions limits, then you understand that global automakers could eventually risk future sales if they don’t start preparing their vehicles for a future ultra-low-emissions scenario.”

Here’s a table of ASX lithium-facing ASX stocks and their performance over time

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| ASX code | Company | Two-week price change | One-month price change | Six-month price | One-year price change | Price Nov 19 (intraday) | Market Cap |

|---|---|---|---|---|---|---|---|

| BOA | BOADICEA RESOURC | 1 | 0.888888888889 | 0.172413793103 | 0.214285714286 | 0.17 | 7.9M |

| CUL | CULLEN RES | 0.421052631579 | 0.227272727273 | -0.386363636364 | -0.181818181818 | 0.027 | 3.0M |

| INF | INFINITY LITHIUM | 0.362068965517 | 0.362068965517 | -0.112359550562 | -0.561111111111 | 0.079 | 14.8M |

| DEV | DEVEX RESOURCES | 0.333333333333 | 0 | -0.333333333333 | -0.666666666667 | 0.004 | 4.4M |

| HNR | HANNANS | 0.272727272727 | 0.272727272727 | -0.125 | -0.263157894737 | 0.014 | 25.8M |

| TKM | TREK METALS | 0.2 | -0.0769230769231 | -0.4 | -0.636363636364 | 0.012 | 3.7M |

| PSM | PENINSULA MINES | 0.2 | 0 | -0.454545454545 | -0.714285714286 | 0.006 | 5.2M |

| NVA | NOVA MINERALS | 0.2 | 0.0909090909091 | -0.142857142857 | 0.6 | 0.024 | 19.5M |

| DHR | DARK HORSE RESOU | 0.2 | 0 | -0.714285714286 | -0.454545454545 | 0.006 | 11.9M |

| LKE | LAKE RESOURCES | 0.190476190476 | 0.453488372093 | 0.190476190476 | -0.342105263158 | 0.125 | 46.8M |

| ORE | OROCOBRE | 0.17661097852 | 0.361878453039 | -0.186468646865 | -0.146468144044 | 4.93 | 1.2B |

| AEE | AURA ENERGY | 0.176470588235 | 0.0526315789474 | -0.0909090909091 | -0.166666666667 | 0.02 | 22.5M |

| CXO | CORE LITHIUM | 0.166666666667 | 0.12 | 0.037037037037 | -0.253333333333 | 0.056 | 33.6M |

| ASN | ANSON RESOURCES | 0.166666666667 | 0.213333333333 | 0.978260869565 | -0.208695652174 | 0.091 | 44.5M |

| PM1 | PURE MINERALS | 0.153846153846 | 0.0714285714286 | -0.0625 | -0.4 | 0.015 | 4.4M |

| LTR | LIONTOWN RESOURC | 0.142857142857 | -0.04 | -0.142857142857 | -0.04 | 0.024 | 25.9M |

| AGY | ARGOSY MINERALS | 0.119047619048 | 0.119047619048 | -0.229508196721 | 0.0681818181818 | 0.235 | 221.6M |

| 4CE | FORCE COMMODITIE | 0.0952380952381 | -0.115384615385 | -0.622950819672 | -0.557692307692 | 0.023 | 10.2M |

| AVZ | AVZ MINERALS | 0.0789473684211 | -0.108695652174 | -0.517647058824 | -0.672 | 0.082 | 153.0M |

| LPI | LITHIUM POWER IN | 0.0740740740741 | -0.121212121212 | -0.107692307692 | -0.553846153846 | 0.29 | 77.4M |

| ENT | ENTERPRISE METAL | 0.0714285714286 | 0 | -0.4 | -0.4 | 0.015 | 5.8M |

| BMT | BERKUT MINERALS | 0.0666666666667 | 0.111111111111 | -0.407407407407 | -0.771428571429 | 0.08 | 4.3M |

| MCT | METALICITY | 0.0588235294118 | 0 | -0.28 | -0.55 | 0.018 | 12.0M |

| LPD | LEPIDICO | 0.0588235294118 | 0 | -0.571428571429 | -0.694915254237 | 0.018 | 57.1M |

| ARE | ARGONAUT RESOURC | 0.0555555555556 | -0.0952380952381 | -0.0952380952381 | -0.269230769231 | 0.019 | 29.5M |

| BSM | BASS METALS | 0.0526315789474 | -0.0909090909091 | -0.333333333333 | 0 | 0.02 | 47.8M |

| KSN | KINGSTON RESOURC | 0.05 | -0.0454545454545 | -0.0454545454545 | 0.05 | 0.021 | 26.9M |

| CFE | CAPE LAMBERT RES | 0.05 | 0.235294117647 | -0.432432432432 | -0.0454545454545 | 0.021 | 22.3M |

| VMS | VENTURE MINERALS | 0.0454545454545 | 0 | -0.30303030303 | -0.640625 | 0.023 | 12.5M |

| EUR | EUROPEAN LITHIUM | 0.0454545454545 | -0.0416666666667 | -0.410256410256 | 0.949152542373 | 0.115 | 63.0M |

| HWK | HAWKSTONE MINING | 0.0434782608696 | -0.142857142857 | -0.2 | -0.0769230769231 | 0.024 | 13.7M |

| GXY | GALAXY RESOURCES | 0.031007751938 | 0.136752136752 | -0.179012345679 | -0.286863270777 | 2.66 | 1.1B |

| AJM | ALTURA MINING | 0.025 | -0.0681818181818 | -0.438356164384 | -0.467532467532 | 0.205 | 391.4M |

| BAU | BAUXITE RESOURCE | 0.0178571428571 | 0.0178571428571 | -0.161764705882 | -0.313253012048 | 0.057 | 12.2M |

| RIO | RIO TINTO | 0.0170983794819 | 0.029180116204 | -0.0710872858641 | 0.124418112569 | 79.71 | 120.7B |

| ZNC | ZENITH MINERALS | 0.0119047619048 | 0.0119047619048 | -0.514285714286 | -0.346153846154 | 0.085 | 18.1M |

| MQR | MARQUEE RESOURCE | 0.0111111111111 | -0.412903225806 | -0.760526315789 | -0.636 | 0.091 | 3.9M |

| ZEU | ZEUS RESOURCES L | 0 | 0.0833333333333 | -0.133333333333 | -0.277777777778 | 0.013 | 2.3M |

| SYA | SAYONA MINING | 0 | -0.0689655172414 | -0.425531914894 | -0.325 | 0.027 | 44.6M |

| SUH | SOUTHERN HEMISPH | 0 | -0.145161290323 | 0.0392156862745 | -0.688235294118 | 0.053 | 4.6M |

| SI6 | SIX SIGMA METALS | 0 | 0 | -0.615384615385 | -0.722222222222 | 0.005 | 2.3M |

| RLC | REEDY LAGOON | 0 | -0.222222222222 | -0.3 | -0.857142857143 | 0.007 | 2.8M |

| PLL | PIEDMONT LITHIUM | 0 | -0.0714285714286 | -0.277777777778 | -0.315789473684 | 0.13 | 69.9M |

| N27 | NORTHERN COBALT | 0 | -0.142857142857 | -0.666666666667 | -0.797752808989 | 0.09 | 4.6M |

| MZN | MARINDI METALS L | 0 | -0.166666666667 | -0.583333333333 | -0.736842105263 | 0.005 | 9.9M |

| MOX | MONAX MINING | 0 | 0 | -0.5 | -0.777777777778 | 0.002 | 1.8M |

| MLS | METALS AUSTRALIA | 0 | -0.25 | -0.571428571429 | -0.4 | 0.003 | 7.0M |

| LRS | LATIN RESOURCES | 0 | 0 | -0.5 | -0.555555555556 | 0.004 | 12.8M |

| LI3 | LITHIUM CONSOLID | 0 | 0.0843373493976 | 0.153846153846 | -0.526315789474 | 0.09 | 8.1M |

| IEC | INTRA ENERGY COR | 0 | -0.0769230769231 | 0.2 | 1 | 0.012 | 4.7M |

| GPP | GREENPOWER ENERG | 0 | 0 | -0.5 | -0.818181818182 | 0.004 | 6.3M |

| ESR | ESTRELLA RESOURC | 0 | 0.105263157895 | -0.0869565217391 | -0.34375 | 0.021 | 10.3M |

| DTM | DART MINING NL | 0 | 0.142857142857 | -0.2 | -0.111111111111 | 0.008 | 6.9M |

| CMC | CHINA MAGNESIUM | 0 | 0.111111111111 | 0.666666666667 | 0.304347826087 | 0.03 | 8.8M |

| CGM | COUGAR METALS NL | 0 | -0.25 | -0.571428571429 | -0.769230769231 | 0.003 | 2.9M |

| CAD | CAENEUS MINERALS | 0 | 0 | 0 | -0.666666666667 | 0.001 | 14.1M |

| BGS | BIRIMIAN | 0 | -0.130434782609 | -0.59595959596 | -0.569892473118 | 0.2 | 46.7M |

| AMD | ARROW MINERALS L | 0 | -0.117647058824 | -0.4 | -0.758064516129 | 0.015 | 4.6M |

| AGO | ATLAS IRON | 0 | 0 | 0.40625 | 1.5 | 0.045 | 432.9M |

| ADV | ARDIDEN | 0 | -0.125 | -0.588235294118 | -0.631578947368 | 0.007 | 11.7M |

| PLS | PILBARA MINERALS | -0.0116279069767 | 0.0828025477707 | -0.0909090909091 | -0.0810810810811 | 0.85 | 1.5B |

| TAW | TAWANA RESOURCES | -0.0188679245283 | 0.0612244897959 | -0.393939393939 | -0.341772151899 | 0.26 | 153.2M |

| KDR | KIDMAN RESOURCES | -0.0225563909774 | 0.413043478261 | -0.434782608696 | 0.003861003861 | 1.3 | 497.5M |

| EMH | EUROPEAN METALS | -0.0238095238095 | 0.0789473684211 | 0.188405797101 | -0.414285714286 | 0.41 | 58.0M |

| LIT | LITHIUM AUSTRALI | -0.0309278350515 | -0.06 | -0.276923076923 | -0.572727272727 | 0.094 | 44.1M |

| KOR | KORAB RESOURCES | -0.0357142857143 | -0.0689655172414 | -0.357142857143 | -0.15625 | 0.027 | 8.3M |

| WKT | WALKABOUT RESOUR | -0.04 | -0.127272727273 | -0.232 | -0.0103092783505 | 0.096 | 29.5M |

| POS | POSEIDON NICKEL | -0.0408163265306 | -0.0408163265306 | 0 | 0.0217391304348 | 0.047 | 121.6M |

| ARM | AURORA MINERALS | -0.0454545454545 | -0.0454545454545 | -0.25 | -0.461538461538 | 0.021 | 2.3M |

| PIO | PIONEER RESOURCE | -0.0555555555556 | -0.105263157895 | -0.190476190476 | -0.484848484848 | 0.017 | 25.6M |

| DGR | DGR GLOBAL | -0.0666666666667 | -0.125 | 0.573033707865 | 0.4 | 0.14 | 85.8M |

| SEI | SPECIALITY METAL | -0.0714285714286 | -0.0714285714286 | -0.409090909091 | 0 | 0.013 | 7.8M |

| KTA | KRAKATOA RESOURC | -0.0740740740741 | -0.21875 | -0.285714285714 | -0.5 | 0.025 | 2.9M |

| DEG | DE GREY MINING | -0.0740740740741 | -0.137931034483 | -0.21875 | -0.537037037037 | 0.125 | 45.0M |

| KAI | KAIROS MINERALS | -0.0769230769231 | -0.272727272727 | -0.368421052632 | -0.730337078652 | 0.024 | 20.5M |

| TRT | TODD RIVER RESOU | -0.0777777777778 | -0.0674157303371 | 0.106666666667 | -0.565445026178 | 0.083 | 7.8M |

| SRK | STRIKE RESOURCES | -0.0833333333333 | 0 | 0.0377358490566 | -0.112903225806 | 0.055 | 8.0M |

| WML | WOOMERA MINING L | -0.0927835051546 | -0.2 | -0.266666666667 | 0 | 0.088 | 10.6M |

| TAR | TARUGA MINERALS | -0.0983606557377 | -0.202898550725 | -0.738095238095 | -0.395604395604 | 0.055 | 7.8M |

| PSC | PROSPECT RESOURC | -0.107142857143 | -0.0740740740741 | -0.342105263158 | -0.45652173913 | 0.025 | 51.6M |

| OAR | OAKDALERESOURCES | -0.111111111111 | -0.111111111111 | -0.466666666667 | -0.627906976744 | 0.016 | 1.0M |

| LCD | LATITUDE CONSOLI | -0.111111111111 | -0.157894736842 | -0.567567567568 | -0.384615384615 | 0.016 | 4.4M |

| AOU | AUROCH MINERALS | -0.125 | -0.263157894737 | -0.285714285714 | -0.72 | 0.07 | 6.9M |

| TKL | TRAKA RESOURCES | -0.125 | -0.2 | -0.363636363636 | -0.555555555556 | 0.028 | 9.3M |

| ADN | ANDROMEDA METALS | -0.125 | 0.166666666667 | -0.125 | -0.222222222222 | 0.007 | 8.6M |

| MIN | MINERAL RESOURCE | -0.128802588997 | -0.108018555335 | -0.311508951407 | -0.230857142857 | 13.46 | 2.5B |

| MZZ | MATADOR MINING | -0.133333333333 | -0.133333333333 | -0.037037037037 | -0.0714285714286 | 0.26 | 14.3M |

| NMT | NEOMETALS | -0.134615384615 | -0.0425531914894 | -0.307692307692 | -0.505494505495 | 0.225 | 122.4M |

| THR | THOR MINING-CDI | -0.137931034483 | -0.193548387097 | -0.342105263158 | -0.193548387097 | 0.025 | 16.9M |

| VMC | VENUS METALS COR | -0.142857142857 | -0.210526315789 | 0.2 | -0.0625 | 0.15 | 14.8M |

| MTH | MITHRIL RESOURCE | -0.142857142857 | -0.333333333333 | -0.571428571429 | -0.85 | 0.006 | 1.4M |

| ORN | ORION MINERALS L | -0.148148148148 | -0.258064516129 | -0.510638297872 | -0.28125 | 0.023 | 43.1M |

| SCI | SILVER CITY MINE | -0.166666666667 | -0.25 | -0.625 | -0.558823529412 | 0.015 | 3.7M |

| PNN | PEPINNINI LITHIU | -0.166666666667 | -0.285714285714 | -0.8 | -0.871794871795 | 0.005 | 3.4M |

| CHK | COHIBA MINERALS | -0.166666666667 | -0.166666666667 | -0.444444444444 | -0.444444444444 | 0.005 | 2.8M |

| AVL | AUSTRALIAN VANAD | -0.170731707317 | -0.15 | -0.15 | 0.7 | 0.034 | 60.5M |

| VXR | VENTUREX RESOURC | -0.173913043478 | -0.116279069767 | -0.025641025641 | -0.396825396825 | 0.19 | 45.6M |

| KLH | KALIA | -0.2 | -0.2 | -0.6 | -0.733333333333 | 0.004 | 10.1M |

| CAZ | CAZALY RESOURCES | -0.233333333333 | -0.148148148148 | -0.59649122807 | -0.439024390244 | 0.023 | 5.3M |

| MTC | METALSTECH | -0.266666666667 | -0.241379310345 | -0.696551724138 | -0.853333333333 | 0.044 | 5.1M |

| GWR | GWR GROUP | -0.290322580645 | 0.1 | -0.435897435897 | 0 | 0.11 | 27.8M |