Lithium finds its bottom, red metal gains and nickel waits, says Sprott

Pic: Getty Images.

- Is there a lithium comeback on the horizon?

- Copper’s perceived bull run seems to have kicked off

- Indonesia may be ruining nickel’s comeback

Lithium, copper and nickel have been volatile these past few years. They’re all having a topsy-turvy year so far, so that’s why this Stockhead has turned to resources asset manager Sprott, which lays down its latest commodity forecasts and says it has high hopes for the three crucial critical minerals.

Li2(w)O(es)?

Market machinations have not been kind to lithium (Li2O) as prices gravitate to new bottoms. No need to fret though. Guess what tends to happen when prices sink significantly?

Mines cut production on bad price forecasts and development dries up. Then, prices bounce back into some scope of parity due to a lack of supply and increased demand – cyclical ebbs and flows.

While it still might be hard to parry favour with investors at the moment, analysts are making the case for lithium once again.

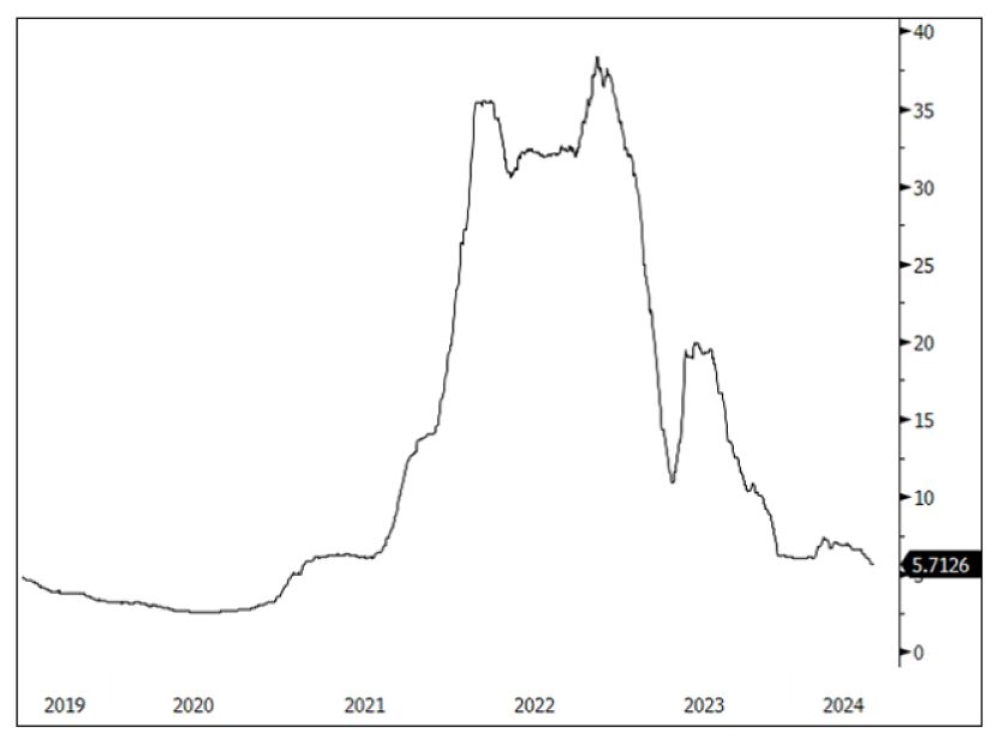

Global resources asset manager and analyst Sprott reckons negatives for Li are short-term, as it sees a lift from the spot price falling 13.57% in June down to US$5.71/lb (US$12,560/t) – its lowest level in over three years.

“With lithium destocking relenting and mines cutting production, current prices are unsustainable to incentivise investment in required future production. As such, we believe this may form the new bottom,” Sprott’s analysts said in their note.

People like cool cars and automakers want to make them

OEMs at the manufacturing level of the value chain are making their voices heard too.

“The EU has followed in US footsteps and has announced tariffs on Chinese electric vehicles that range from 17% to 38% on top of an existing 10% duty,” Sprott says.

It found that China’s EV value chain is benefiting from unfair subsidisation and causing a threat to European EV producers.

“This follows the increase in US tariffs from 25-100% on passenger EVs and from 7.5-25% on lithium-ion batteries announced in May.

“However [they] were mostly symbolic, as the country currently imports almost no Chinese EVs.

“Europe, on the other hand, imports a significant amount of Chinese EVs, with the value surging from US$1.6 billion in 2020 to US$11.5 billion in 2023.”

Supply deficits are looking on the back of growing EV adoption, with record sales of 3.2m sold globally during Q1 this year and a realised 18.3% of total annual passenger vehicle sales.

It’s also a substantial 24% year-on-year increase. While this lithium price chart (per pound) looks a bit dire, demand is set to buoy prices long term.

“There is tension in the current lithium environment between the short-term impact of negative sentiment and longer-term positive fundamentals that will come to light,” says Sprott.

That’s backed up by oil giant ExxonMobil and lithium miners coming to the industry’s defence at the recent Fastmarkets Lithium Supply and Raw Battery Materials Conference last month, by continuing to back EV-demand growth and committing to investment.

Pilbara Minerals (ASX:PLS) CEO Dale Henderson who was in attendance said that “for those of us that are worried about the market sentiments at this moment in time, keep your eye on the long-term trajectory.”

Latest in Lithium:

Pantera Minerals (ASX:PFE) just keeps increasing its landholding in the well-known and growing Smackover Formation, a lithium-from-brines rich region in Arkansas which has majors such as ExxonMobil, Standard Lithium and Albemarle developing multi-million dollar projects.

Pantera recently added another 3700 acres to its tenure, which now constitutes an impressive 25,998 net acres in the region.

The company’s partnership with global technology company SLB (NYSE:SLB) and the imminent arrival of the advanced subsurface modelling will accelerate the explorer’s progress as it prepares for the first re-entry test well at its flagship Superbird lithium project.

Carmakers Mercedes and Stellantis are in discussions with the Serbian government over lithium processing and battery metal production in the country, as Rio Tinto sets itself up to develop its US$2.4bn Jadar mining operation.

The Serb government just restored Rio’s mining license and the EU could not be happier with the news it may have a prolific new supply of lithium coming online in the near future.

Majors looking for juniors to copper up

Sprott reckons despite the short-term consolidation, the overall trend for copper remains upward and several factors contribute to a bullish outlook. Chinese smelters are cutting production due to plummeting treatment costs and additionally, the US and UK have sanctioned Russian copper, fragmenting global supply.

“BHP’s bid to acquire Anglo American has ignited investor interest, highlighting potential mergers and M&A activity that may suggest the industry continues to prefer buying existing assets over developing new ones,” Sprott’s analysts write.

“The copper spot price fell 4.61% to $4.29 per pound in June, yet while it has retraced some of its gains, the red metal remains on its upward trajectory, with a year-to-date gain of 11.72%.”

Copper miners and juniors alike have performed similarly, but with additional leverage to the underlying copper price. Year-to-date, they are up 25.41% and 17.93%, respectively, Sprott says.

Copper bandits in the news lately:

GreenTech Metals (ASX:GRE) has wrapped up the first stage of a planned 2200m RC drill program, aimed at quantifying new resources at its Whundo copper-zinc project in WA’s West Pilbara.

The junior’s got a grand plan and a handshake deal to process ore at Anax Metals (ASX:ANX) Whim Creek processing hub that would see >20,0000tpa of copper equivalent produced out of the deposits.

Arizona is copper hot and New World Resources (ASX:NWC) is looking at a low-risk 1.2Mtpa underground mining operation with a minimum 12 year mine life from its Antler project.

A recent preliminary feasibility study showed decent metrics with an NPV7 of US$636m and an IRR of 34.3%.

Nickel becomes pig-headed, ruins the party… for now

A telling sign that perhaps BHP is moving further into copper is its recent exit from Nickel West operations due to oversupply from Indonesian pig iron production, another “told ya so” that our very own mining guru Josh Chiat laid out last week.

Figures showing nickel production from the densely populated South Asian Archipelago has increased astronomically in the past few years, rising from an output of 345,000t in 2017 to 1.8Mt in 2023.

Indonesia not-so-quietly started ramping up production and while nickel prices did soar in March 2022 (peaking at about US$50,000/t and oh so briefly US$100,000/t, albeit due to a short squeeze), Aussie miners were somehow caught off guard when it flooded the market, even though the Indonesian government literally stated it would significantly increase production.

June started pretty well, but nickel dropped 12.41% during the month and despite the gains, Sprott says, are part of a downward trend on prices “driven by overproduction in Indonesia and softening demand from China”.

It’s not all bad news though. Sprott reckons nickel miners will get a boost from new US government incentives to avoid critical minerals owned/controlled by a “Foreign Entity of Concern (FEOC)”, which includes China, Russia, Iran and North Korea.

“Ultimately, the world’s shift to policies that impede globalisation is inflationary for nickel prices,” Sprott says.

Nickel lighters:

There’s a couple of ASX juniors in play and holding on to nickel projects (that have copper and PGEs in tow to buffer), such as DY6 Metals (ASX:DY6) and its Ngala Hill project in southern Malawi.

While still in early doors exploration, DY6 is targeting identified massive sulphide zones and ground activities are set to commence in Q3 this year.

Western Yilgarn (ASX:WYX) has a farm-in JV agreement with Bellpark Minerals to prove up the Ida Holmes Junction project, which has prospective magmatic nickel-copper-PGE mineralisation.

At Stockhead, we tell it like it is. While Western Yilgarn, DY6 Metals, GreenTech Metals, Pantera Minerals and New World Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.