Lithium Energy unlocks part two of Argentina’s world class Lithium Triangle

Pic: Franklin Jacome via Getty Images

Lithium Energy has received approval to explore a second key tenement at its Solaroz lithium brine project in Argentina’s vaunted Lithium Triangle as activity at the region’s majors shines a spotlight on its incredible potential.

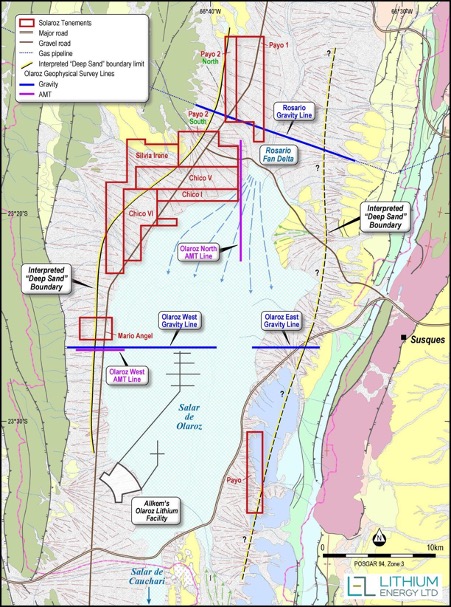

ASX-listed explorer Lithium Energy (ASX:LEL) now has Environmental Impact Assessment approval from the Jujuy Provincial Government Mining Authority for both its Payo and Mario Angel tenements, with more approvals expected to come in shortly.

It comes at an opportune time to be exploring for the battery metal, with prices at all time highs in Asia in excess of US$75,000/t for battery grade lithium carbonate as demand from electric vehicle producers continues to accelerate.

The 543 hectare Mario Angel tenement is on the western side of the lithium rich Olaroz Salar, just 6km west of Allkem’s (ASX:AKE) brine production fields for its Olaroz processing facility.

Another six tenements are expected to be granted shortly, enabling LEL to get to work proving up its exploration target of 1.5-8.7Mt of lithium carbonate equivalent at a lithium concentration of 500mg/L to 700 mg/L.

“The receipt of the second of the Government approvals to start exploration at Solaroz is another important milestone for Lithium Energy and a further positive endorsement by the Argentinian Government Authorities of the Solaroz Lithium Project,” LEL executive chairman William Johnson said.

Good neighbours

Lithium Energy received a shot in the arm from a good neighbour on Monday night when Allkem released a major upgrade to its Olaroz brine resource in the Lithium Triangle.

Already a world class resource producing upwards of 12,000tpa of lithium carbonate a year, Olaroz is now 2.5 times larger than previously thought with a massive 16.2Mt of lithium carbonate equivalent.

Along with its Cauchari basin Allkem now boasts 22.5Mt LCE in Argentina, underpinning an expansion in production capacity to 42,500t at Olaroz as demand for lithium from EV’s skyrockets.

That’s big news for LEL, since it interprets the Olaroz brines to continue into its Solaroz concessions. If there’s resource growth on Allkem’s side of the boundary, it is not a stretch of imagination to think something could emerge on LEL’s side of the fence.

“There is no better address to be exploring for lithium than the prolific Lithium Triangle where a number of world class lithium brine projects have been discovered,” Johnson said.

“Our land position could not be better located being either directly adjacent to or principally surrounded by lithium majors ASX/TSXlisted Allkem Limited (formerly Orocobre) and NYSE/TSX-listed Lithium Americas Corporation.

“Furthermore, Allkem’s recent upgrade to their Olaroz Resource in tenements adjacent or nearby to those held by Lithium Energy has provided further support for the Company’s conceptual Exploration Target for Solaroz.

“There has been significant M&A activity in the area showing the global interest in the district and lithium brines in particular, and we are incredibly excited to kick off our exploration efforts at Soloroz.”

Time to validate

Validation of that exploration target will come from geophysical surveys and exploration drilling campaigns over its 12,000ha Solaroz tenements.

In anticipation of the remaining exploration approvals being granted, Lithium Energy says it is already engaging with local geophysics and drilling contractors to prepare for the advancement of exploration works across the whole Solaroz project.

Geophysical surveys will define the basin basement morphology and thickness of the hydrogeological units that could contain economic brines.

Drilling will be used to assess the distribution and geochemical make up of the brine and its physical qualities.

This will be used to develop a pathway to a feasibility study including the delineation of a maiden mineral resource.

LEL’s hope is to progress exploration programs with a view to fast tracking the production of lithium carbonate on the proviso they are successful.

This article was developed in collaboration with Lithium Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.