Lithium Energy, Novonix to spin off Queensland graphite assets into ASX-listed battery anode material manufacturer

Corazon Mining has May Queen at the top of its exploration queue. Pic via Getty Images

- Lithium Energy and Novonix to spin off their Queensland graphite projects into an ASX listed company, Axon Graphite

- Axon Graphite will look to become a vertically integrated mine to battery anode material manufacturing company

- It will seek to raise $20m through an IPO priced at 20c to kick off operations

- Both LEL and NVX will have a 25% cornerstone interest in Axon Graphite

Special Report: Lithium Energy and Novonix have reached an agreement to merge their adjoining Queensland graphite assets into a vertically integrated mine to battery anode material manufacturing company listed on the ASX.

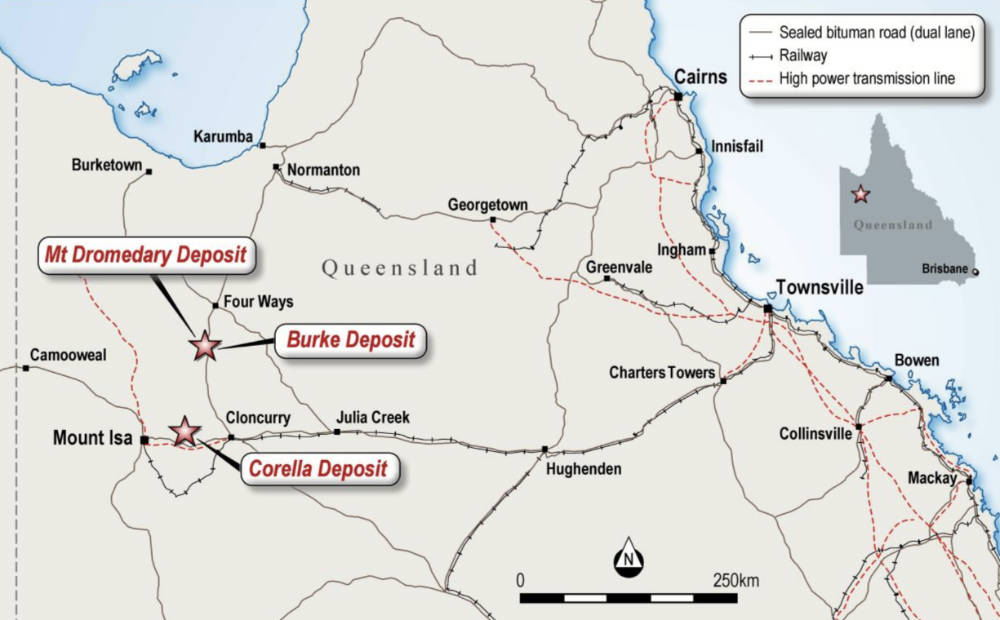

The agreement will merge Lithium Energy’s (ASX:LEL) Burke graphite project – ~783km from Townsville where the Queensland government is looking to develop the Lansdown Eco-Industrial Precinct to produce downstream ingredients for batteries – with Novonix’s (ASX:NVX) Mt Dromedary graphite project.

Burke has a resource of 9.1Mt grading 14.4% total graphitic carbon (TGC) for 1.3Mt of contained graphite while Mt Dromedary has a resource of 14.3Mt @ 13.3% TGC for 1.9Mt of contained graphite, a majority of which is in the higher confidence indicated and measured categories.

This gives the new company – Axon Graphite – significant economies of scale as it seeks to develop a vertically-integrated battery anode material (BAM) manufacturing facility in Queensland.

Additionally, Axon graphite will also own LEL’s Corella graphite deposit about 150km to the south that has resources of 13.5Mt @ 9.5% TGC for 1.3Mt of contained graphite.

Axon Graphite will have three graphite deposits. Pic supplied (LEL)

BAM focused play

Axon Graphite will look to raise $20m through an initial public offering with a minimum subscription of $15m and oversubscriptions of up to $5m (for $25m) at an issue price of 20c per share.

Shareholders of both LEL and NVX will be entitled to participate in a (pro-rata) priority offer of the IPO shares.

Assuming a $20m raising, LEL and NVX will each hold a 25% cornerstone equity holding in the new company, ensuring that they remain leveraged to success.

Axon Graphite’s planned BAM plant will use feedstock from the consolidated graphite projects, which are expected to produce a +95% TGC graphite flake concentrate at the mine site.

This concentrate will be transported to the proposed manufacturing facility or processing by firstly mechanically shaping and spheronising the flakes and then chemically purifying the spheronised graphite to form spherical purified graphite (SPG), a high-quality BAM product.

It will then be sold for use in lithium-ion battery manufacturing or for battery energy storage solutions.

“The consolidation of the adjacent high-quality Burke and Mr Dromedary graphite deposits will create a world-class inventory of high-grade graphite to support plans to develop an Australian-based, vertically integrated battery anode material (BAM) business,” LEL executive chairman William Johnson said.

“We expect significant operational synergies and economies of scale will be gained from the consolidation of these adjacent graphite deposits.

“We are delighted also to have Novonix as a partner in Axon Graphite. Novonix has established an enviable position within the global battery industry and their experience and industry contacts will be of great value for Axon Graphite moving forward.”

Novonix chief executive officer Dr Chris Burns said that combining Burke and Mr Dromedary will enhance the scale and economics of these resources and provide the focus for the development of a substantial natural graphite mine and business.

“We believe a stand-alone vehicle provides the opportunity to attract new development capital to enable the development of the resource and production of highly refined grade natural graphite for EVs and ESS (energy storage solutions),” he added.

The prospectus for the IPO will be lodged within the next six to eight weeks.

Axon Graphite plans

Following the IPO, Axon Graphite plans to carry out resource development drilling at its graphite projects, bulk sampling from Burke/Mt Dromedary, and metallurgical testing.

It will also evaluate and construct a SPG pilot plant to produce flake concentrate from bulks samples, carry out feasibility studies on the combined Burke/Mt Dromedary mining operations and the proposed BAM manufacturing facility in Queensland.

Other work will include advancing product marketing and offtake discussions with potential BAM customers, engaging with the Australian and Queensland governments to access joint development funding and or grants/incentives available for critical minerals development projects, and securing environmental and other approvals.

This article was developed in collaboration with Lithium Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.