Liontown Resources pounces on Queensland vanadium project; shares jump

Lithium explorer Liontown Resources has boarded the vanadium train, touting potential results from a project in Queensland.

Liontown shares (ASX:LTR leapt 60 per cent last year when it confirmed widespread lithium mineralisation at a newly acquired project in Western Australia’s Eastern Goldfields.

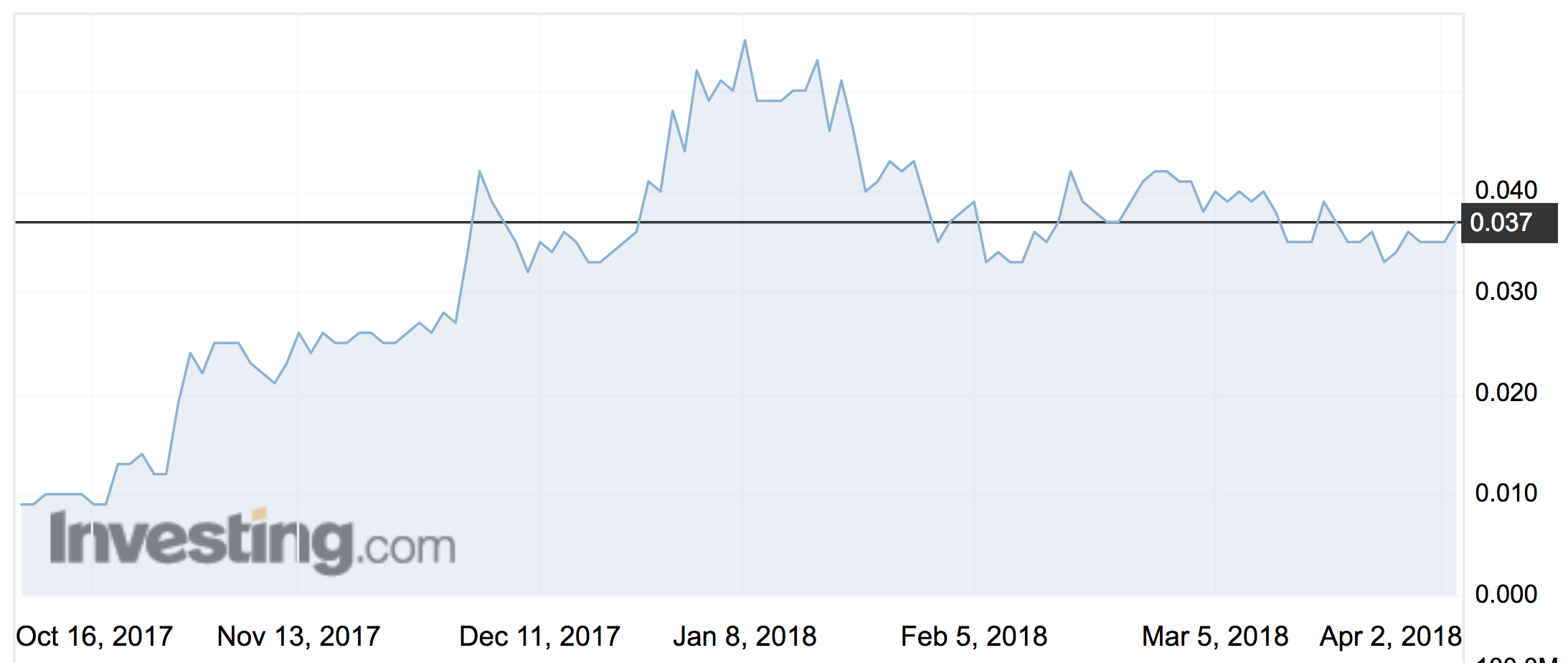

Today the explorer said there was potential for vanadium at its Toolebuc vanadium project — pushing the shares up 9 per cent to 3.8c by 11am AEST.

The price of vanadium has rocketed 550 per cent in the past three years — and related ASX stocks have been performing very strongly.

Liontown told investors a review of historical data and rock chip sampling which returned assays of up to 0.36 per cent V2O5 last year suggested high levels of mineralisation.

The project, in north-west Queensland, is made up of five granted exploration permits.

The project is next door to vanadium deposits worked by Intermin Resources (ASX:IRC) which host “inferred” resources of 1.76 billion tonnes at 0.31 per cent V2O5 and 0.67 billion tonnes at 0.35 per cent V2O5 respectively.

Mineral resources are categorised in order of increasing geological confidence as inferred, indicated or measured.

JORC compliance refers to the mining industry’s code for reporting exploration results, mineral resources and ore reserves, managed by the Australasian Joint Ore Reserves Committee.

Liontown shares opened almost 6 per cent higher on Wednesday morning at 3.7c.

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.