Legacy Minerals’ 30pc antimony, 85g/t gold rocks highlight rich potential of Drake project

Strong antimony and gold rock chips have outlined the potential of Legacy Mineral’s Drake project to host Hillgrove-style mineralisation. Pic: Getty Images

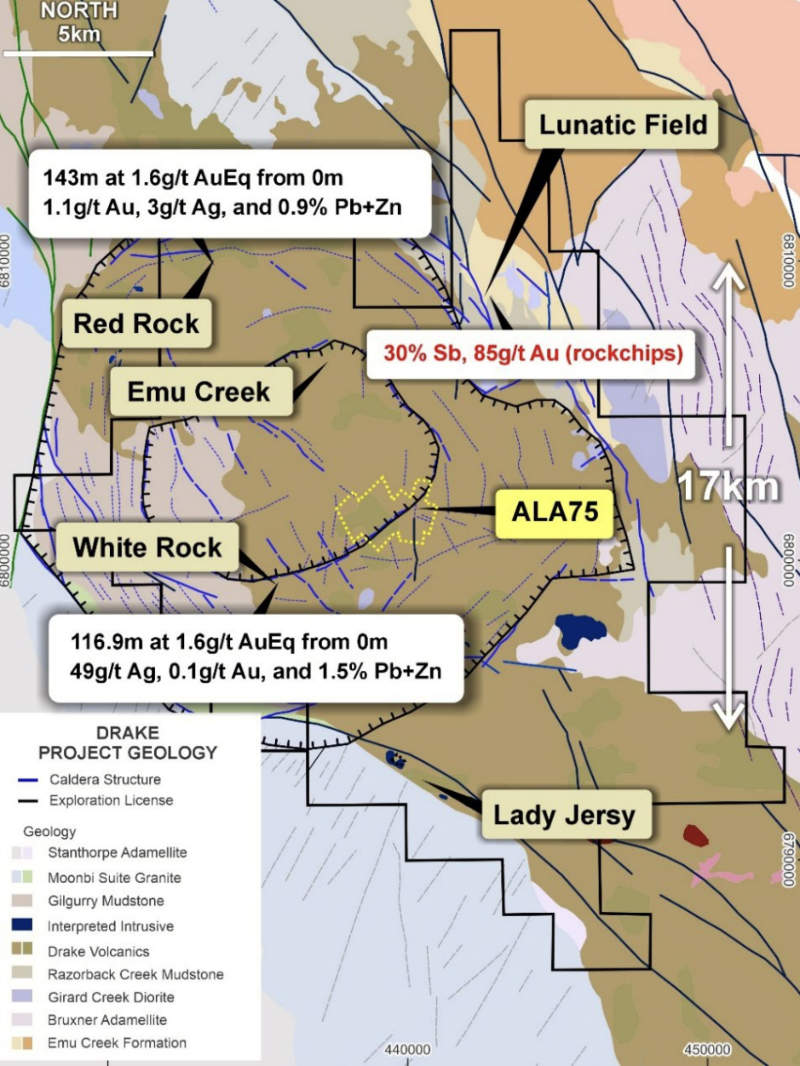

- Rock chip sampling showcases Drake project’s potential to host Hillgrove-style mineralisation with assays of up to 30% antimony, 85g/t gold

- Results demonstrate the untested potential and exploration upside of the Lunatic Field prospect

- Maiden resource for Drake expected to be delivered in March

Special Report: Rock chip sampling has highlighted the potential for Legacy Minerals’ Drake project in NSW to host Hillgrove-style mineralisation after returning assays of up to 30% antimony and 85g/t gold.

The rock chips collected during reconnaissance mapping of workings identified from the recently completed light detection and ranging survey at the Lunatic Field prospect highlighted multiple new mineralised workings and vein trends.

Notably for Legacy Minerals (ASX:LGM), the prospect hosts several occurrences of antimony-gold mineralisation similar to that found at the Hillgrove project (1Moz gold and 93,000t antimony), which is among the 10 largest antimony resources globally.

Drake sits within the highly prospective New England Fold Belt, one of the epithermal gold, silver and base metal districts that formed along the east coast of Australia during the Permian age as back arc extensional volcanic basins.

It is centred on a poorly understood but regionally important, low-sulphidation, epithermal, gold, silver, zinc and copper mineralised system with previous exploration limited to regional geophysics and surface geochemical sampling.

The NEFB hosts a number of major mines and deposits such as Hillgrove, the 2.5Moz Cracow gold mine, 2.5Moz Mt Rawdon gold mine and 8Moz Mt Morgan mine.

Antimony is a key component in ammunition and other weapons.

It is also used in solar panels to increase their efficiency and in making batteries less flammable, and it’s classified as a critical metal by not only Australia, but also the US, Canada, Japan and the EU.

LGM managing director Christopher Byrne said the exceptionally high-grade antimony and gold results returned from reconnaissance sampling of historical workings demonstrated the untested potential and exploration upside of the Lunatic Field prospect.

“The last significant exploration and drilling was conducted in 2006, when antimony prices were much lower at US$3650/tonne,” he added.

“With China’s recent restriction on antimony exports and antimony’s critical role in high-technology equipment, this strategic mineral has become even more important.”

Antimony opportunity

Previous 2006 drilling of 19 shallow and wide-spaced reverse circulation holes to test historical antimony workings intersected previously mined areas with reports indicated lode widths of up to 3m with a 2-3m mineralisation halo on either side of the main interpreted lode.

LGM notes the antimony field covers ~5km2 with historical reports indicating that some workings at the Lunatic and Johnson’s prospects extend discontinuously for up to 1.6km.

Adding interest, LiDAR interpretation and historical records suggest that over 630 historical workings are present across the vein field including shafts, adits, open-cut trenching and underground development to a depth of 86m.

Earlier this week, the company started a 279km2 airborne mobileMT survey over the Lunatic Field to help define geological structures and lithologies related to gold, silver and copper mineralisation.

It will also explore strategic opportunities to unlock value across the Lunatic Field as new information becomes available.

A maiden resource estimation for Drake is nearing completion with final reviews underway and delivery expected in March

Other exploration

Besides the work on Drake, LGM has also completed core cutting and sampling of historical drill holes at its Thomson gold-copper project on the southern margin of the Thomson Orogen near the interpreted contact with the Lachlan Fold Belt.

Assaying of these samples is now underway with results expected in March while final interpretations of data from the Fleet Space and gravity survey are nearing completion.

At the Bauloora project, gold giant Newmont (ASX:NEM) has completed processing of samples from its December 2024 diamond drilling and expects to receive results in March-April.

Multi-element soil and surface sampling is currently underway to extend the systematic geochemical coverage towards the mapped southern extents of the vein field.

Meanwhile, S2 Resources (ASX:S2R) is planning to carry out a follow-up geophysical survey to further refine the target at Glenlogan for drill testing while at the Fontenoy joint venture with Earth AI, assays from last year’s diamond drilling are expected in March-April.

This article was developed in collaboration with Legacy Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.