Lefroy’s odds of making two big gold finds rocket with heavyweight Gold Fields on-side

Picture: Getty Images

Special Report: Who better to have as your partner than a major gold producer that has already made big gold discoveries in a unusual location?

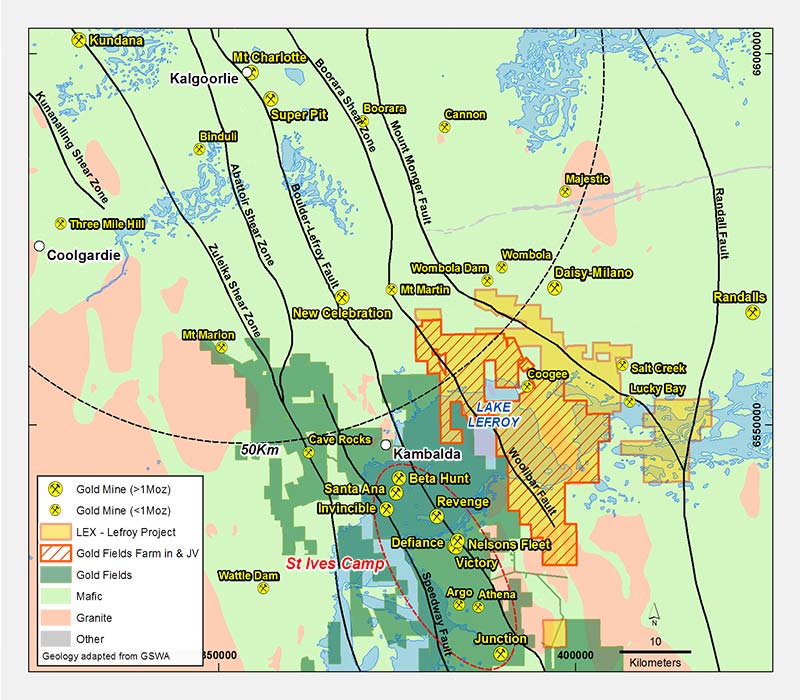

That’s exactly what Lefroy Exploration has with one of the world’s largest gold miners, Gold Fields, active on the lake part of its 600 sq km Lefroy Gold Project in Western Australia.

Gold Fields recently started a major drilling program in Lake Lefroy on the Western Lefroy tenements as part of a $25m farm-in and joint venture deal the pair struck back in June last year.

This leaves Lefroy free to continue exploration on the less risky and less expensive land part of the project, which significantly increases and accelerates the junior’s chances of making two big discoveries at the same time.

What’s even better is that Gold Fields has the skills to bring a gold mine on a lake into production — it has already done it with its aptly named Invincible deposit, part of the 15 million ounce St Ives gold camp right next door to Lefroy’s landholding.

“We’re both looking for the same thing,” boss Wade Johnson told Stockhead.

“Our vision is to find that big new gold discovery in the Eastern Goldfields and we think we’ve got it in that big package of land we’ve got there.”

A big-time partner

Gold Fields has seven operating mines in Australia, Ghana, Peru and South Africa with total attributable annual gold-equivalent production of 2.2 million ounces.

The heavyweight’s projects in Australia include the wholly owned St Ives, Agnew and Granny Smith mines in the Eastern Goldfields of Western Australia, which have combined annual production of 935,000 ounces.

And Lefroy isn’t just limited to major discoveries. It also has opportunities to potentially commercialise smaller discoveries with four operating gold plants within 50km of its Lefroy project.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

As part of the joint venture, Lefroy has the “tag along” right to process gold ore from a development project through Gold Fields’ St Ives Mill on pre-agreed terms, with no additional capital to be spent by Lefroy on a new plant.

This means Lefroy will be a capital light explorer and potential producer on success.

“We’re looking for a big deposit and if we find it, we can then make a commercial decision about whether we build a new mill or use an existing mill,” Mr Johnson said.

“To build a new mill means you’ve got to raise a lot of money and take the time to construct it. Luckily there are already four mills in our area so we should have a treatment option without constructing our own mill.

“This is especially important if we make some smaller discoveries, say 50,000 to 100,000 ounces, which doesn’t justify a standalone mill.”

Gold Fields isn’t just a joint venture partner, it also owns an 18 per cent stake in Lefroy.

This is a good indicator of the confidence Gold Fields has in the potential for discovery within Lefroy’s large land package in the highly prospective Eastern Goldfields.

“What they see in the geology at Western Lefroy can assist us with our exploration in Eastern Lefroy,” Mr Johnson explained.

“So our work is complementary, but they’re doing the heavy lifting on the vast unknown geology under Lake Lefroy, and that allows us as the smaller company to concentrate our activities on Eastern Lefroy.”

Lefroy Exploration is a Stockhead advertiser.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.