Leeuwin Metals prepares to test its exploration muscle at the Cross Lake lithium project

Mining

Special Report: Leeuwin Metals is positioning itself to launch a significant drilling campaign to test multiple high-grade spodumene-bearing pegmatites at its Cross Lake project in Canada’s Manitoba province as part of a broader exploration drive.

Cross Lake covers 2,002km2 of granted and pending mineral exploration licences over promising ground about 120km south of the major regional mining centre of Thompson.

It also benefits from extensive infrastructure such as a rail line just 100km away and access to nearby hydropower.

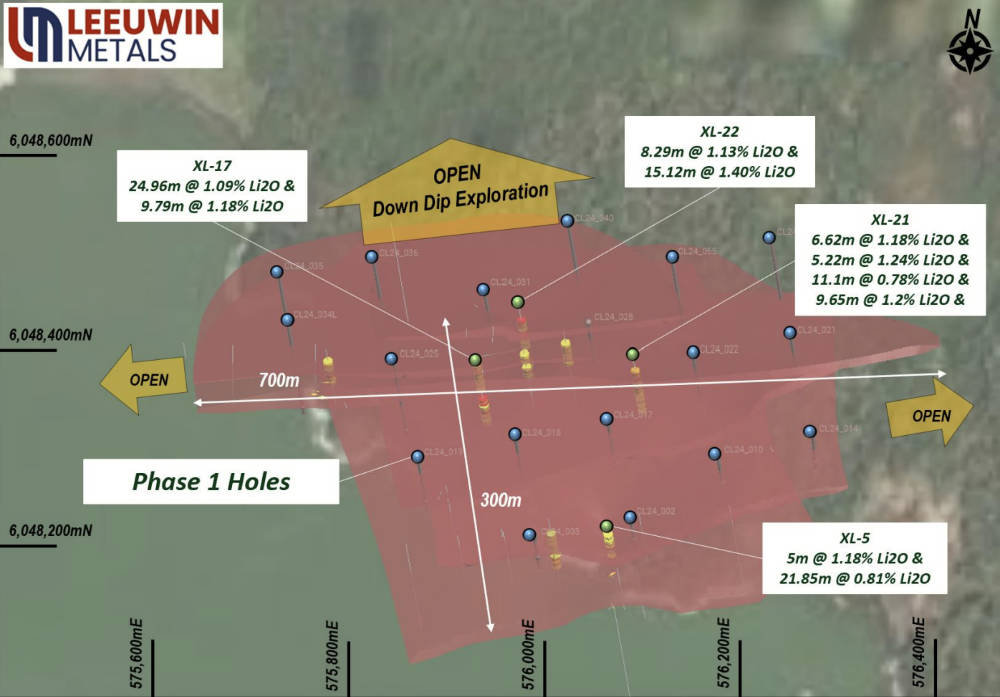

Despite historical drill holes returning assays such as 24.96m at 1.09% Li2O from 6m, 9.79m at 1.18% Li2O from 75.55m and 7.21m at 1.94% Li2O from 19m, the project has yet to be systematically explored for its lithium potential, a shortcoming that Leeuwin Metals (ASX:LM1) appears to have intention of addressing.

Its maiden field work of surface channel sampling has already confirmed that a large 4.7km long lithium-caesium-tantalum mineralised trend with over 20 spodumene-bearing pegmatites is present after returning results such as:

Rock chip sampling also returned results of up to 4.09% Li2O.

LM1 is now preparing to take the next step in exploring Cross Lake with plans to launch a 2,500m Phase 1 drill program to test the spodumene-bearing pegmatites in the coming months.

It has already engaged and/or identified drill contractors and has already completed design of the drill program, which will test the shallow mineralisation and down dip extents of the system with hole depths planned between 50m to 200m.

The company will also carry out mapping and geochemical testing over the 4.7km trend.

Additionally, LM1 will carry out summer field work to advance regional targets within the project tenure over +70km strike of the greenstone belt.

This work will include field mapping, sampling and spectral analysis from the middle of this year.

To help with exploration costs, the company has applied for funding of up to C$300,000 from the Manitoba Mineral Development Fund (MMDF) to support the planned drill program.

“We are excited with the progress we have made across the portfolio in our first year being listed. This is highlighted by the advancement at the Cross Lake lithium project, where we have identified a significant lithium occurrence, defining 4.7km of strike of lithium rich pegmatites and sampled multiple +20m wide zone of lithium in historical drilling,” managing director Christopher Piggott said.

“With the drill permit application pending, we look forward to commencing our maiden drill program at Cross Lake in the coming months, where there is significant potential for the company to define a large-scale lithium project.”

LM1 is also carrying out a technical review with Glencore of its high-grade nickel and platinum group elements (PGE) drill results from its William Lake project in the world-class Thompson nickel belt within Manitoba.

Drilling in 2023 had returned results such as 21.9m at 1.02% nickel from 206.65m and 6.5m at 2.56% nickel from 439.2m.

The review also includes historical data as the company seeks to find additional PGE opportunities at William Lake.

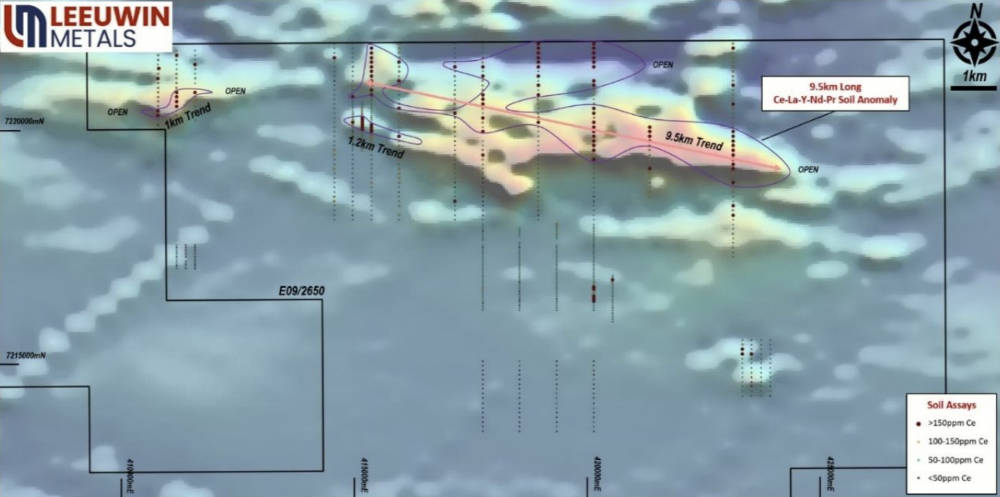

Over in Western Australia, the company has applied for additional tenure along strike from the licences it already holds in the Gascoyne region.

This follows soil sampling that identified an encouraging 9.5km strike containing a rare earth elements soil anomaly.

Assays are also pending for fieldwork carried out in the March 2024 quarter that followed-up on the multi-line soil anomaly.

Nor is the Gascoyne the only region that the company is looking for more ground.

It has also applied for tenements in the Pilbara, exploration leases in the southern extension of the Southern Cross greenstone belt and open ground in the Ravensthorpe area where it is looking for lithium and gold.

This article was developed in collaboration with Leeuwin Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.