Landmark scoping study shows Meteoric’s Caldeira mine could flip the script for western rare earths producers

Mining

Mining

Special Report: Meteoric Resources’ hotly anticipated Caldeira scoping study shows the ultra-high-grade clay deposit could be among the lowest cost sources of future-facing rare earths in the world, coming in at just US$7/kg in the first five years of production.

The operation could flip the script on China’s control of the rare earths market via the unique geology of the deposit, potentially delivering a source that will beat on cost many of the dominant rare earths companies accused of flooding the market from the Middle Kingdom.

Located in Minas Gerais, Brazil’s mining Mecca, the Meteoric Resources (ASX:MEI) owned Caldeira has an enormous global resource of 619Mt at 2,538ppm total rare earth oxides.

Having been updated twice in the past year, more expansion potential is on the cards.

Not only do high value magnet rare earths – used to manufacture rare earth magnets found in electric vehicle motors and wind turbines – make up 23% of the in ground REE mix, but higher confidence measured and indicated resources also make up a quarter of the resource at 171Mt at 2,880ppm TREO.

Those are drilled to a density required to be included in mine plans.

According to MEI CEO Nick Holthouse, what makes the project truly unique is its geology.

“We have these fantastically high grades coupled with the strong metallurgical response we are getting from the simple ammonium sulphate flow sheet which equates to a very low opex,” he says.

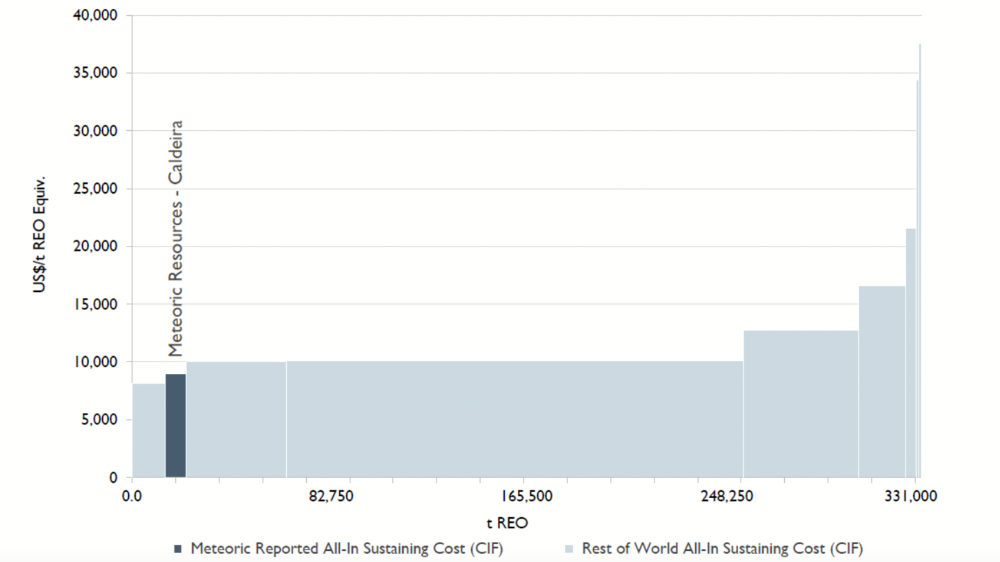

“This puts us at the very bottom of the operating cost curve.”

Even with the current low pricing cycles coming out of China, Holthouse says MEI is likely to be operating at a healthy margin, making the project resilient even in depressed market cycles – a hallmark of a Tier-1 operation.

The new scoping study presents the opportunity – with further study work, approvals and financing – to make Meteoric the third significant producer of rare earth metals for EVs, defence, aviation and wind turbines after Australia’s Lynas (ASX:LYC) and America’s MP Materials; both of which include Gina Rinehart as a large shareholder.

The scoping study was based on the concept of developing an initial 5Mtpa processing facility using currently identified resources from just six of the 69 licences which MEI holds within the Caldeira project.

Caldeira contains the world’s highest rare earth grades among clay deposits, with selective mining to bring up average mined grades to an eye-watering 4,500ppm TREO in the first five years.

That has resulted in an estimated all in sustaining cost of an initial US$7/kg, increasing to US$9/kg over the 20-year life of mine evaluation period.

Based on independent market research from Project Blue Consulting, the Caldeira project sits well within the first quartile of known projects on an operating cost per kg/TREO basis.

At an AISC of US$9.00/kg TREO, the Caldeira project would be the lowest cost producer outside China.

For the premier magnet rare earth metals neodymium and praseodymium, typically sold in a combined NdPr oxide mix, the cost base comes to average neodymium US$17.60kg over the first five years and US$21.30/kg over the life of mine.

That compares to current rare earth prices in China of US$51/kg, spot levels which are sitting around cyclical lows having surged as high as US$175/kg only two years ago.

Capital expenditure for the construction of the initial processing facilities and mining fleet of US$297m (excluding contingency of 35%) delivers a low capital intensity which MEI says is highly competitive compared to alternative rare earth projects globally.

Another bonus is the combination of a low strip ratio (0.12:1) and mineralisation being hosted in free dig material with short haul distances, adding further to the low-cost profile of the future mine.

Caldeira would deliver annualised production of 11,000t TREO over the first five years with LOM average production of 9,100t TREO, comprised of 31% NdPr and 1% dysprosium-terbium – heavy rare earths which are also used in permanent magnets but only sparsely produced outside China.

Impressive also are the sustainability metrics, with MEI’s low intensity, free dig mining method and a simple low cost AMSUL flowsheet with significant reagent and water recycling. Not to mention, the mine will be among the few globally to be powered by 100% renewable sources from the local grid.

“This scoping study represents a fundamental shift away from conventional understanding of flowsheet complexities, capital intensity and, perhaps most importantly, operating cost and capital intensity perceptions in the rare earth industry,” Holthouse says.

“While the scoping base case is focused on a 5Mtpa throughput and truncated 20 year mine life, Caldeira’s ability to grow beyond that mine life and product output is very much open ended due to its resource size and future exploration upside.

“This represents a truly unique opportunity in the rare earth sector,” he says.

The scoping study has already progressed into the pre-feasibility study phase with the results for that work due to be completed and presented to market in December 2024.

A decision to progress to a Bankable Feasibility Study will be made in Q4 2024.

This article was developed in collaboration with Meteoric Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.