Land grab: Private purchase could break open New World’s Antler copper project

Pic: Getty

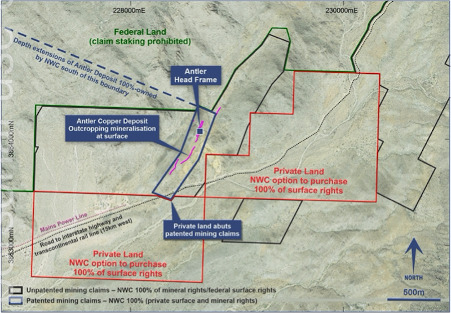

Special Report: New World Resources has secured the right to acquire private property adjacent to its high-grade Antler copper project in Arizona, opening up huge possibilities, including the fast-tracking of permits.

New World (ASX:NWC) has struck a deal to acquire almost 840 acres of private property located immediately south and east of the historic Antler project – a move which would allow it to place almost all the project’s surface infrastructure on private land.

Surface infrastructure could include mine portals, processing facilities, supporting infrastructure and ore or waste stockpiles.

The news is massive, as the State of Arizona regulates mining activities on private land, with prescribed timelines for review and approval of mining permit applications.

With minimal disturbance and hence low impact on surrounding federal lands, it is likely that the federal approval process will be simplified.

The new property is already serviced by power and roads, removing the need for new rights-of-way for important mine utilities, with the overall result being a reduction to the project’s footprint which would minimise capital and operating costs and the project’s impact on the environment and other stakeholders.

It’s got it all

There is potential to upgrade the existing power transmission line at relatively low cost to serve mining operations, which should help project CAPEX. And use of mains power should help lower project OPEX.

The new private land may also provide a source of process water; while also facilitating short material haulage distances.

NWC managing director Mike Haynes said the acquisition was a significant step towards a copper mine at Antler.

“Securing additional privately-owned surface rights immediately adjacent to the old mine has been a high priority for us, ever since our drilling demonstrated that there is a high probability that an economically viable mining operation can be re-started at the high-grade Antler copper deposit,” he said.

“Finalising this acquisition agreement is therefore a major milestone towards developing a new mining operation.

“We now have clarity on where we can optimally build surface infrastructure – which will deliberately be close to the Antler mine, on privately-owned land. This should reduce the project’s footprint, help minimise both capital and operating costs, while also streamline the mine permitting process.”

The Antler runs deep

Today’s news comes hot on the heels of the announcement by NWC earlier this week that the copper mineralisation at Antler extends more than 730m down-dip from outcropping mineralisation detected at surface.

The company’s deepest hole drilled at Antler hit 13.3m at 2.8% copper, 2.2% zinc, 1.4% lead, 58.3 grams per tonne silver and 1.13g/t gold from 881m more than 75m down-plunge of the previous deepest drilling at Antler’s Main Shoot.

The mineralisation remains completely open at depth and extensional drilling is ongoing, with New World increasingly confident of the potential to further expand the Antler resource base.

A maiden Indicated and Inferred mineral resource for Antler was announced in November last year, coming in at 7.72 million tonnes at 2.23% copper, 5.32% zinc, 0.9% lead, 28.8g/t silver and 0.18g/t gold when estimated using a 1% copper-equivalent cut-off.

Ongoing mine studies have since been exploring the potential to recommence mining at Antler for the first time since the 1970s.

Initial results from these studies are expected in the coming months and will be a critical step in preparing mining permit applications, while three diamond core rigs continue to drill to expand the Antler resource.

Assay results are currently pending for a further 14 holes.

Terms of the deal

Under the private land agreement, New World can exercise its option to acquire the land that is adjacent to Antler at any time within the next five years.

The company paid US$250,000 at the time the option agreement was executed; and will pay an annual fee of US$175,000 to maintain the option.

To take a 100% interest, a payment of US$2 million would be required within the five-year period, with half of the initial option payment and half of the annual option payments made to be credited towards the overall purchase price.

This article was developed in collaboration with New World Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.