Lakes Oil woos Rawson in its bid to become a gas producer

Pic: Vertigo3d / E+ via Getty Images

Gina Rinehart-backed Lakes Oil and fellow ASX-listed junior Rawson Oil & Gas are tying the knot.

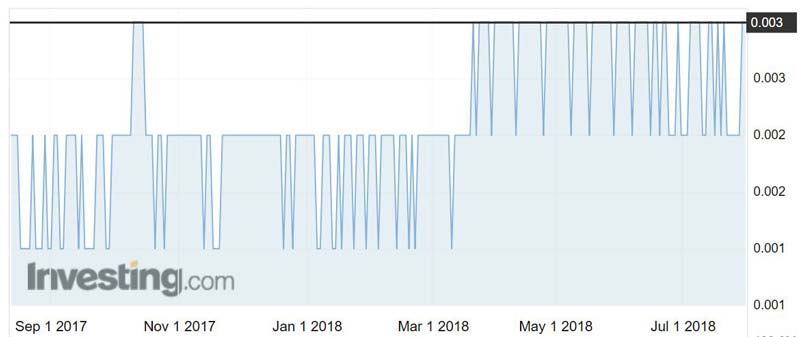

The $58 million Lakes Oil (ASX:LKO) has made an all-scrip off-market offer that values Rawson (ASX:RAW) at $3.75 million in its bid to advance towards production.

And Rawson, which currently has a market value of about $4 million, has recommended the bid of 15 Lakes Oil shares for every one of its shares to shareholders.

Lakes Oil has struggled to move its own assets forward since the Victorian government last year suspended conventional onshore gas exploration until 2020 and permanently banned unconventional exploration including hydraulic fracturing (or fracking) and coal seam gas.

It’s been over four months and Lakes Oil is still waiting to find out if it has won its Supreme Court battle to overturn the ban.

The marriage to Rawson would give Lakes Oil a gas-prospective landholding in South Australia targeting the same structure that lies within its Otway-1 well across the border in Victoria.

Rawson’s Nangwarry-1 well would allow Lakes Oil to finally move towards production and the tie-up would help Rawson fund the drilling of the well.

“I think it should be good for both shareholders because you’ve got Rawson, for example, wanting to drill a well on their property in South Australia,” Lakes Oil chairman Chris Tonkin told Stockhead.

“They of course have to raise some money to do that and they have a small shareholder base which would make it very, very difficult.

“And they get the benefit of the upside on our projects in Victoria. It’s only a matter of time I think until we are actually able to develop those, and from our point of view we get the chance to drill a well in South Australia.”

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Lakes Oil had about $1.3 million in cash at the end of the June quarter and has agreed to fund Rawson’s working capital requirements until the deal is complete.

Major shareholders of Rawson have already agreed to take the deal, giving Lakes Oil a 19.99 per cent stake so far.

Mr Tonkin is confident the rest of Rawson’s shareholders will follow suit.

“We expect to go to 50 per cent fairly quickly,” he said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.