Lake Resources inks critical tech, funding deal with Lilac Solutions to develop Kachi lithium project

Pic: John W Banagan / Stone via Getty Images

Under the new agreement, Lilac Solutions will contribute tech, engineering teams, and an on-site demonstration plant to earn a maximum 25% in the advanced project.

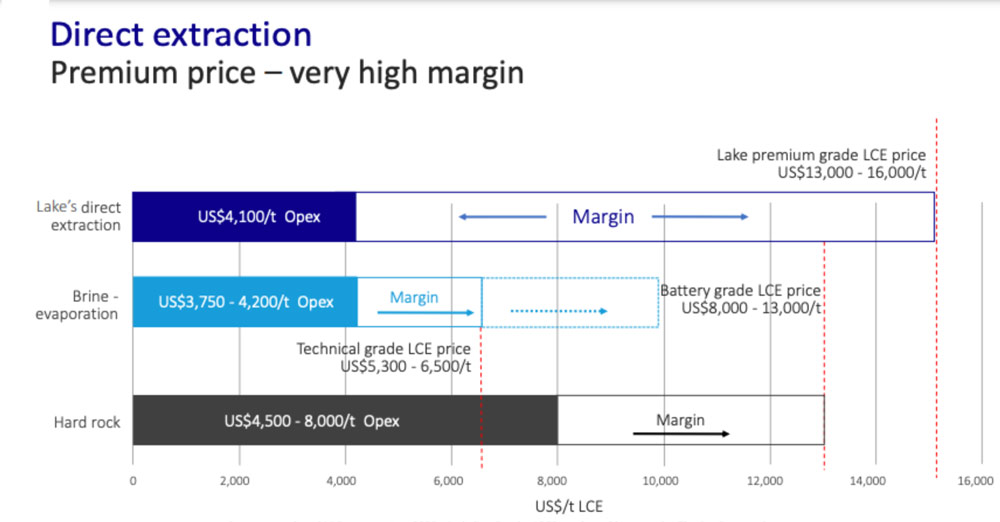

While Lake Resources’ (ASX: LKE) flagship Kachi project already ranks amongst the top 10 global lithium brine resources worldwide, its not-so-secret weapon is Lilac Solutions’ innovative direct-extraction technique, which produces cheap, high quality, environmentally friendly lithium.

The trifecta.

Lilac, after earning its interest in Kachi, will be expected to fund ~US$50 million, equivalent to its pro rata share of future development costs — aligning innovation, funding, development, and production.

Whats interesting here is that those funds are coming from the US tech sector, via Lilac, from successful investors who have made substantial returns from disruption – and now for the first time, those funds are coming to the upstream end of the battery materials supply chain for electric vehicles

What makes the Lilac production process special?

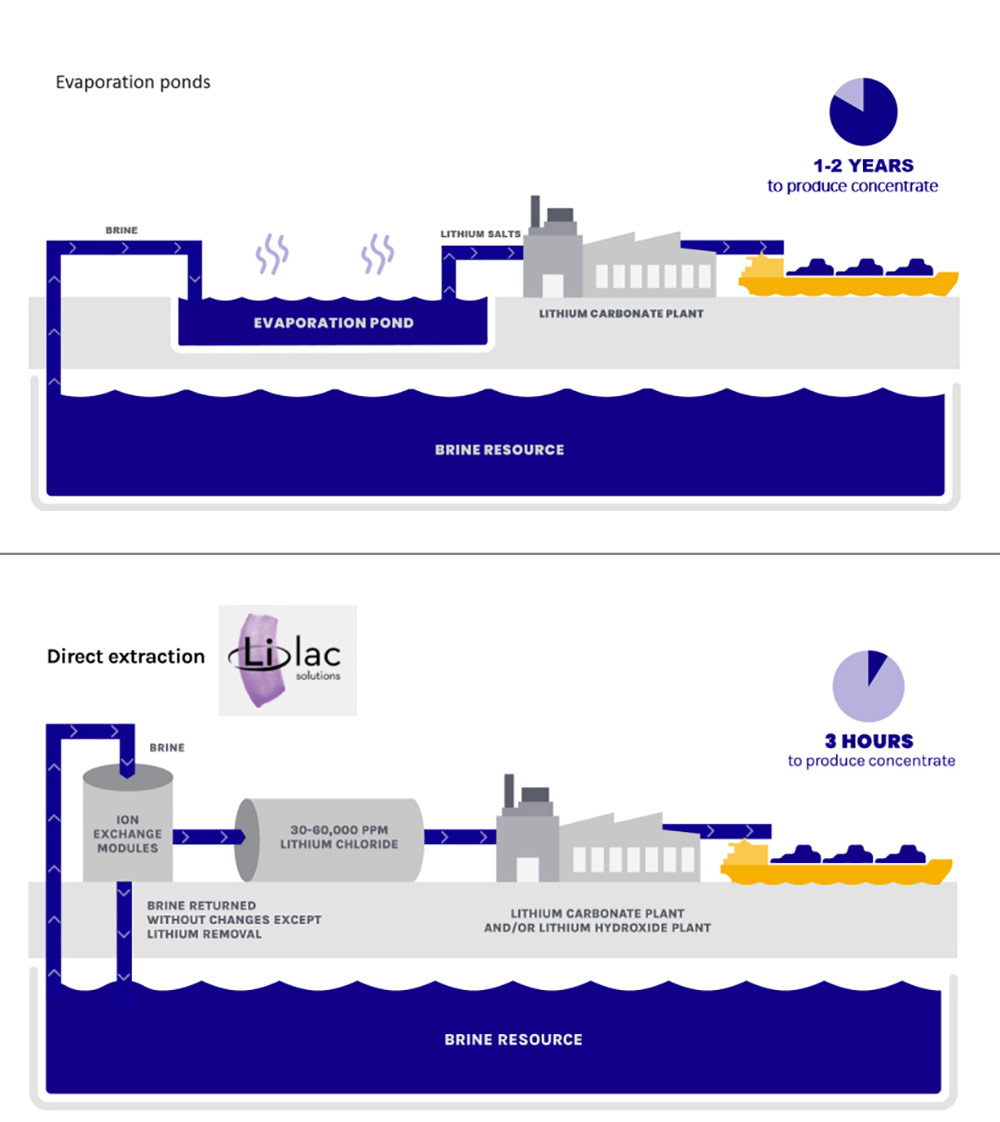

Traditional brines producers evaporate the brines in ponds, concentrate all the salts, and take the lithium out.

The problem with this method is producers don’t get a consistent, high quality battery product, managing director Steve Promnitz told Stockhead previously.

“When you put [brines] in evaporation ponds and use the power of the sun, every one of those 100 ponds is different. Different chemistry, different evaporation rates,” he says.

“Back when quality wasn’t so much of an issue — when most lithium was going into ceramics and lubricants – that was fine. Now we have to do better.”

The Lilac ‘Direct Extraction’ production process pumps brine into a tank for a couple of hours, where little ion exchange beads latch onto all the lithium.

Then the water is released – without lithium — back into the aquifer.

It is lower cost and offers higher lithium recovery rates (80-90%) than other technologies to produce battery quality lithium carbonate (99.97% purity), while also protecting the local environment, including water resources.

“Lilac’s technology is truly disruptive as it has taken a non-mining tech solution which cuts operating costs and boosts lithium recovery from our brines,” Promnitz says.

“The process is modular, producing high purity lithium and can be ramped up quickly through pilot to commercial stages – this equity stake ensures a rapid commercialisation of the Lilac technology at the Kachi site.”

Lilac chief executive officer Dave Snydacker says the Lilac tech can efficiently deliver the large volumes of high-quality lithium chemicals needed by battery makers.

“Importantly, this will be done in a way that is environmentally-friendly,” he says.

“We’ve worked extensively with this brine, generating the data needed for engineering studies, and it is a fantastic fit for the Lilac technology.”

‘Closing the gap’ to full funding

This deal follows the recent successful sourcing of an Expression of Interest from the Export Credit Agency of the United Kingdom to provide project finance for the first stage of the Kachi Project.

This Expression of Interest will cover ~70% of the total finance required to expand production to 50,000 tpa of high purity lithium carbonate equivalent.

“With a successful capital raising; partnering with a leader in lithium processing that will place us in the bottom quartile on the cost curve; and getting an Expression of Interest for debt funding from the UK’s Export Credit Agency – it has been a busy few months for Lake,” Lake chairman Stu Crow says.

“We are closing the gap to being fully funded when you assume the DFS and other requirements for UKEF are met.

“There aren’t many near term lithium projects that can say they are funded to production.”

Lake is targeting a financial investment decision mid next year.

This article was developed in collaboration with Lake Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.