Koonenberry transforms its NSW gold-copper portfolio with significant acquisitions

Koonenberry Gold will become a significant player in the Lachlan Fold Belt. Pic: Getty Images

- Koonenberry Gold is acquiring a suite of gold and copper exploration assets across NSW

- Transactions will give company a 4410km2 land position and includes the promising Enmore gold project

- Acquisition of Gilmore Metals grants company stake in two existing farm-in JVs with Newmont

Special Report: Koonenberry Gold is acquiring a suite of gold and copper exploration assets that will give it a commanding 4410km2 land position across frontier, emerging and world class terranes in NSW.

Central to this transformation is the binding agreement to acquire the Enmore Gold Project in the New England Fold Belt, which shares similar geology and prospectivity to Larvotto Resources’ (ASX:LRV) Au-Sb mine just 20km to the north.

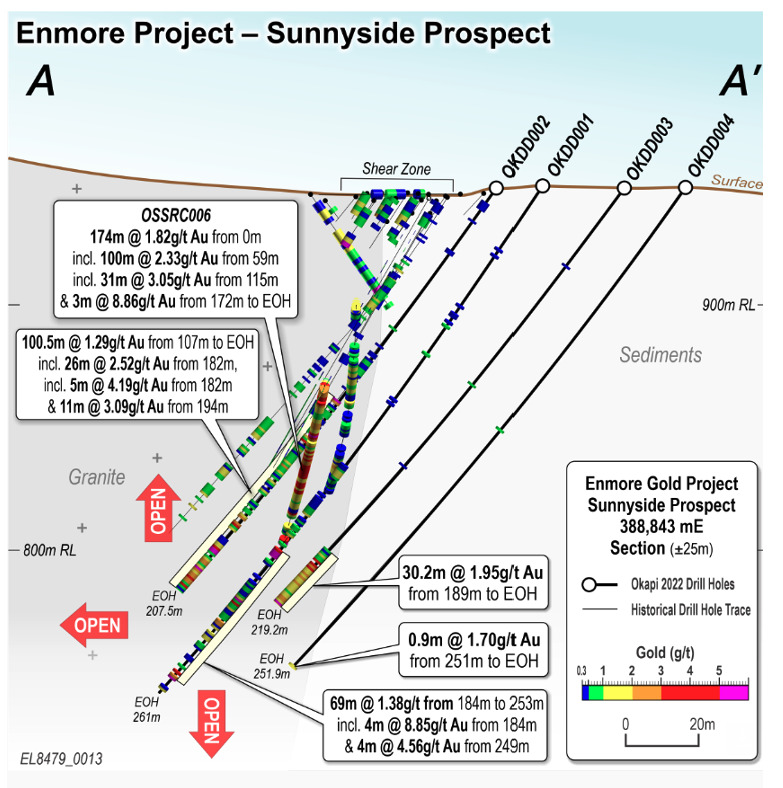

Standout results from historical drilling include a 174m drill intersection at the Sunnyside prospect grading 1.82g/t gold from surface with a higher-grade zone of 31m at 3.05g/t gold from 115m. Significantly, the drill hole results are open in all directions. Elsewhere, assays of 0.45m at 234g/t gold, 0.9m at 21g/t gold and 3m at 15g/t gold from sampling of underground workings at Lone Hand point to bonanza gold potential.

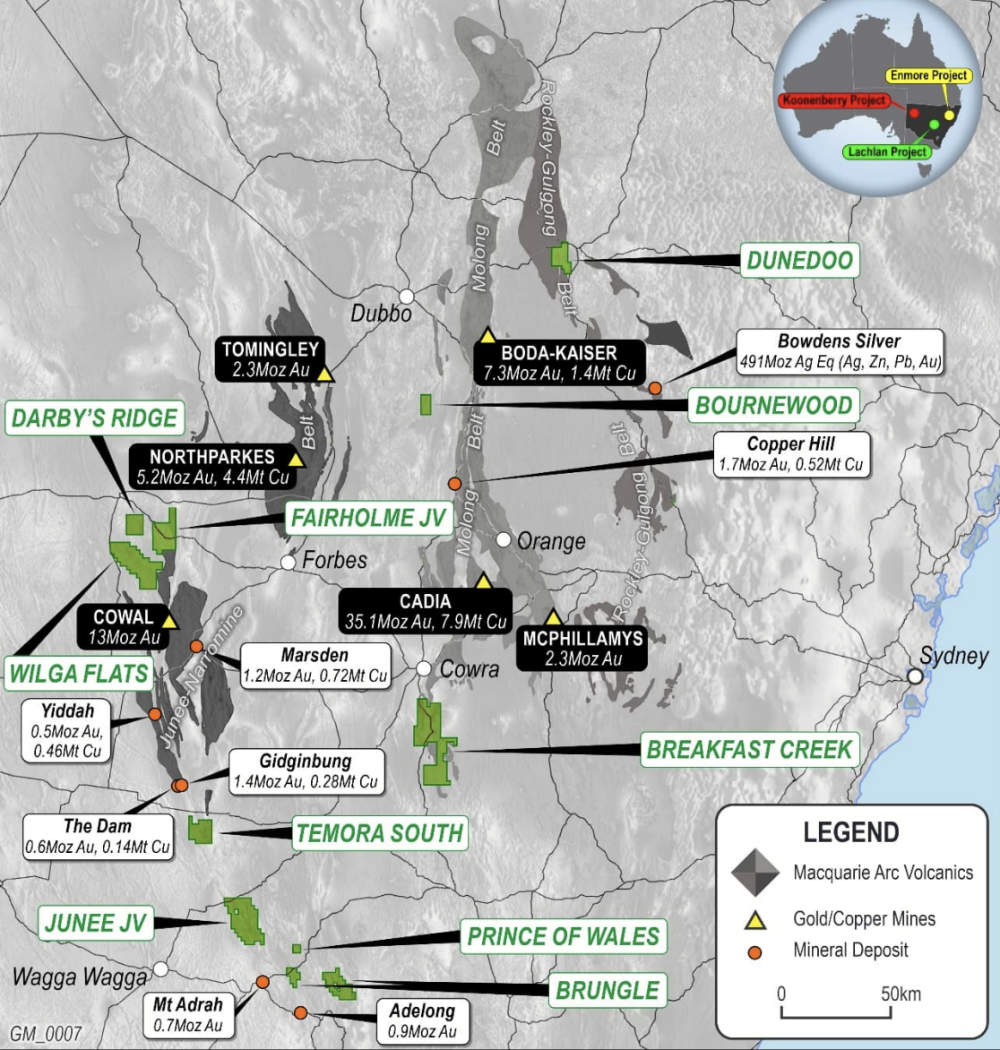

Koonenberry Gold (ASX:KNB) is also picking up 10 granted exploration licences that will make it a significant player in the highly prospective Lachlan Fold Belt and one exploration licence west of its current projects through the acquisition of Gilmore Metals.

The Lachlan Project include two existing farm-in joint ventures with Newmont (ASX:NEM).

The Lachlan Project sits within the productive Junee-Narromine, Molong and Rockley-Gulgong belts near Tier 1 deposits and include the Junee JV where drilling returned 224m at 0.19% copper and 0.2g/t gold from 172m and Breakfast Creek, which has seen results of up to 18% copper and 3.4g/t gold.

Concurrent to the acquisitions, the company has received commitments for $4.5m through a share placement supported by major shareholder Lion Selection Group (ASX:LSX) and incoming holder Lowell Resources Fund (ASX:LRT).

Exciting prospectivity

Managing director Dan Power said “we are extremely excited to add these highly prospective assets to our gold and copper exploration portfolio”

“The Enmore gold project has some exciting historical high-grade gold assays in drilling, rock chips and underground workings with clear targets, a well understood geological model and a near-term opportunity to rapidly advance with drilling. This acquisition effectively transforms the company from a pre-discovery greenfields explorer to a one with discovery drillholes in place which are open in all directions.” he said.

“The Lachlan projects include strategic landholdings in the Lachlan Fold Belt with very encouraging early-stage results across multiple targets.

“In addition, the Junee project, in joint venture with a subsidiary of Newmont Corporation, has seen a significant amount of work already completed and is 20% free carried. Encouraging early-stage drill results point to porphyry Cu/Au discovery potential.

“With a concurrent capital raising, supported by Lion Selection Group, Lowell Resources Fund as well as our existing and new shareholders, the company will be in a very strong position to fund its planned activities.”

This article was developed in collaboration with Koonenberry Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.